Here’s an assessment from Dr. Nguyen Tri Hieu, a finance and banking expert, during an interview with reporters about the overall picture, policies, and development orientation of Vietnam’s banking sector.

Reporter: How do you assess the current state of Vietnam’s banking sector?

Dr. Nguyen Tri Hieu: The banking sector plays a crucial role in the country’s monetary system. Currently, total credit outstanding has reached over 134% of GDP. On the positive side, banks are the largest providers of capital to the economy. This year, the State Bank set a credit growth target of about 16% to support the minimum GDP growth target of 8% (later adjusted to 8.3-8.5%). Typically, credit growth needs to be twice the GDP growth rate, so 16% is appropriate for the set goal.

However, on the flip side, a credit-to-GDP ratio of over 134% is a high-risk level. Many international financial institutions, such as the World Bank and the IMF, have repeatedly warned Vietnam about the rapid credit growth, which makes the entire financial system overly dependent on bank capital, creating systemic risk.

Reporter: Specifically, what are the biggest risks facing the banking sector?

Dr. Nguyen Tri Hieu: One significant risk is the maturity mismatch risk. About 70% of banks’ mobilized capital is short-term, but a considerable portion is lent out as medium and long-term loans. According to regulations, the ratio of short-term capital used for medium and long-term loans should not exceed 30%, but in reality, some banks have exceeded this threshold. When the ratio of short-term mobilized capital (up to 12 months) to medium and long-term loans (over 12 months) is high, the liquidity risk related to maturity also increases.

The second risk is interest rate risk. In Vietnam, most long-term loans apply floating interest rates, calculated as the deposit interest rate plus a margin. When the deposit interest rate fluctuates, the loan interest rate also adjusts accordingly, creating pressure on both businesses and individuals borrowing capital. Unlike in the US, where people can take out mortgages with a fixed interest rate for 30 years, Vietnam does not have this model due to the lack of long-term capital.

Additionally, some banks exceed the limit on the ratio of outstanding loans to mobilized capital (recommended maximum of 85%), even reaching 100%. This reflects a high dependence on credit and leads to multiple risks: liquidity, interest rates, and repayment capacity. Meanwhile, the economy’s capital still mainly comes from banks rather than the capital market, such as securities or bonds.

Reporter: The State Bank has continuously requested commercial banks to implement solutions to stabilize deposit interest rates and lower lending rates. How do you evaluate this move and its impact on banking activities?

Dr. Nguyen Tri Hieu: Reducing interest rates to support businesses and individuals is reasonable and necessary to achieve the growth target of 8.3-8.5% this year. When businesses and people have access to cheaper capital, they will have better conditions to expand investment, consumption, and production.

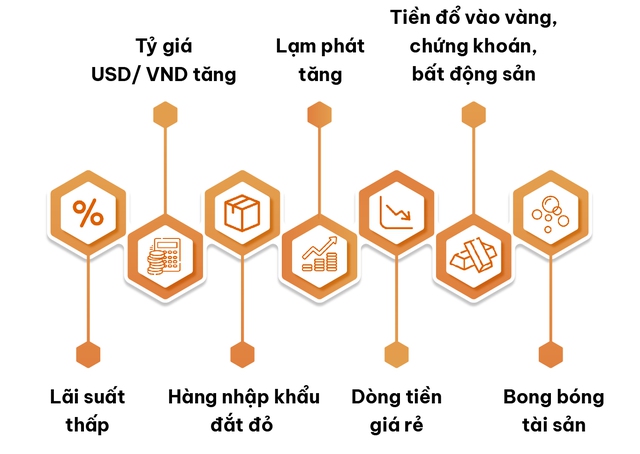

However, this policy also has some limitations. First, if deposit interest rates drop too low, people may withdraw their deposits and switch to other investment channels such as gold, which has already increased significantly in the first seven months of 2025, or securities. This will make it difficult for banks to mobilize capital, while credit growth remains higher than deposit growth, leading to imbalances and limited lending capacity.

