I. MARKET ANALYSIS OF STOCKS AS OF AUGUST 13, 2025

– The main indices remained in the green during the trading session on August 13. Specifically, the VN-Index increased by 0.21%, reaching 1,611.6 points. The HNX-Index rose by 1.16% to 279.69 points.

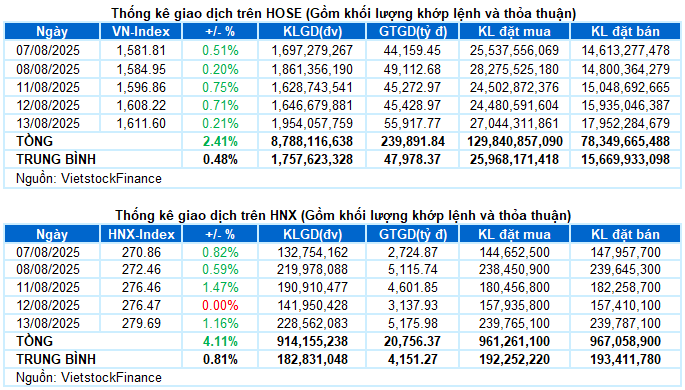

– The trading volume on the HOSE rose by 17.7%, surpassing 1.8 billion units. The HNX also witnessed a significant increase, recording nearly 226 million units, a 60.1% surge compared to the previous session.

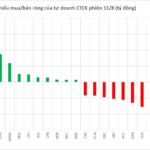

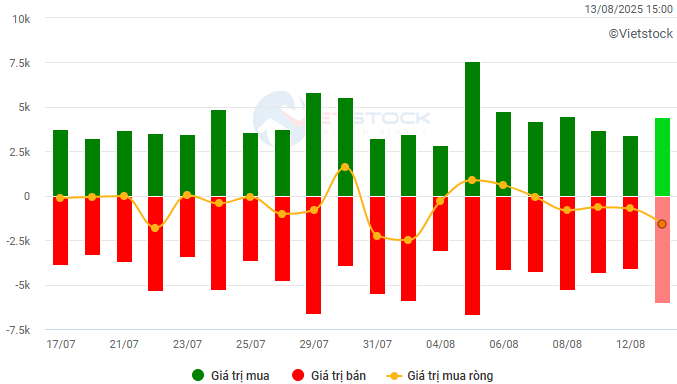

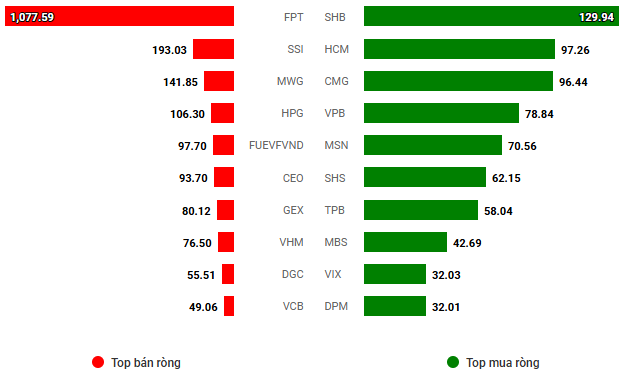

– Foreign investors continued to offload stocks, with a net sell value of VND 1.5 trillion on the HOSE and nearly VND 35 billion on the HNX.

Trading value of foreign investors on the HOSE, HNX, and UPCOM. Unit: VND billion

Net trading value by stock. Unit: VND billion

– The market experienced strong fluctuations during the August 13 session. The VN-Index opened with a gain of over 7 points, but buying power could not be maintained for long. Profit-taking pressure gradually increased, causing the index to reverse and even dip below the 1,590-point level by the end of the morning session. The strong recovery scenario in the afternoon session repeated once more. The VN-Index gradually regained its losses and closed at 1,611.6 points, up 0.21% from the previous session.

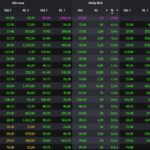

– In terms of impact, MBB and CTG were the leading stocks, contributing nearly 4.5 points to the VN-Index. They were followed by MSN, LPB, and BVH, which added another 2.4 points to the overall gain. On the other hand, VPB was the most negative stock, causing the index to lose 1.4 points.

– The VN30-Index closed slightly lower by 0.09%, settling at 1,753.71 points. The basket showed a mixed performance, with 16 declining stocks, 11 advancing stocks, and 3 stocks remaining unchanged. Among the gainers, MBB stood out with an impressive 6.2% increase. CTG and LPB also maintained positive momentum, ending the session with gains of over 3%. Conversely, VPB, SSB, and FPT witnessed corrections, falling by more than 2%.

Sectors started to show clearer differentiation. The financial group significantly contributed to the market’s recovery in the afternoon session, with notable names such as MBB (+6.17%), CTG (+3.33%), LPB (+3.02%), SHS (+4.18%), HCM (+3.24%), VCI (+3.3%), BVH, MBS, and CTS hitting the ceiling price. The real estate group also performed well, with several stocks surging over 4%, including DIG, KDH, SZC, IJC, NTL, TIG, NLG, NBB, EVG, IDJ, API, and TAL.

