Vietnam’s rubber imports in July reached over 175,000 tons, with a value of more than $274 million, according to preliminary statistics from the Customs Department. This marks a 13.7% increase in volume and a 14.2% increase in value compared to the previous month. Cumulatively, in the first seven months of the year, the country imported over 1 million tons of rubber, valued at nearly $1.7 billion, representing a 7.2% volume increase and an 18.7% value increase from the same period last year.

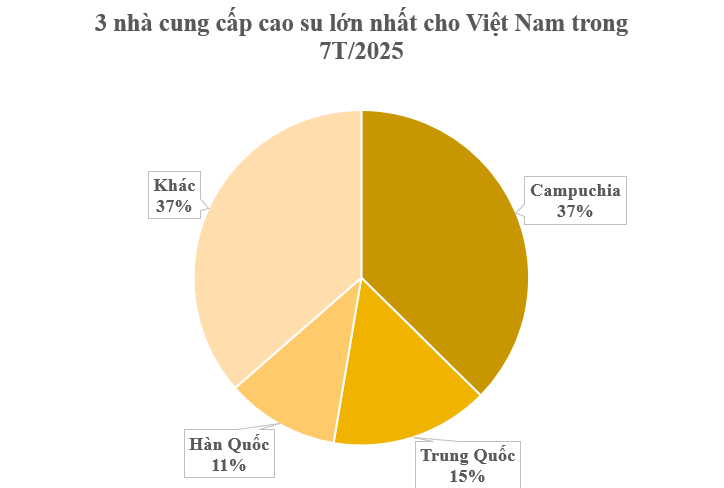

In terms of market sources, Cambodia is currently Vietnam’s largest rubber supplier, providing over 378,000 tons valued at over $510 million. This reflects a slight decrease of 4% in volume but an 11% increase in value compared to the previous year. The average import price increased by 15%, reaching $1,348 per ton.

China ranks second among suppliers, with over 154,000 tons and a value of more than $276 million. This shows a significant volume increase of 46% and a 34% value increase compared to the same period in 2025. However, the average import price decreased by 8%, standing at $1,788 per ton.

South Korea is Vietnam’s third-largest rubber supplier, contributing over 110,000 tons valued at over $188 million. This represents a 12% increase in both volume and value compared to 2024, with the import price remaining unchanged at $1,701 per ton.

Currently, import taxes on natural rubber range from 5% to 10%, depending on the product type and origin of the shipment. Preferential rates, including 0% import tax, may apply to goods originating from ASEAN countries under free trade agreements such as AFTA, provided that valid C/O is presented.

Vietnam and Thailand are among the world’s leading rubber exporters, playing a crucial role in supplying raw materials to the tire, glove, and industrial product industries. Thailand has consistently maintained its top position in natural rubber exports, typically accounting for over 30% of the global market share, with key markets in China, Japan, the US, and Europe. Vietnam ranks third globally, after Thailand and Indonesia, specializing in raw rubber and rubber mixtures, mainly exported to China, India, and South Korea. While Thailand leverages its advantages in vast planting areas, stable production, and modern processing systems, Vietnam excels in product diversification and market expansion through free trade agreements.

According to the Vietnam Rubber Association (VRA), the total export turnover of the rubber industry is expected to exceed $11 billion in 2025, including natural rubber ($3.5 billion), rubber products ($5 billion), and rubberwood ($2.5 billion)…

Despite competition from regional powerhouses like Thailand, Indonesia, and Malaysia, Vietnam maintains its competitiveness through a synchronized value chain, stable supply capacity, and continually enhanced quality.

Despite positive signals, rubber prices face significant pressure due to fluctuations in international trade policies. As per the Import-Export Department (Ministry of Industry and Trade), new tax measures from the US, particularly on imported automobiles, coupled with declining crude oil prices and trade tension concerns, are creating challenges for the global rubber market.

The Secret Race for Mid-Autumn Festival Gifts in 2025

The Mid-Autumn Festival gift market in 2025 is a highly competitive arena, with tens of thousands of businesses vying for attention. Gifts are no longer mere tokens of appreciation but have become strategic weapons in the battle for premium brand recognition.

Can Vietnamese Enter and Play in Casinos? Which Casinos are There in Vietnam?

“In Vietnam, there is a vibrant landscape of casinos with a total of 9 licensed operations. This includes 6 smaller-scale projects and 3 large-scale, resort-style casinos. These establishments offer a range of gaming and entertainment options, contributing to a dynamic and exciting industry in the country.”

Vietnam Airlines Joins Hands with South Korea’s Largest Carrier to Explore Aircraft Maintenance Joint Venture at Long Thanh Airport

Vietnam Airlines is set to soar to new heights with strategic collaborations with Korean partners. The airline has signed Memorandums of Understanding to explore joint ventures in aircraft maintenance, repair, and overhaul (MRO); cargo transportation; and bilateral tourism promotion, creating seamless travel experiences and boosting economic growth.