Second, low-interest rates can weaken the value of the VND compared to the USD, pushing up the USD/VND exchange rate. From the beginning of the year to the end of July 2025, the exchange rate has increased by about 2.9%, leaving no room for further interest rate reductions. As a result, imports become more expensive, putting pressure on inflation and increasing public debt (in VND). Finally, cheap capital also risks creating asset bubbles as it flows into channels such as gold, securities, or real estate for speculative purposes.

Reporter: Recently, the government announced a pilot program to remove credit room for banks. If this policy is implemented, do you think it will boost the banking sector’s growth?

Dr. Nguyen Tri Hieu: The credit room has been in place for over a decade, during a time of high inflation. The State Bank was then forced to limit the credit growth of individual banks to control the situation. In 2009-2010, when I first returned to Vietnam, some banks had credit growth of up to 100%, leading to soaring inflation and bad debts. Immediately after, the State Bank applied the credit room mechanism to curb this issue.

Currently, there are hardly any banks with such excessive credit growth rates. The State Bank has many other tools to control credit, while inflation is maintained at 4-5%, indicating successful management. Moreover, many banks’ mobilized capital is lower than their credit growth rate, so they lack the resources for a breakthrough increase.

In my opinion, this is an appropriate time to remove the credit room and let the banking sector operate according to market mechanisms: lend more when demand is high and less when demand is low, adjusting to supply and demand. The credit room has become outdated and even hinders banks’ lending activities as the State Bank has to continuously adjust it mid-year because the limit set at the beginning of the year is no longer suitable.

I have supported removing the credit room for many years. In 2022, during a meeting with the State Bank and experts when I returned from the US, I emphasized the need to abolish it immediately. Although the removal of the credit room has not been implemented yet, it is a reasonable and correct decision.

If credit control is desired, several ratios can be applied, including a maximum of 30% for short-term capital used for medium and long-term loans, an LDR (loan-to-deposit ratio) of no more than 85%, and a minimum CAR (capital adequacy ratio) of 8%. Along with periodic inspections, the management agency can identify and limit banks with rapid growth or support those with weak growth. Additionally, the interest rate tool can also be used to adjust the money market and lending activities.

However, I believe the State Bank should still maintain the credit ceiling for the entire system at 16%. Each year, the credit growth target for the whole country should be announced clearly for all economic components to grasp, but for individual banks, the limit should be abolished.