In contrast, information technology was the worst-performing sector, declining by 1.64%. However, this decrease was mainly due to the sector’s largest stock by market capitalization, FPT (-2.23%). Meanwhile, most other stocks in the sector remained in positive territory, including ELC (+1.06%), DLG (+3.24%), VEC (+7.96%), and CMG, which hit the ceiling price. Additionally, many energy stocks faced strong selling pressure, such as BSR (-1.96%), PLX (-1.3%), PVS (-3.17%), PVT (-1.32%), PVD (-1.09%), PVC (-1.54%), and VTO (-1.92%).

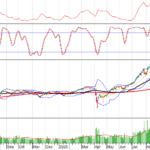

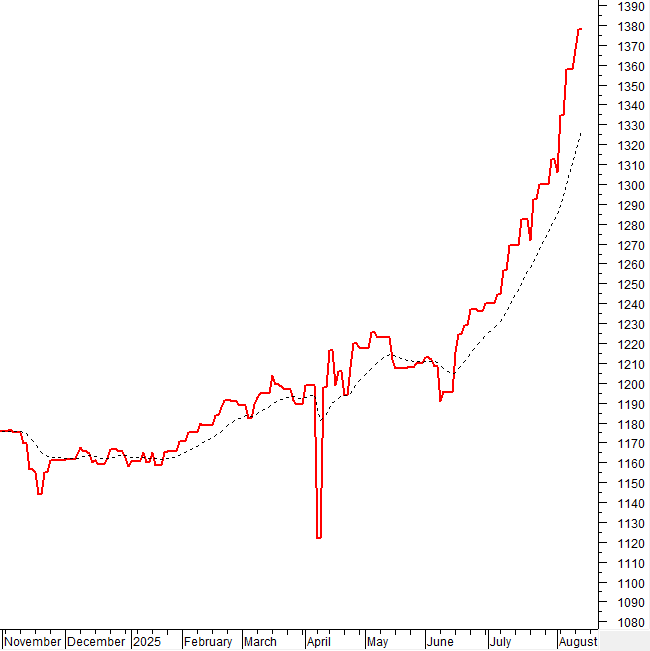

The VN-Index experienced strong fluctuations, with trading volume above the 20-day average. At present, the MACD indicator continues to move upward after generating a buy signal, reinforcing the positive outlook in the short term. However, strong intra-day fluctuations may persist as the index reaches new highs.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Trading volume above the 20-day average

The VN-Index experienced strong fluctuations, with trading volume above the 20-day average. At present, the MACD indicator continues to move upward after generating a buy signal, reinforcing the positive outlook in the short term.

However, strong intra-day fluctuations may persist as the index reaches new highs.

HNX-Index – Increased for the sixth consecutive session

The HNX-Index surged strongly towards the end of the session, marking its sixth consecutive gaining session.

The Stochastic Oscillator and MACD indicators continue to move upward after generating buy signals, reinforcing the short-term uptrend. If these signals are sustained, the index could target the old peak of August 2022 (corresponding to the 295-305-point region) in the coming period.

Money Flow Analysis

Movement of smart money: The Negative Volume Index of the VN-Index is currently above the 20-day EMA. If this status quo is maintained in the next session, the risk of an unexpected downturn (thrust down) will be mitigated.

Foreign capital flow: Foreign investors continued to net sell in the trading session on August 13, 2025. If this trend persists in the coming sessions, the situation may turn more pessimistic.

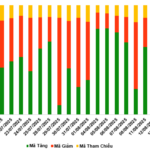

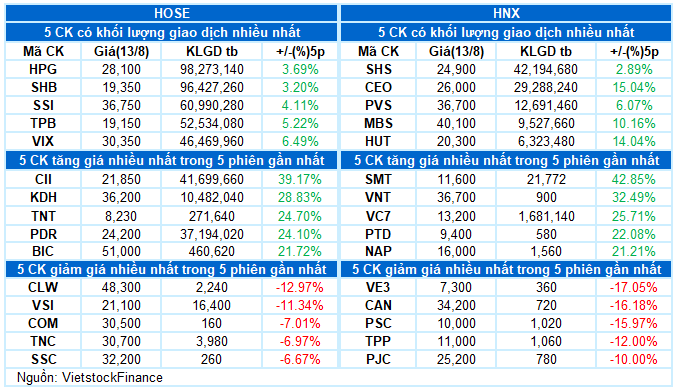

III. MARKET STATISTICS AS OF AUGUST 13, 2025

Economics & Market Strategy Analysis Department, Vietstock Consulting

– 17:22 13/08/2025

“Cautious Sentiments Persist in the Warrant Market on August 14, 2025.”

The market closed on August 13, 2025, with a positive note, witnessing 82 advancing stocks, 153 decliners, and 24 stocks remaining unchanged. Foreign investors turned net buyers, with a net purchase of 693,000 CW.

The Billionaire’s Boom: A Tale of Soaring Success.

Thanks to MSN’s surge during today’s trading session (August 11), Nguyen Dang Quang, Chairman of Masan Group, saw his wealth increase by approximately $75 million, reaching a total of $1.2 billion according to Forbes data. This places him at a global ranking of 2,799th.