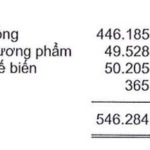

Pomina Steel Joint Stock Company (HOSE: POM) announced its second-quarter 2025 consolidated financial report, with a 25% decrease in net revenue to VND 462 billion compared to the second quarter of 2024. POM stated that the factory is still temporarily suspended, and the main source of revenue comes from processing activities.

The company recorded a gross profit of nearly VND 49 billion, a significant recovery from a gross loss of nearly VND 51 billion in the second quarter of 2024.

In the second quarter of 2025, POM implemented strict control measures on irregular incurred expenses and other expenses to optimize costs while the main production activities have not yet been restored.

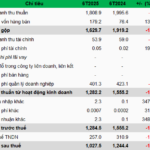

In this period, POM’s financial revenue decreased significantly to only VND 412 million, compared to VND 2.2 billion in the second quarter of 2024, mainly due to a decrease in foreign exchange rate differential income.

Financial expenses increased by 10% to VND 165.34 billion. Notably, actual interest expenses decreased from VND 176 billion to VND 163 billion. However, the financial expenses for the second quarter of 2024 benefited from a reversal of investment in POM2 of nearly VND 26 billion, which did not occur this year, causing a relative increase in financial expenses for the second quarter of 2025.

Selling expenses were VND 457 million, a 91% decrease compared to VND 5.2 billion in the same period last year. Enterprise management expenses recorded a negative value of VND 12 billion due to depreciation of fixed assets in the period of VND 28 billion.

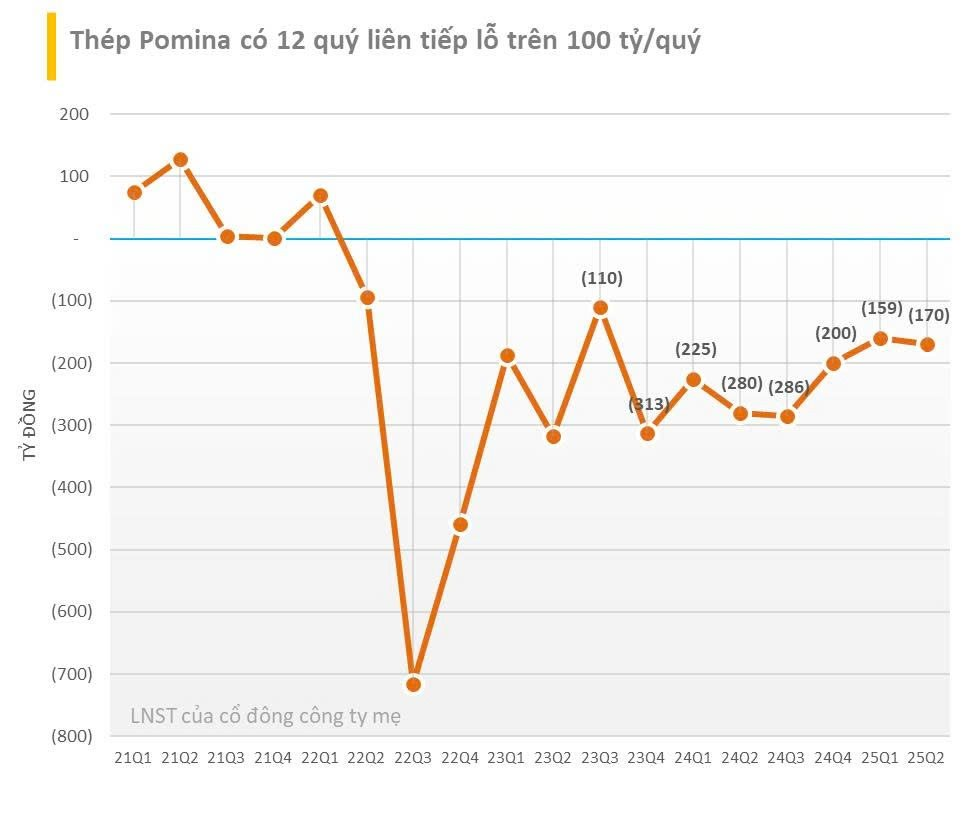

As a result, POM reported a post-tax loss of VND 170 billion, an improvement from a loss of VND 280 billion recorded in the same quarter last year. This is Pomina’s 13th consecutive quarterly loss and the 12th consecutive quarterly loss of over VND 100 billion.

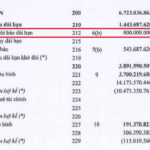

For the first six months of 2025, Pomina recorded net revenue of VND 1,491 billion, a 37% increase compared to the same period in 2024. The six-month post-tax profit was a loss of VND 330 billion, an improvement from a loss of VND 505 billion in the first half of 2024. As of June 30, 2025, POM had a cumulative loss of over VND 2,868 billion.

As of June 30, 2025, the company’s total assets were VND 9,498 billion, a 4% decrease from the beginning of the year. The majority of the company’s assets are uncompleted basic construction costs of nearly VND 5,724 billion, which are costs for the purchase of machinery and equipment and the construction of a blast furnace and EAF steelmaking project with a capacity of 1 million tons/year in Phu My Industrial Park.

Total liabilities at the end of the second quarter were VND 9,502 billion. Due to the cumulative loss, the company’s equity has turned negative at VND 4.1 billion.

The Lotus Corporation Invests $386 Million in Land Acquisition Near Long Thanh Airport, Envisioning a 700-Hectare Urban Development

“With a confident assertion, the Chairman of Hoa Sen Group underlined the corporation’s robust financial standing and significant advantage in affordable construction materials. The Group is committed to leveraging its core business resources to make long-term investments in the real estate sector.”

The Vietnam Stock Exchange Plunges 17% in H1 Profits

In the first half of 2025, the Vietnam Stock Exchange (VNX) recorded a remarkable performance with approximately VND 1,809 billion in net revenue and nearly VND 1,028 billion in net profit, reflecting a 9% and 17% decrease, respectively, compared to the same period last year.

The Green Airport: CEO Group’s Profitable Venture into Industrial Park Development

“CEO Group reports a doubling of profits for the second quarter of 2025, attributed to successful cost-cutting measures. The Group’s quarterly profits soared to 39 billion VND. During this period, CEO Group also invested 50.5 billion VND in its newly established subsidiary, which has a charter capital of 450 billion VND.”

“Van Phu Reports 6-Month Profit Growth of 56% in First Half of 2025”

“The positive macroeconomic climate has had a significant impact on the real estate market’s recovery, and this is reflected in the impressive financial performance of Van Phu – Invest Real Estate JSC (HOSE: VPI). The company has announced a remarkable 56% year-over-year increase in its after-tax profit for the first half of 2025, amounting to VND 148.8 billion.”