The Prime Minister recently issued Directive 128/CD-TTg on August 6, 2025, requesting the State Bank of Vietnam (SBV) to urgently develop a roadmap and pilot the removal of credit growth target measures (also known as credit room).

Completing a historical role

Earlier in late July, the SBV announced that commercial banks with a credit growth rate of 80% of the target in 2025 would be allowed to proactively adjust their credit balance compared to the level announced by the SBV.

This indicates that the credit room is expected to increase in the coming time. Loosening credit growth restrictions can stimulate the economy, but if not tightly controlled, it may jeopardize the financial system.

The State Bank of Vietnam implements measures to control commercial banks and protect people’s savings deposits.

|

Dr. Nguyen Tu Anh, Director of Research at VinUni University, stated that during the period from 2010 up to now, the credit room or credit growth target has played an extremely important role in Vietnam’s monetary policy management. This is considered an effective tool to control capital flows and stabilize the macro-economy over the past decade.

The credit room has acted as a regulator, preventing the influx of money into the market in an uncontrolled manner. Thus, the State Bank can tightly control the total means of payment, avoiding the situation of overheating credit growth leading to asset bubbles and inflation. Through controlling the money supply, the credit room has helped stabilize many important indicators of the economy.

Despite its important historical role, the credit room also reveals issues that need to be addressed to suit the new context of economic development.

The administrative allocation of the credit room has reduced the competitiveness of commercial banks. Efficient banks with good project appraisal capabilities and high capital demands may be limited, while other banks do not fully utilize the allocated room.

The credit room creates uncertainty for customers, especially businesses. For example, a company borrowing capital for a project in phases may suddenly be refused disbursement midway because the bank has reached its credit limit. This not only disrupts business plans but also causes difficulties when they have to seek alternative capital sources from another bank.

“It can be seen that although it has completed the mission of stabilizing the macro-economy, the credit room is currently posing new challenges, requiring a more flexible and appropriate management solution in the future,” emphasized Dr. Nguyen Tu Anh.

|

On August 6, Prime Minister Pham Minh Chinh signed Official Dispatch No. 128/CD-TTg, requesting the SBV to urgently develop a roadmap and pilot the removal of credit growth target measures, to be implemented from 2026. It is necessary to develop standards and criteria for credit institutions to operate effectively, be healthy, have good governance and management capabilities, comply with safety ratios in banking activities, and have high credit quality indices… The Prime Minister also requested the SBV to take measures to prevent, inspect, supervise and strictly handle acts of manipulation, cross-ownership, extending credit to “backyard” enterprises, and unhealthy ecosystem enterprises… that do not comply with regulations. |

Ensuring safety

Mr. Nguyen Quang Thuan, Chairman of FiinGroup, said that loosening the credit room does not always lead to unsafe situations, but it requires tight management. Currently, the safety of the banking system has improved significantly compared to the past.

The core issue of the banking system now is the thin ratio of ownership capital while the demand for credit growth is very high. However, it is impossible to deny the successes of the Vietnamese banking industry in the past two decades, especially in maintaining the stability of the system in the context of crises.

The State Bank of Vietnam implements measures to control commercial banks and protect people’s savings deposits. |

The liquidity of the system is still guaranteed, and the quality of bad debt is controlled. Improving the safety capital ratio is the most important step for the banking industry to continue its mission of growth and better resilience to fluctuations in the future.

“The State Bank has issued Circular 14, requiring the application of risk management standards according to Basel III, which is not yet effective immediately, but this is a right step. This will consolidate the capital buffer and increase the supervisory power of the State Bank. Banks that soon comply with Basel III should be given priority in loosening the credit room,” said Thuan.

At a press conference on the results of the banking industry’s operations in the first six months, Mr. Pham Chi Quang, Director of the Monetary Policy Department of the SBV, said that since 2012, the SBV has managed the credit growth room. However, no tool is permanent. In the past time, the SBV has had a roadmap to innovate and renew monetary policy management.

Accordingly, in 2024, the SBV assigned credit targets for credit institutions from the beginning of the year. By 2025, the SBV has lifted the credit growth target for groups of foreign banks, branches of foreign banks, joint venture banks, and non-banking credit institutions. Thus, only domestic commercial banks are assigned credit growth targets.

