I. MARKET DEVELOPMENT OF WARRANTS

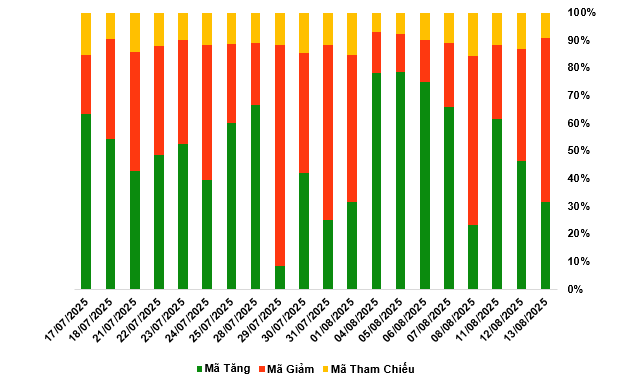

As of the trading session ending on August 13, 2025, the market witnessed 82 advancing codes, 153 declining codes, and 24 reference codes.

Market breadth over the last 20 sessions. Unit: Percentage

Source: VietstockFinance

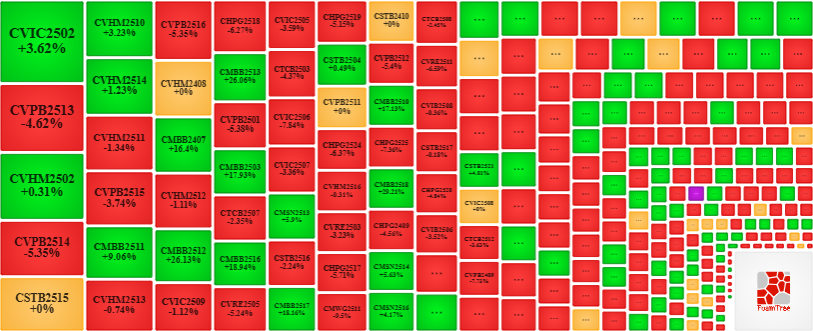

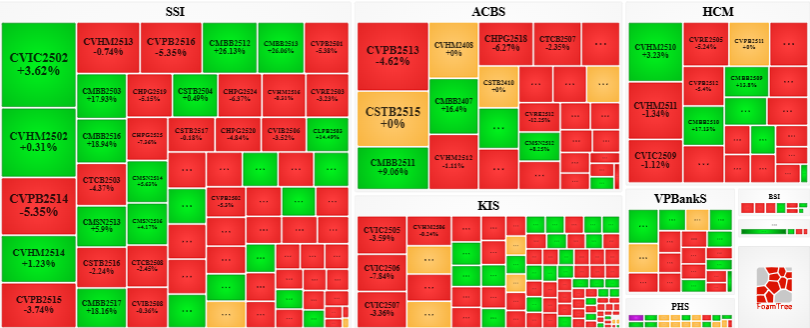

During the trading session on August 13, 2025, sellers regained control of the market, resulting in a decline for most of the warrant codes. Specifically, the large declining codes in the group were CVPB2513, CVHM2511, CVIC2509, and CHPG2518.

Source: VietstockFinance

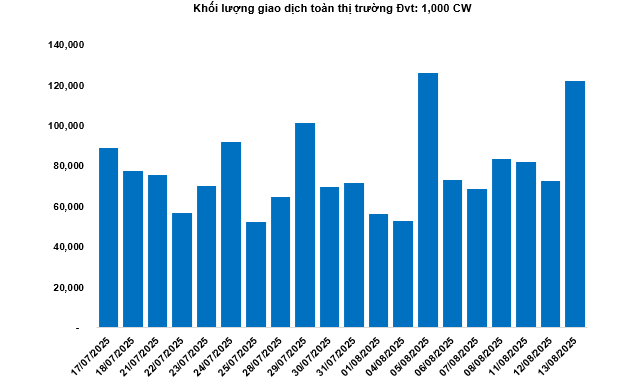

The total market trading volume during the August 13 session reached 122.57 million CW, up 68.92%; the trading value reached VND 286.09 billion, up 58.33% compared to the August 12 session. Among these, CLPB2502 led the market in volume with 6.05 million CW, while CMBB2512 took the lead in trading value with VND 17.42 billion.

