In its recent August strategy report, SSI Securities Corporation (SSI Research) believes that despite potential short-term market volatility due to increased profit-taking pressure after the high-margin period at the end of July, the VN-Index is expected to target the 1,750-1,800 range in 2026.

The main driver is expected to be a robust profit growth recovery, supported by a rebound in the real estate market and public investment, favorable interest rate environments, easing tariff-related concerns, and especially the market upgrade expectation in October.

SSI Research maintains its forecast for the whole market’s parent company net profit after tax (NPATMI) growth in 2025 at 13.8% year-on-year, corresponding to a 15.5% growth in the last six months, although there may be slight adjustments after the financial reporting season ends.

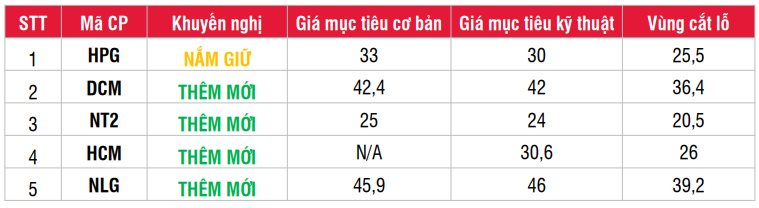

Accordingly, the analytics team provides the following recommended portfolio for August:

Regarding Hoa Phat Group (code: HPG) , given the positive results in the first half, SSI maintains its projection for HPG’s net profit growth in the second half of 2025 and the whole of 2026 to remain positive at 42% and 29% year-on-year, respectively. This growth will be contributed by the new capacity of the Dung Quat 2 plant and improved steel price prospects.

Dung Quat 2 – Phase 2 is expected to come into operation from Q3 2025, increasing HPG’s crude steel capacity to 15 million tons/year from Q4 2025. The company plans to start test runs for Phase 2 of the Dung Quat 2 plant in the latter part of Q3.

The growth momentum is also driven by the recovery in Chinese construction steel and HRC prices, which bodes well for Vietnamese steel prices in the second half of 2025.

Similarly, Ca Mau Fertilizer Plant (code: DCM) is expected to see accelerated profit growth in the last six months of 2025 due to rising urea prices amid limited supply in Europe and the Middle East, as well as lower FO oil prices reducing material costs. The application of the amended VAT Law from July 1, 2025, allows the company to deduct VAT on gas input costs.

SSI projects a strong profit growth of VND 856 billion (+111% yoy) for DCM in the second half of 2025. Thus, the full-year 2025 profit is estimated at VND 2,075 billion (+55% yoy). Profit growth is still expected in 2026 but at a more modest rate (VND 2,428 billion, +17% yoy).

SSI Research expects the 2025-2026 profits of Nhon Trach 2 Oil and Power JSC (code: NT2) to recover from the lows of 2024. Revenue and net profit estimates for 2025 are VND 7,200 billion (+21% yoy) and VND 599 billion (+622% yoy), respectively. The analytics team forecasts higher power demand in the last six months of 2025 compared to the first half, with expectations of Vietnam’s average temperature approaching or exceeding the multi-year average (higher than in the first half). This will support NT2’s increased power generation.

In the securities group, in a favorable market condition, SSI believes that the proprietary portfolio of Ho Chi Minh City Securities Corporation (code: HCM) will improve in the second half of 2025. As of the end of Q2 2025, HCM’s portfolio had increased its investments in TCB (accounting for 34% of total investment value), FPT (24%), and MWG (10%).

Furthermore, the successful issuance of put-through warrants to increase charter capital will be a strong catalyst for HCM to potentially expand margin lending. In Q1 2025, HCM’s margin lending to equity ratio was 195%, and if the capital increase is successful, the company can bring this ratio down to 144% compared to the ceiling of 200%.

In the list, there is a representative from the real estate group, Nam Long Investment Corporation (code: NLG) . SSI estimates NLG’s profit for 2025 to reach VND 637 billion, up 23% year-on-year, contributed by projects such as Akari City, Mizuki Park, Southgate, Central Lake, Izumi City, and the transfer of a 15% stake in the Izumi City project to a Japanese partner, expected to bring in a profit of about VND 300 billion in Q3 2025.

SSI also estimates sales to reach VND 7,200 billion (+39% year-on-year) in 2025 and VND 9,200 billion (+28% year-on-year) in 2026 from projects such as Mizuki Park, Southgate, Central Lake, An Zen Residence, and Paragon Dai Phuoc.

Technical Analysis for August 11: A Silver Lining Amidst the Gloom.

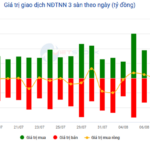

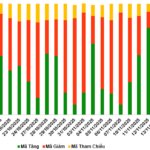

The VN-Index and HNX-Index both climbed in the morning session, but the lack of significant improvement in liquidity revealed investors’ ongoing dilemma.

Market Beat on August 11th: Failing to Conquer the 1,600-Point Threshold.

The market closed with strong gains, as the VN-Index rose by 11.91 points (+0.75%), finishing at 1,596.86. The HNX-Index also climbed 4 points (+1.47%), ending the day at 276.46. It was a bullish day for the market, with 505 advancing stocks outpacing 297 declining ones. The VN30, a basket of Vietnam’s 30 largest stocks, mirrored this sentiment, as 21 stocks advanced against 9 declines.