Trung An-branded rice products – Illustration

|

On August 7, Trung An’s Board of Directors approved a plan to borrow VND 190 billion from Agribank – Ho Chi Minh City Branch. The loan is intended to purchase rice for the National Reserve in 2025, according to a contract with the State Reserve Bureau of Region XIV. The maximum loan term is 4 months for each shipment, depending on the contract progress after winning the bid.

The loan is partially secured by land use rights, ownership of houses and assets attached to Lot 96, Map Sheet 45, Ninh Kieu (new), Can Tho City, with a security value of VND 65 billion, accounting for a minimum of 34% of the total debt. The remaining maximum of 66% is unsecured lending, with the replacement security being the receivables from the State Reserve Bureau of Region XIV.

As of the end of the second quarter of 2025, Trung An’s financial debt balance was nearly VND 1,165 billion, down 11% from the beginning of the year, of which 99.8% was short-term debt. Major creditors include BIDV – Mekong Delta Branch (VND 588 billion), Agribank – Ho Chi Minh City Branch (VND 439 billion), and Sacombank – Can Tho Branch (VND 110 billion).

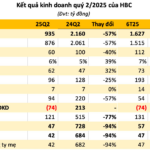

Fourth consecutive quarterly loss

In the second quarter of 2025, Trung An recorded a net loss of nearly VND 7.4 billion, up from a loss of VND 3.5 billion in the same period last year, marking the fourth consecutive quarter of losses. This was due to a decrease in sales volume and the absence of financial income from term deposits as in the previous year.

| TAR’s quarterly business results for the period 2024-2025 |

|

|

In the first six months, TAR recorded a loss of nearly VND 3.5 billion, falling short of the profit target of VND 8.8 billion for 2025. Trung An was once a leading rice exporter but is now recovering from a prolonged financial crisis and facing audit issues in its annual financial statements.

As of the end of June 2025, the net cash flow from operating activities improved, turning from negative VND 249 billion to positive VND 153 billion, thanks to the recovery of receivables and reduction in inventory.

Stock price recovery

On the stock market, TAR stock is currently restricted from trading. As of the close on August 8, the share price stood at VND 5,700 per share, up 14% in the last month and 58% in the past three months, with an average trading volume of over 71,000 shares per day. However, compared to its historical peak of nearly VND 41,000 per share in late 2021, the stock has lost 86% of its value.

At the 2025 Annual General Meeting of Shareholders, the company’s management stated that they are addressing the issues between the old and new auditing firms, expecting to resolve them this year and lift the trading restriction.

| TAR share price movement since the beginning of 2025 |

|

|

– 14:28 11/08/2025

“IDP Appoints New CEO Amidst Record Losses and Plummeting Stock Prices”

In a bid to turn around its fortunes, International Dairy Products Joint-Stock Company (IDP) has appointed Doan Huu Nguyen as its new CEO and legal representative. This move comes after the company reported a net loss of over VND 36 billion in Q2 2025, marking the first time it has fallen into the red in its history. Nguyen replaces Bui Hoang Sang, who took on the role just over a year ago.

The Dam Sen Park Administrator Receives 12 Tax Enforcement Orders

Phú Thọ Tourist Joint Stock Company (Phú Thọ Tourist, UPCoM: DSP), the owner of Dam Sen Cultural Park, has been enforced to pay over VND 3.4 billion in taxes that have been overdue for more than 90 days from the due date as regulated.