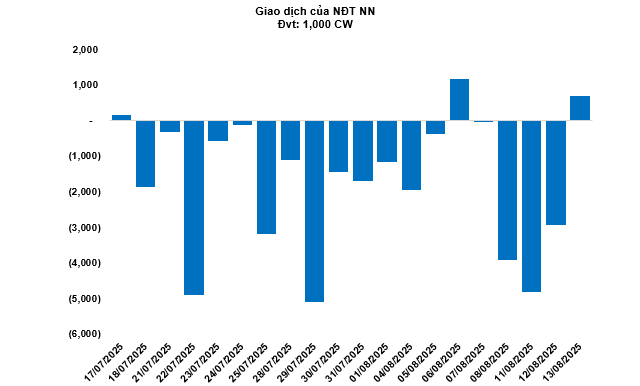

Foreign investors returned to net buying in the August 13 session, with a total net buy of 693,000 CW. CHPG2513 and CSHB2510 were the two codes with the highest net buy volume.

The following securities companies: SSI, ACBS, HCM, KIS, and VPBank currently hold the most warrant codes in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

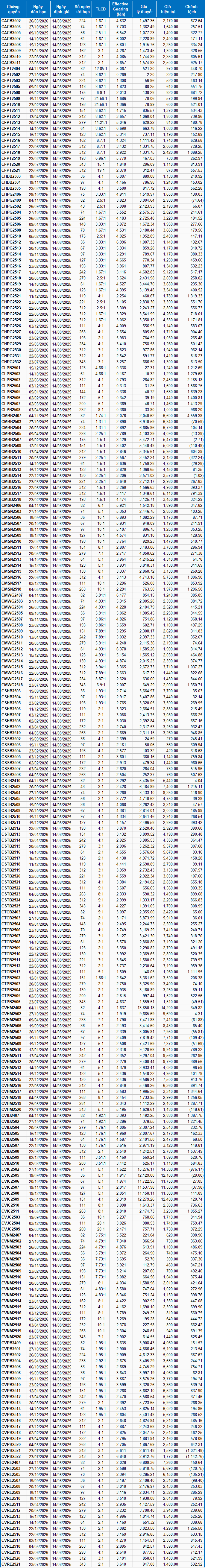

Based on the valuation method suitable for the initial stage as of August 14, 2025, the reasonable prices of the warrants currently traded in the market are presented as follows:

Source: VietstockFinance

Note: The opportunity cost in the valuation model is adjusted to suit the Vietnamese market. Specifically, the risk-free bill interest rate (government bills) will be replaced by the average deposit interest rate of large banks, with term adjustments suitable for each type of warrant.

According to the above valuation, CVPB2522 and CVPB2521 are currently the two warrant codes with the most attractive valuations.

Warrant codes with higher effective gearing ratios will exhibit larger fluctuations in correlation with the underlying securities. Currently, CVNM2512 and CACB2503 are the two warrant codes with the highest effective gearing ratios in the market.

Economic Analysis and Market Strategy Division, Vietstock Consulting Department

– 18:58 13/08/2025

Market Beat on August 11th: Failing to Conquer the 1,600-Point Threshold.

The market closed with strong gains, as the VN-Index rose by 11.91 points (+0.75%), finishing at 1,596.86. The HNX-Index also climbed 4 points (+1.47%), ending the day at 276.46. It was a bullish day for the market, with 505 advancing stocks outpacing 297 declining ones. The VN30, a basket of Vietnam’s 30 largest stocks, mirrored this sentiment, as 21 stocks advanced against 9 declines.

The Capital’s Crackdown: Hanoi’s Plans to Remove Unauthorized Street Markets This Year

“The latest decree from the capital’s administration is a testament to their forward-thinking and progressive approach to governance. With this new directive, they aim to implement strategies that will shape the future of the city and its residents.”