This is a roadmap towards completely removing credit growth targets in the future. However, the consequences of the past and the difficulties of the credit system still exist. Therefore, to remove the credit room, the SBV needs to have measures and policies suitable to the specific conditions of Vietnam.

“The goal is to increase the initiative of credit institutions while ensuring the safety of the system, economic security, and controlling inflation,” emphasized Quang.

Also, according to Quang, in case of removing the credit room, there is a risk of interest rate increase. Therefore, the SBV will consider carefully and thoroughly assess the policy impacts to report to the Government and the Prime Minister on the roadmap for removing the credit room in the coming time.

|

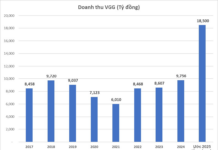

Positive credit growth The SBV has directed credit institutions to promote solutions to stabilize interest rates, thereby creating conditions for reducing lending rates; ensuring that cheap capital flows reach the production and business sector, priority sectors, and growth drivers in time. Earlier, SBV Deputy Governor Pham Thanh Ha said that by July 29, the credit of the whole system increased by 9.8% compared to the end of 2024 and by 19.75% compared to the same period, a positive growth rate compared to recent years. The deposit interest rate continues to be relatively stable, and the lending interest rate tends to decrease compared to the end of 2024. Specifically, the average deposit interest rate for new transactions of commercial banks is 4.18%/year, stable compared to the end of 2024; the average lending interest rate for new transactions is 6.53%/year, a decrease of about 0.4%/year compared to the end of 2024. |

|

Allowing banks to lend more According to analysts, loosening the credit room means that the SBV allows banks to lend more, but it does not change the nature of savings deposits. Savings deposits are still guaranteed by the bank and insured by the Vietnam Deposit Insurance Corporation in case of bank incidents. Moreover, the SBV implements measures to control commercial banks to protect people’s savings deposits. These measures mainly aim to ensure the safety and stability of the entire banking system, thereby protecting the interests of savers. For example, the SBV requires banks to maintain a minimum capital safety ratio according to international standards such as Basel III, ensuring that banks have enough capital buffers to withstand risks. The SBV sets limits on the loan-to-deposit ratio (LDR), liquidity status, and other safety ratios to prevent the risk of insolvency. The SBV issues regulations on debt classification and risk provision. Banks must strictly comply to ensure sufficient funds to handle bad debts without affecting capital and solvency. |

PHUONG MINH

– 07:54 13/08/2025

The Art of Monetary Policy: Navigating Interest Rates and Exchange Rates with Agile Governance.

The government has requested that the State Bank of Vietnam proactively undertake research, evaluation, and forecasting within the scope of its functions, tasks, and authority. This includes developing monetary policy scenarios and orientations from now until the end of 2025 and for 2026. A report is to be submitted to the Government’s Standing Committee for consideration and feedback no later than August 20, 2025.

“Pursuing Excellence: Achieving Socio-Economic Goals for 2025”

The Prime Minister has urged all ministries, sectors, and localities to rally and address challenges, limitations, and shortcomings. By seizing every opportunity, we aim to achieve the economic and social development goals set for 2025, especially targeting a GDP growth rate of 8.3 – 8.5%, keeping CPI increase below 4.5%, and maintaining macroeconomic stability. These efforts will lay the foundation for even greater success in 2026, with aspirations to reach a growth rate of 10% and beyond.

Is Real Estate and Stock Market Sucking Up Huge Capital from Banks a Concern?

The surge of credit into the stock market is a temporary blip, according to analysts. However, the real story lies in the significant flow of credit into the real estate sector, which warrants closer attention.

Unlocking the Secrets to Effective Real Estate Investment: A Comprehensive Guide by the Ministry of Construction

The growth rate of credit for real estate across many banks has reached an impressive 20-30%, an astounding threefold increase compared to the overall credit growth rate of the system. The Ministry of Construction suggests that the State Bank should develop a special credit package for reasonably priced housing to further stimulate credit growth.