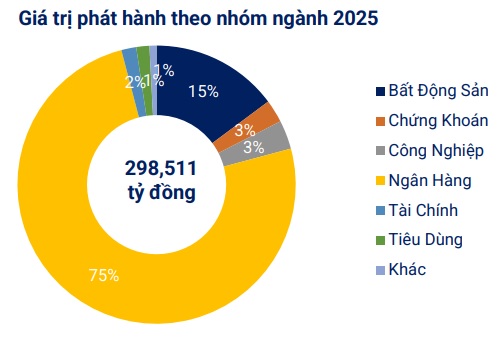

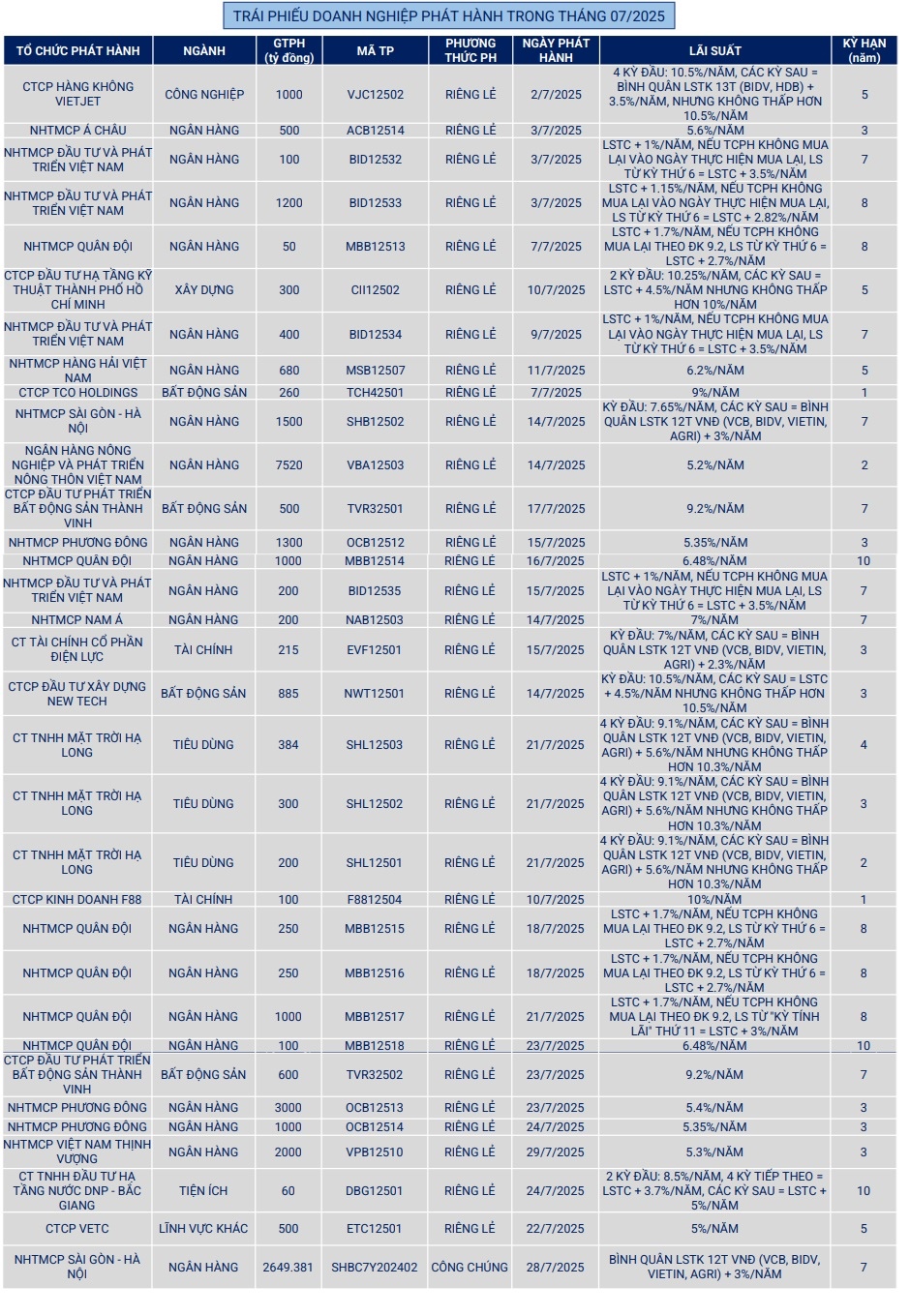

The bond market in July witnessed 31 private placements worth nearly VND 27.3 trillion and 1 public offering worth VND 2.65 trillion in July 2025.

Source: VBMA

|

Source: VBMA

|

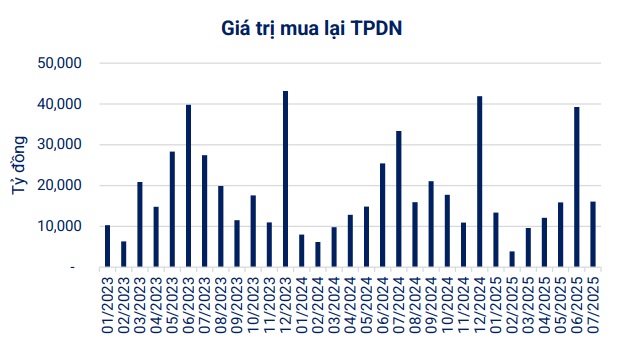

On the buyback front, enterprises repurchased over VND 16 trillion of bonds before maturity, down 52% from the same period in 2024. In the remaining five months of 2025, an estimated amount of over VND 109 trillion in bonds will mature. The majority of these are real estate bonds, totaling nearly VND 56 trillion, or 51%.

Regarding abnormal information disclosure, there were 7 bond codes that delayed interest and principal payments, totaling VND 881 billion.

Source: VBMA

|

The total trading value of private corporate bonds in the secondary market in July 2025 reached VND 132,028 billion, averaging VND 5,740 billion per session, down 8% from the June average.

Coming up, there will be 2 notable bond issuances. The first is from Rong Viet Securities (VDS), as their Board of Directors approved the plan to issue the third private placement in 2025 with a maximum value of VND 800 billion. These are “3-non” bonds – non-convertible, without warrants, and without collateral. The par value is expected to be VND 100 million per bond. The bonds have a 1-year term with an interest rate of 8% per annum.

The second issuance is from Vietnam Asia Commercial Joint Stock Bank (VietABank, HOSE: VAB) with a plan to issue the first public offering in 2025. The maximum issuance value is VND 300 billion, with a par value of VND 100,000 per bond, and these are also “3-non” bonds. The bonds have a 7-year term with an initial interest rate of 7.6% per annum.

Chau An

– 11:14, August 13, 2025

Corporate Bonds Rebound, Redemption Pressure Mounts

The Vietnamese corporate bond market is witnessing a notable recovery in both issuance and buyback activities, indicating a resurgence of investor and business confidence. However, alongside these positive signals, there is a mounting maturity pressure, particularly from the real estate sector, which faces significant challenges regarding cash flow and repayment capabilities.

The Looming Maturity Pressure on Real Estate Bonds in August Intensifies: Marking the Market’s Most Strained Period

“August sees a significant spike in the maturity value of non-bank group bonds, with an estimated face value of VND 27.4 trillion, a substantial 51.7% increase from the previous month’s value of VND 18.1 trillion. This surge in maturity value makes August the peak month for bond repayments in 2025.”