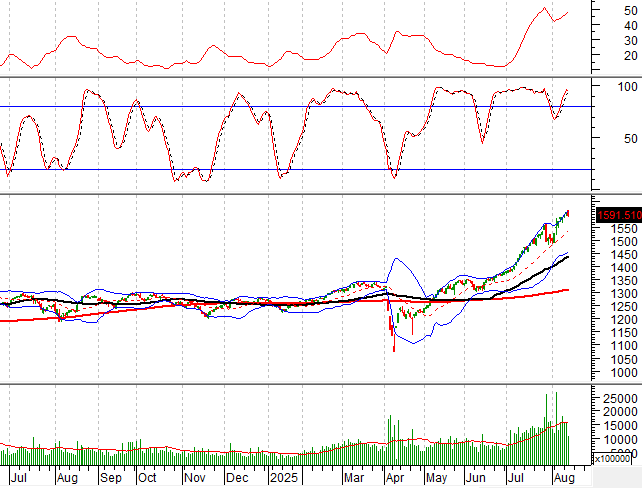

Technical Signals for VN-Index

In the trading session on the morning of August 13, 2025, the VN-Index declined and formed a Big Black Candle pattern, along with an increase in trading volume. If this situation persists until the end of the afternoon session, the outlook will be rather pessimistic.

The Stochastic Oscillator indicator reversed strongly in the overbought region. In the context of the ADX indicator continuing to remain in the strong trend region (ADX>25), investors need to be cautious if sell signals appear.

Technical Signals for HNX-Index

In the trading session on the morning of August 13, 2025, the HNX-Index witnessed a slight decline, ending its previous five consecutive gaining sessions.

In case of a correction, the old peak conquered in September 2023 (corresponding to the 250-259 point range) will act as a strong support.

HDG – Hanoi Construction Corporation

In the morning session on August 13, 2025, HDG’s stock price opened with a strong increase and formed a Big White Candle pattern, with trading volume exceeding the 20-session average, indicating investors’ optimistic sentiment.

Additionally, the price surpassed the old peak from July 2024 (corresponding to the 29,500-30,000 range) while the Stochastic Oscillator indicator continued to rise after giving a buy signal. This suggests a fairly optimistic outlook for the future.

LPB – Loc Phat Bank

In the trading session on the morning of August 13, 2025, LPB’s stock price opened higher, with trading volume exceeding the 20-session average, reflecting investors’ optimistic sentiment.

Furthermore, the price broke above the upper band (Upper Band) of the Bollinger Bands, while the MACD line continued to rise after providing a buy signal. This further reinforces the current upward momentum.

Currently, the price has reached a new 52-week high, indicating a fairly optimistic outlook for the near future.

(*) Note: The analysis in this article is based on real-time data up to the end of the morning trading session. Therefore, the signals and conclusions are only for reference and may change when the afternoon trading session ends.

Technical Analysis Department, Vietstock Consulting

– 12:12 13/08/2025

Stock Market Outlook for Tomorrow, August 12: Avoid Buying Stocks at High Prices

Despite the surge in stock prices, leading brokerage firms are urging investors to refrain from chasing stocks at these elevated levels. The recommendation is to exercise caution and avoid buying at these highs to mitigate potential risks.

“VPBank’s Expert Insight: VN-Index Enters a ‘Mega Uptrend,’ with a Prolonged Growth Tsunami Ahead.”

The market remains highly positive in the short term, bolstered by an incredibly robust flow of capital. Experts attribute this momentum to a confluence of factors, including favorable economic conditions and confident investors. This surge in liquidity has injected a sense of optimism into the market, with participants eagerly anticipating sustained growth.

Stock Market Conquest: Breaking the 1,600-Point Barrier

The VN-Index successfully surpassed the 1,600-point threshold despite facing strong volatility during the trading session. However, the emergence of long-shadow candles with fluctuating volumes in recent sessions indicates investor indecision. At present, the Stochastic Oscillator continues to climb deeper into overbought territory. Technical fluctuations are likely to persist in the short term as the index ventures into new highs.