“Vinaconex Reports Impressive Second-Quarter Financial Results”

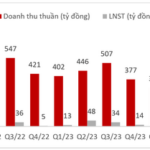

The second quarter of 2025 ended on a high note for Vinaconex, with impressive financial results. The company, officially known as the Vietnam Construction and Import-Export Corporation (listed on the Ho Chi Minh Stock Exchange as VCG), reported a remarkable surge in revenue and profit.

For the quarter, Vinaconex’s revenue exceeded VND 4,412 billion, reflecting a significant 57% increase compared to the same period last year. Even more impressively, the company’s net profit reached nearly VND 309 billion, more than tripling the amount from the previous year.

Looking at the first half of 2025 as a whole, Vinaconex maintained strong performance. The company’s revenue for this period surpassed VND 7,008 billion, representing a 28% year-on-year increase. This growth was predominantly driven by a 42% surge in the construction segment, which contributed nearly VND 5,155 billion. However, it is worth noting that the company’s after-tax profit decreased by 18%, amounting to over VND 508 billion. In relation to their plans, the company has achieved 45% and 42% of their revenue and profit targets, respectively.

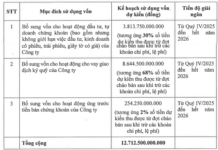

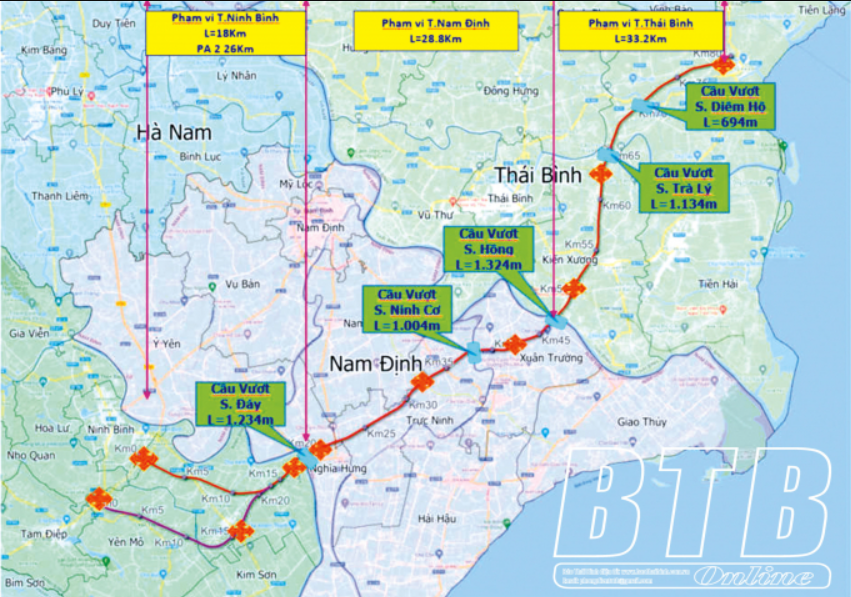

A notable strategic move by Vinaconex was its investment of nearly VND 54 billion to acquire a 15% stake in the Nam Dinh – Thai Binh Expressway Investment Joint Stock Company. This company is the investor in the project to build the Ninh Binh – Hai Phong expressway section passing through Nam Dinh and Thai Binh provinces, with its headquarters currently located in Hung Yen province.

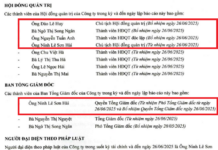

The Nam Dinh – Thai Binh Expressway Investment Joint Stock Company is a recently established entity, having been founded in May 2025. It primarily operates in the field of road construction, with a charter capital of over VND 1,567 billion and five founding shareholders. Geleximco Group, a well-known conglomerate, holds a 40% stake in the company. The remaining 60% is divided equally among four other companies: Nam Son Trading and Construction Joint Stock Company, Phuong Thanh Tranconsin Joint Stock Company, Vinaconex (VCG), and Hoang Cau Infrastructure Investment and Construction Joint Stock Company.

Geleximco Group, founded in 1993, has a rich history. Initially known as Hanoi General Import-Export Joint Stock Company, it was the first private enterprise in Vietnam authorized to engage in direct import and export trading. Over the years, the group has expanded its operations to encompass four main sectors: industrial production, infrastructure and real estate, finance and banking, and trade and services.

