Land plots with red books remain a favored asset class among investors.

Land plots with red books – a favored asset class

Mr. Tran Khanh Quang, an experienced real estate investor, believes that land plots have long been a favored investment option, as this asset class has consistently demonstrated significant price appreciation potential. “The longer you hold, the more you gain. Investors should adopt a medium- to long-term strategy of 2-5 years for land plots,” he emphasized.

A survey by Batdongsan.com.vn revealed that 64% of investors prefer primary real estate, while only 36% opt for secondary properties. When choosing primary real estate, investors prioritize legal project documentation (78%), transportation infrastructure (71%), utilities (66%), and landscape and design (47%). Thus, well-planned projects with complete legal documentation and developed infrastructure are attracting substantial investment capital.

Currently, the trend of “flipping” real estate has noticeably decreased compared to last year, with only 12% of investors intending to hold properties for less than a year. In contrast, 49% plan to hold their assets for 3-10 years. This reflects the expectation of sustainable profits in the land plot segment over the medium to long term.

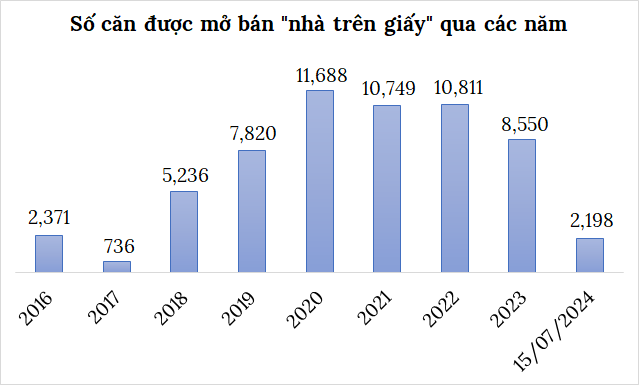

Most investors anticipate an increase in land prices, given the limited new supply and quietly growing demand. Simultaneously, there is a distinct shift towards areas with lower base prices and potential for price appreciation driven by infrastructure development during this phase.

Notably, according to Batdongsan.com.vn, northern investors are inclined to invest in land plots in the south, especially those with red books. Among investors from Hanoi, 39% plan to invest in land plots, and this figure rises to 48% for investors from other northern provinces.

The game shifts southward as infrastructure nears completion

Transportation infrastructure development and low initial capital requirements are significantly influencing land prices and guiding investors’ purchasing decisions.

