Despite a number of new apartment projects being launched in Ho Chi Minh City’s real estate market recently, secondary market prices for apartments in the city center and suburban areas have surged, with some even surpassing previous records.

Skyrocketing Prices

A survey by NLD reporters revealed that at Vinhomes Central Park in My Thanh Tay Ward, apartments with two bedrooms and an area of 80 sq m now cost VND 8-9 billion each (an increase of VND 800 million to VND 1 billion compared to last year). Apartments with an area of 90 sq m in the Landmark area have even reached nearly VND 12 billion, about 15% higher than in 2024.

Apartment prices at The Sun Avenue have surged in recent months after news of the resolution of pink book issues.

In District 7, a project by Quoc Cuong Gia Lai that was launched at the beginning of the year with prices of VND 54-55 million per sq m (about VND 3.6-3.7 billion per apartment with two bedrooms and an area of 73 sq m) has seen its market prices rise to over VND 64 million per sq m, equivalent to VND 4.3 billion per apartment (excluding VAT). Including taxes, the price could go up to VND 4.8 billion. Some apartments are being traded at around VND 60-62 million per sq m.

The Ben Van Don area in District 4 has also witnessed similar trends. Tresor, a project invested in by Novaland, has seen the price of one-bedroom apartments (50 sq m) increase from VND 3.2-3.3 billion at the beginning of the year to VND 4-4.2 billion. Two-bedroom apartments (58 sq m) are now being offered at VND 5.4-5.5 billion, a 30% increase compared to last year. Meanwhile, Icon 56, also developed by Novaland but with pink books already available, commands higher prices: one-bedroom apartments of 50 sq m reach VND 5.2 billion, a 22% increase from the previous year.

The most significant price increase can be seen at The Sun Avenue in Binh Trung Ward. Mr. Pham Minh Nguyen, a resident there, said that last year, someone offered VND 4.3-4.4 billion for a two-bedroom apartment (67 sq m) but he refused to sell. Currently, the price has risen to VND 6.5-6.7 billion (about VND 82 million per sq m), an increase of more than 50% in just one year. According to Mr. Nguyen, the main reason for this is the news that the project is about to complete the pink book issuance process.

Several other projects with initially lower prices have also seen significant increases after improving their legal status, such as Saigon Gateway (Vo Nguyen Giap Street, Tang Nhon Phu Ward), which has gone from VND 30-35 million per sq m last year to VND 38-42 million; TDH Riverview (Tam Binh Ward) has increased from VND 30 million to VND 35-36 million per sq m; and The Capella (Luong Dinh Cua Street, An Khanh Ward) has recorded a 22% increase over the past year, with an average price of VND 6 billion for a two-bedroom apartment with an area of 87 sq m.

Mr. Phan Quoc Danh, a real estate broker, noted that secondary apartment prices in the city’s eastern area have risen faster than in other areas because most of the newly launched projects have very high initial prices. For example, right next to The Sun Avenue, The Prive by Dat Xanh is selling at VND 120 million per sq m, while Eton Park, not far away, has similar prices, and Global City has now reached VND 140 million per sq m. This has pulled the market psychology, pushing up secondary market prices.

Easy to Explain

Mr. Ta Trung Kien, Director of Wowhome Real Estate Company, said that it is understandable that many condominium projects that have been handed over and had their legal issues resolved have seen price increases. In the case of The Sun Avenue, the recent sharp increase is not only due to legal factors but also to the spillover effect from surrounding projects.

According to Mr. Kien, in the past year, many neighboring projects by other developers have been sold at prices above VND 100 million per sq m. “This large price gap has led both sellers and buyers in already-handed-over projects to tend to ‘pull’ prices up to match the new level. Additionally, the transportation infrastructure in this area connects well with the eastern part of the city and the traffic axis towards Ba Ria – Vung Tau (formerly known as Highway 51), meeting the needs of buyers who want convenient transportation and access to administrative units that have been rearranged,” Mr. Kien explained.

Dr. Pham Viet Thuan, Director of the Ho Chi Minh City Institute of Economics and Environment, analyzed that the main reason for the increase in secondary apartment prices, especially in projects that have recently improved their legal status, is the imbalance between supply and demand. For many years, the supply of new apartments has continuously decreased, and projects in the middle and affordable segments have almost disappeared from the market. Meanwhile, the demand for housing among the population remains high, especially in Ho Chi Minh City.

At the same time, a series of stalled projects due to legal issues have been resolved, allowing developers to accelerate the handover process. This has boosted confidence and encouraged buying demand. The issuance of pink books for previously stalled projects has also contributed to increasing the value of apartments, especially for condominiums that have been handed over for many years but are in good locations.

In addition to legal factors, key infrastructure projects, such as Metro Line 1, the expansion of major roads, and the opening of new commercial centers, have acted as “magnets” for investment. “Any area that benefits from improved infrastructure has seen significant price increases. For example, along Pham Van Dong Street or in some wards of the former Thu Duc City, apartment prices have risen sharply after transportation improvements.

This context, coupled with very high primary prices in many new projects, has led many buyers to turn to the secondary market, where they can find apartments in convenient locations with clear legal status and prices that are still more ‘breathable’ than those of newly launched projects. This demand pressure continues to push up old apartment prices, creating a new price level across the market.

Search Demand Increases by 70%

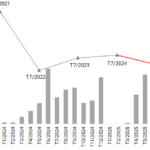

According to data from Batdongsan.com.vn, in mid-2025, the demand for apartments in Ho Chi Minh City rebounded, with search volume increasing by up to 70%. In fact, in the second quarter, many projects continued to launch new products, but most of them belonged to the high-end segment, with prices ranging from VND 80-100 million per sq m or higher, such as The Global City, Celadon City, CitiGrand, and Alta Height. Primary market prices continued to inch up by 4%-6% in new projects and 2%-4% in old ones.

The Ultimate Guide to the Unprecedented Revelations from the Ministry of Construction: Housing and the Real Estate Market

The Ministry of Construction is committed to enhancing its information system for housing and the real estate market. We are taking significant steps to ensure that 100% of the data is accurate, comprehensive, clean, and dynamic. Our priority is to safeguard the security and confidentiality of this information while making it readily available and adaptable to the digital environment.

The Rebirth of Capital Square Danang

A luxury apartment project, funded by VinaCapital, was initiated nearly two decades ago with a substantial investment of hundreds of millions of dollars, yet it remained largely stagnant. However, when the project changed hands to a Vietnamese owner, it awoke from its slumber, with prices now surpassing 100 million VND per square meter.

The Surprising “U-Turn” by McDonald’s

Once bidding farewell to its decade-long journey at the prime location in Ho Chi Minh City, McDonald’s has made a surprising comeback to the very same spot just a year later, leaving locals bewildered.