The Nam Son Trading and Construction Joint Stock Company, established in 2008, is based in Quang Ninh province, focusing on real estate development. As of August 2018, the company had a charter capital of VND 50 billion, with Mr. Nguyen Manh Thang holding 48.6%, Nguyen Kim Quan 26.4%, and Nguyen Kim Thanh 16.8% of the ownership. Mr. Nguyen Trong Luu served as the company’s General Director and legal representative at that time. In October 2019, Mr. Vu Phuc Tho took on the role of legal representative and Chairman of the Board of Directors. The company increased its capital to VND 450 billion in November 2020, and Mr. Do Hoang Ha has been serving as the General Director and legal representative since then.

Phuong Thanh Tranconsin Joint Stock Company, a well-known name in the field of bridge and road projects, is under the management of the Ministry of Transport. Tracing its origins back to 1999, it was initially established as the Transport Trade Union Joint Stock Company. After undergoing a series of transformations, including privatization in 2004 and a name change in 2011, the company is now known as Phuong Thanh Tranconsin Joint Stock Company. As of March 2025, the company boasts a charter capital of VND 1,668 billion, with Mr. Pham Van Khoi serving as the General Director and legal representative.

Phuong Thanh Tranconsin has left its mark on numerous significant projects, including the upgrade and repair of National Highway 37 from Bac Giang to Thai Nguyen, National Highway 38 from Hai Duong to Cau Trang, Package 12 of the Quan Lo – Phung Hiep route, Package 6 of the N2 route in Long An, Package 2 of the National Highway 1 My Thuan – Can Tho section, the Noi Bai – Lao Cai highway, the Tra Vinh 53.1 project, National Highway 91 in Chau Doc, the Cai Lay – Dinh Khao section of the Ho Chi Minh Highway, the expansion of National Highway 1 from My Thuan to Can Tho, and many others.

The Hoang Cau Infrastructure Investment and Construction Joint Stock Company, formerly known as G.E.L.E.X.I.M.C.O Infrastructure Investment and Construction Joint Stock Company, was established in 2008 in Hanoi. Primarily focused on road construction, the company changed its name to Hoang Cau in late 2015. At that time, its charter capital was VND 150 billion, and it further increased its capital to VND 250 billion in late 2024. Mr. Tran Ngoc Phuong is currently serving as the company’s General Director and legal representative.

On May 12, the People’s Committee of Thai Binh province held a groundbreaking ceremony for the Ninh Binh – Hai Phong expressway project, which will pass through Nam Dinh and Thai Binh provinces. This public-private partnership (PPP) project has a total investment of nearly VND 19,785 billion, with a design speed of 120 km/h and a scale of four completed lanes. The total length of the route is approximately 60.9 km, of which 27.6 km passes through Nam Dinh and 33.3 km through Thai Binh.

Route of the Ninh Binh – Hai Phong Expressway through Nam Dinh and Thai Binh. Source: Thaibinh.gov

|

The project’s investment includes over VND 1,567 billion in owner equity and over VND 8,880 billion in other legal capital sources. Additionally, VND 9,337 billion in state capital has been allocated for the project. The expressway is expected to be completed by 2027 and put into operation in 2028.

– 14:49 12/08/2025

Introducing the Prime Real Estate of Dong Nai: Now Open for Business

Introducing the future of real estate in Dong Nai: a transparent and accessible journey towards your dream property. The province is set to unveil auction-bound land plots through a multi-channel approach, utilizing the power of media, e-government portals, and dynamic real estate exchanges. Get ready to navigate the exciting world of real estate with ease and confidence!

“Record-breaking Revenue and Profits: Nafoods Commences Construction of NASOCO Phase 2”

Nafoods Group (HOSE: NAF) has reported record-breaking revenue and profits for the second quarter of 2025 and the first half of the year. Along with this impressive financial performance, the company is also embarking on an expansion journey with the second phase of the Nasoco project, positioning itself to capitalize on future growth opportunities.

Record-Breaking Revenue and Profits: Nafoods Group Breaks Ground on Nasoco Project Phase 2

Nafoods Group (HOSE: NAF) has reported record-breaking revenue and profits for the second quarter of 2025 and the first half of the year. Along with this impressive financial performance, the company is also embarking on an expansion journey with the second phase of the Nasoco project, positioning itself to capitalize on future growth opportunities.