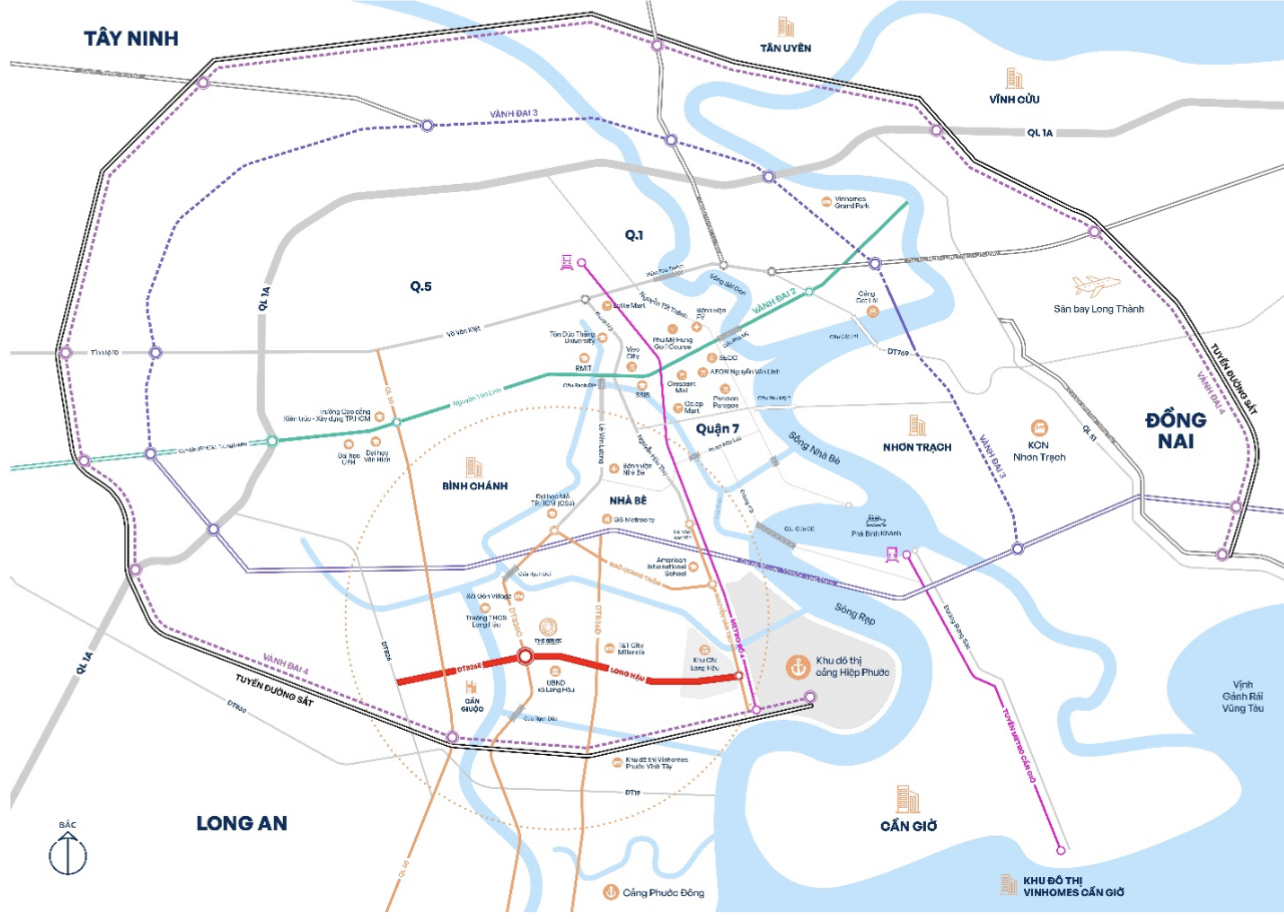

There has been a noticeable shift in capital flow from the east of Ho Chi Minh City, where land prices are already high, to the south of the city. This area offers lower land prices but benefits from ongoing infrastructure investments, presenting opportunities for price appreciation.

Market observations indicate that well-planned land plot projects in southern Ho Chi Minh City, located near major roads and benefiting from upcoming infrastructure projects, are attracting significant investor interest.

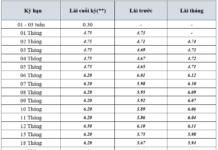

A prime example is The 826 EC commercial township (15ha) developed by Hai Thanh. Ahead of its launch on August 17, the project has witnessed positive demand due to its competitive pricing, proximity to Ho Chi Minh City, individual red books for each plot, and flexible payment policies. With a down payment of just VND 560 million, customers can benefit from a 18-month installment plan. Additionally, reputable banks like VietinBank, MB Bank, and ACB offer attractive loan packages, including a 30-year loan term, 15-month interest-free period, and a 24-month grace period for principal repayment. As a result, The 826 EC commercial township has attracted not only buyers from Ho Chi Minh City and the locality but also considerable interest from northern investors.

The 826 EC commercial township becomes the new “hotspot” for southern Ho Chi Minh City residents, offering a range of entertainment activities such as artistic kite flying, bracelet-making workshops, and statue painting.

The project is strategically located on two fronts along the provincial roads DT826E & DT826E (Can Giuoc) and is close to the Ben Luc – Long Thanh expressway, which is expected to open in Q3 2026. Additionally, the project is adjacent to several key transportation routes currently under expansion and upgrade, including National Highway 50 (scheduled for completion by the end of 2025), Nguyen Huu Tho Road (to be completed in 2026), Rach Tom Bridge (officially started construction on July 10), Ho Chi Minh City Ring Road 4, and the accelerated implementation of Metro Line 4. These factors collectively enhance the project’s appeal to investors.

Not only The 826 EC commercial township but also other projects such as Saigon Village, T&T City Millennia, Saigon RiverPark, and Elite Life are witnessing healthy demand amid the improving infrastructure in the south. Investors are optimistic about a 10-20% price increase by the end of the year.

In reality, the concentrated infrastructure investments in areas neighboring Ho Chi Minh City are significantly influencing buyer psychology. Historically, real estate price increases have been associated with significant infrastructure and planning projects. Thus, capital is flowing towards areas with lower base prices, following the infrastructure development, which is a well-founded trend.

Long An (formerly) will be the “new focal point” of satellite real estate development around Ho Chi Minh City due to the trend of urban expansion into surrounding belts and provinces.

Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn, opined that the real estate market in Long An (formerly) is in the early stages of infrastructure development, with significant growth potential. Three key advantages include improved connectivity to Ho Chi Minh City through major transportation routes, abundant land availability, and significantly lower prices than Ho Chi Minh City. These factors will be crucial in driving the area’s real estate value in the coming years.

Regarding price prospects, experts forecast a 10-15% annual increase in real estate prices, particularly for land plots in prime locations with comprehensive infrastructure and well-planned projects. This asset class offers stable long-term returns and significant upside potential when infrastructure or planning announcements are made. In Long An (formerly), the completion of key projects in 2025-2026 is expected to catalyze a new wave of price increases, especially in areas bordering Ho Chi Minh City, such as Can Giuoc.

Savills: Dalat’s Potential as a Haven for the Ultra-Wealthy

“With its breathtaking natural heritage and ever-improving transport links, Dalat stands at the precipice of explosive growth. The city has the potential to become a haven for the ultra-wealthy, akin to renowned mountain resorts such as Aspen in the United States or Davos in Switzerland.”

A Heavily Polluted Canal in Ho Chi Minh City: The $360-Million Project to Bring it Back to Life

The decrepit houses and pitch-black water of Rach Van Thanh in Thanh My Tay Ward, Ho Chi Minh City, paint a dismal picture. However, there is hope on the horizon as plans are afoot to invest over VND 8,555 billion in the rehabilitation of this canal, offering a glimmer of renewal and transformation for the better.

Why is the Construction of the Longest Sea-Crossing Bridge in Central Vietnam Delayed and in Disarray?

The Thuan An Sea Bridge, the longest in Central Vietnam, stands proudly with construction nearing completion at over 86% progress. However, the approach roads leading to this majestic structure lag far behind, presenting a stark contrast with their unfinished state, riddled with obstacles and disorder.

Is the Big Wave Coming? A Quiet Stir in Danang’s Land Market as ‘Big Players’ Make Their Move.

“With investors and their deep pockets returning to the scene, post-Tet, the Danang land market is witnessing a surge in liquidity and prices. This resurgence signals a prelude to a potential big wave, as transactions in the 4-10 billion VND range start to pick up pace.”