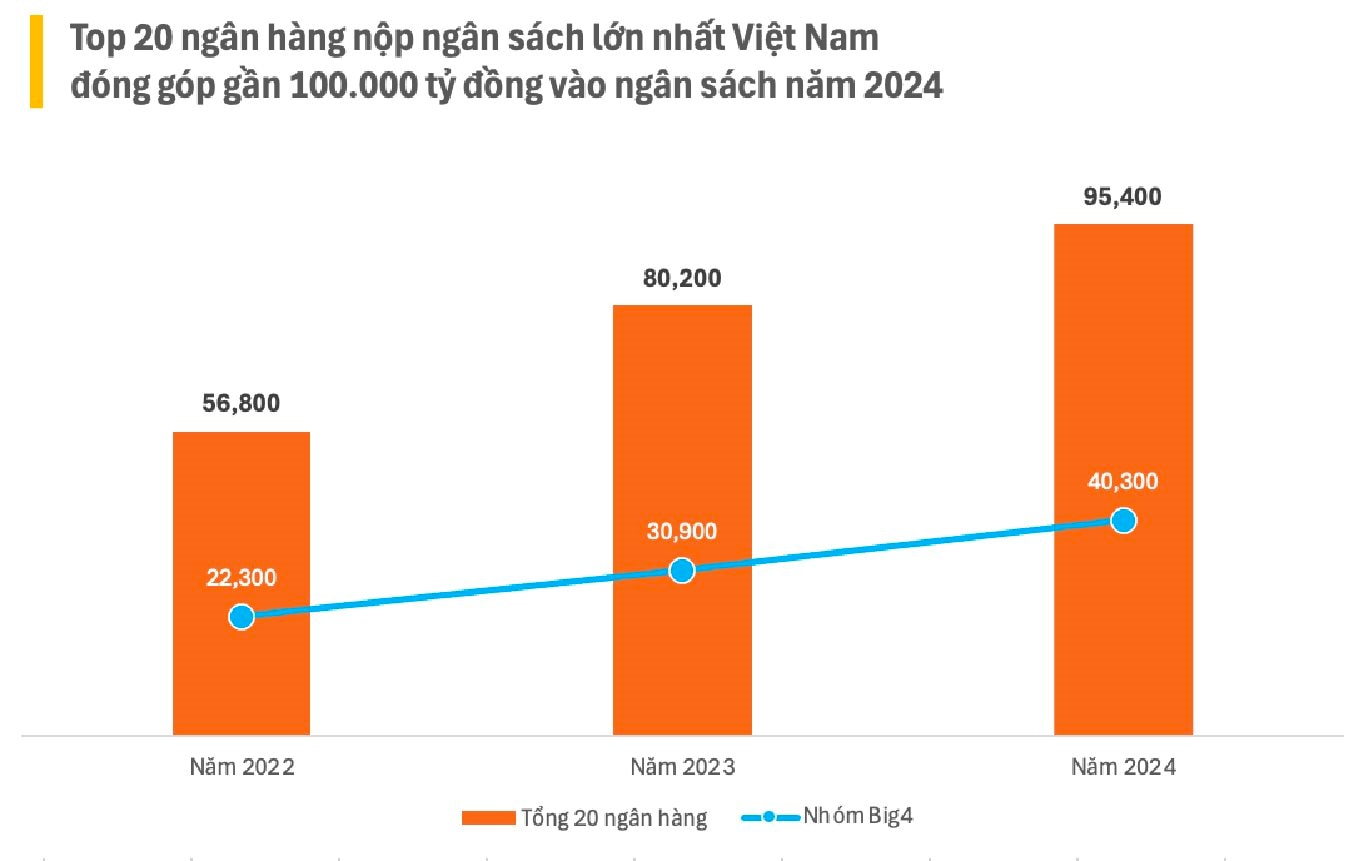

Reporter: According to the Private 100 List 2025 released by CafeF, among the top 30 private enterprises with the largest tax contributions, there are 10 private banks. Does this indicate the growing role of private banks in the economy, sir?

Dr. Nguyen Tri Hieu: This figure indeed demonstrates the increasing importance of private banks in the economy, not only in profitability but also in significant tax contributions. It reflects the competitiveness, flexibility, and ability to adapt quickly to market changes of private banks.

(Source: CafeF Statistics)

In the context of Vietnam’s deeper international integration, private banks must play a leading role in providing diverse, modern, and suitable financial products and services for the market. They often pioneer the application of new technologies, expand digital banking services, consumer finance, and electronic payments, and are more flexible in mobilization and lending strategies, thereby directly supporting businesses and people.

Compared to state-owned banks, private banks tend to make decisions closer to market mechanisms and are more flexible in meeting the capital needs of businesses and individuals. This is why private banks have many advantages for rapid growth.

On the other hand, state-owned banks, besides profitability, also have to fulfill tasks related to development orientations and policies, so their flexibility is often lower. Additionally, a large portion of their post-tax profits must be remitted to the State Treasury instead of being retained to increase owner’s equity, as non-state-owned joint-stock banks can do. However, it is undeniable that state-owned banks have successfully implemented socio-economic policies for decades.

However, to enhance the competitiveness and dynamism of the entire industry, we should create conditions for the banking system to operate more substantially according to market mechanisms. The state should gradually reduce its ownership in state-owned banks while strengthening supervision, enabling them to operate as flexibly as private economic components. This aligns with Resolution 68, which emphasizes the leading role of the private sector in the economy.

Regarding tax contributions, state-owned banks currently provide clear benefits as their profits are directly allocated to the state budget. If part of these profits were retained for reinvestment and support for the private sector, identified as a strategic driving force in Resolution 68, it could promote the robust development of this sector, thereby creating sustainable resources for the economy.

Reporter: Looking towards the end of 2025 and 2026, what are your predictions for the prospects and priority directions of the banking sector?

Dr. Nguyen Tri Hieu: The banking sector is entering a strong growth phase thanks to the impact of digital technology and the digital economy. However, compared to the world, we are still behind. Although we have applied digital technology and the digital economy, it is mainly limited to serving individual customers through applications and cashless payment services. Meanwhile, the digitalization of corporate banking (wholesale banking) needs further enhancement. The use of AI is also growing and being applied in various banking activities, especially in risk management.

Currently, many credit decisions still depend significantly on humans, and the appraisal method is not entirely automated and comprehensively digitized. In particular, the national data system needs to be completed to form “benchmarks,” financial ratios for each industry in the economy. These benchmarks can include liquidity, leverage ratios, profitability, etc., and be divided by segments such as commerce, construction, import-export, and wholesale. A comprehensive and up-to-date benchmark system will enable banks to assess their customers’ risk levels by comparing them to the benchmarks in their respective industries.

Based on these benchmarks, banks will have a basis for making credit decisions based on big data. For example, in the import-export industry, what should the risk ratio, leverage ratio, and average profit be? When reviewing applications, banks will refer to these benchmarks. However, we lack a comprehensive benchmark system due to limited data collection, and banks have not yet adopted a comprehensive digital platform, with many manual processes remaining.

Additionally, Vietnamese banks still heavily emphasize collateral as the primary source of loan repayment. In contrast, international practice considers the first source of repayment to be the enterprise’s cash flow and profits; collateral is only a backup and secondary source. Lending should be based on the ability of the enterprise to generate and circulate cash flow to repay the loan. If the primary source of repayment is insufficient or risky, then the secondary source, collateral, is considered.

In reality, many domestic banks prioritize collateral from the outset, contrary to international practice.

Thank you for your insights, sir!

CafeF Lists 2025 marks the return of two prestigious honor rolls:

PRIVATE 100 – Top private enterprises with tax contributions of VND 100 billion and above

VNTAX 200 – Top enterprises with tax contributions of VND 200 billion and above in the fiscal year

This list is compiled by CafeF from publicly available sources or verifiable data, reflecting the actual tax contributions of enterprises, including taxes, fees, and other obligatory payments. The transparent and accurate compilation of public data not only acknowledges the financial contributions of enterprises but also spreads social responsibility and affirms their position in the economy.

Some notable enterprises in the 2025 list, reflecting the actual contributions for the 2024 fiscal year, include Agribank, ACB, AIA, BIM Group, Coteccons, HDBank, LOF, Masan Group, MoMo, OCB, PNJ, Tasco, DOJI Group, Nam Long Group, TCBS, Techcombank, TPBank, Vingroup, VPBank, Vinamilk, VNG Group, VPS, etc.

Does Loosening Credit Room Affect Savings Deposits?

The credit growth landscape is set for a potential surge, however, we shouldn’t expect a rush to increase lending rates. This surge won’t spark a rate race, and it’s important to note that deposit savings of the public remain secure and unaffected.

Unlocking the Secrets to Effective Real Estate Investment: A Comprehensive Guide by the Ministry of Construction

The growth rate of credit for real estate across many banks has reached an impressive 20-30%, an astounding threefold increase compared to the overall credit growth rate of the system. The Ministry of Construction suggests that the State Bank should develop a special credit package for reasonably priced housing to further stimulate credit growth.