“Large-Scale Project Changes Hands”

On June 27, 2025, the People’s Committee of Ha Nam province (now part of Ninh Binh province) approved the transfer of the Lam Ha Center Point project in Lam Ha ward, Phu Ly city to the Total Joint Stock Company for Investment Development and Construction (HOSE: DIG).

The 12-hectare project, with a total investment of over VND 2,115 billion, includes 5-storey commercial townhouses, villas, linked houses, and land for social housing. Before the transfer, the project was granted a construction permit for technical infrastructure in late October 2024. DIG expects to record revenue of more than VND 1,114 billion from this transaction. The General Director, Mr. Nguyen Quang Tin, stated that the cash flow from the transfer will significantly support the company’s investment activities this year.

In July, VietinBank (HOSE: CTG) announced its search for investors to transfer the VietinBank Tower project in the TM1 plot of the Nam Thang Long Urban Area in Hanoi. The project has a total investment of over VND 10 trillion and a usage area of 300,000 m2, comprising two towers of 68 and 48 stories, connected by a 7-story pedestal serving purposes such as a commercial center, conference hall, and restaurant. This project was once envisioned as VietinBank’s iconic financial headquarters, with an architectural design featuring the letter “V” representing the bank.

At the end of May, Vietnam Construction and Commerce Joint Stock Corporation (CTX Holdings, UPCoM: CTX) announced plans to transfer the entire Constrexim Complex project – a commercial, office, and apartment complex in the new Cau Giay urban area. The project covers an area of 2.5 hectares and consists of 5 towers ranging from 38 to 45 stories, located in a prime location with three fronts facing major roads. The project has been renamed Sun Felia Suites and is being advertised extensively, with a likely buyer being a member of the Sun Group.

Constrexim Complex project developed by CTX Holdings

|

Most recently, Saigon General Service Joint Stock Company (Savico, HOSE: SVC) announced the completion of the transfer of its capital in the Long Hoa – Can Gio high-end residential project through a public auction, thereby earning more than VND 619 billion.

The transferee is Gelex Infrastructure Joint Stock Company. This divestment is part of SVC’s 2025 real estate portfolio restructuring plan.

The nearly 30-hectare project, located in Long Hoa commune, Can Gio (old district), was handed over by Ho Chi Minh City People’s Committee in 2005 after the investment policy was approved in 1999. However, after land filling in the fourth quarter of 2009, progress has been stagnant for many years.

According to the initial design, the total investment was about VND 320 billion, expecting to bring in pure revenue of VND 672 billion and post-tax profit of about VND 254 billion.

Long Hoa – Can Gio residential project perspective

|

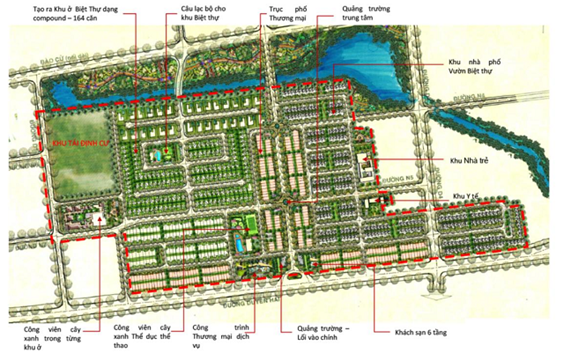

Restructuring investment portfolios through project company M&A

On May 27, the Board of Directors of Sunshine Group Joint Stock Company (HNX: KSF) approved the policy to acquire 100% of Thanh Xuan Import-Export Joint Stock Company with three other companies to implement a 54.99-hectare project in Alluvia City, Hung Yen province, developed by Xuan Cau Holdings Joint Stock Company. Alluvia City covers an area of nearly 200 hectares, with a total investment of over VND 31 trillion, located in an area with well-developed infrastructure, near large urban areas such as Ecopark and Vinhomes Ocean Park, and construction started in early March 2025.

Following the trend of buying shares, a member of Saigon Thuong Tin Real Estate Joint Stock Company (TTC Land, HOSE: SCR) successfully auctioned 51% of the shares of Tin Nghia – A Chau Investment Joint Stock Company from Tin Nghia Corporation (UPCoM: TID) in January 2025, thereby TTC Land owns the entire Cu Lao Tan Van (Centrial Island) project with an area of 48 hectares in Dong Nai. The project is oriented to develop a complex of residential, service and tourism areas, located in a strategic position connecting Ho Chi Minh City – Dong Nai – Binh Duong.

On the contrary, Vietnam Construction and Import-Export Joint Stock Corporation (HOSE: VCG) sold 8.4 million shares of Vinaconex Tourism Development and Investment Joint Stock Company (UPCoM: VCR), reducing ownership from 51% to 47%. This move came shortly after VCG’s Board of Directors decided to divest entirely from VCR (equivalent to 107.1 million shares) at a minimum price of VND 48,000/share. The deal is estimated to bring VCG over VND 5,140 billion.

VCR is the owner of the 176.1-hectare Cai Gia – Cat Ba tourism urban area, with an investment of nearly VND 11 trillion. Even though VCG no longer holds a controlling stake, VCG and VCR still cooperate to develop an area of 7.1 hectares of the project. Specifically, VCR will contribute land and existing infrastructure, while VCG will contribute capital for construction, ensuring a minimum post-tax profit for VCR of VND 5 billion.

Notably, after VCG announced its divestment, several organizations became major shareholders of VCR. Specifically, Hanoi Alpha Real Estate Exchange Floor Company Limited bought more than 48.4 million shares (23.06%) in the session on July 3, with a total value of about VND 2,402 billion. Imperia An Phu Company Limited spent nearly VND 2,500 billion to buy more than 50.2 million VCR shares, increasing its ownership to 24.1%.

Current status of Cat Ba Amatina project. Source: VCG

|

Novaland Investment Group Joint Stock Company (HOSE: NVL) also promoted restructuring among its subsidiaries. In March, NVL reduced its ownership in No Va My Dinh from 67.15% to 59.52% and divested from related legal entities such as Dinh Phat Real Estate Joint Stock Company, Investment and Development of Real Estate 350 Co., Ltd., Investment and Development of Real Estate CQ89 Co., Ltd., and Thanh My Loi Joint Stock Company. The total value of the share transfer in this group of companies amounted to more than VND 1,600 billion.

In addition, NVL transferred 19% of its capital in Aqua City (and related companies), thereby earning approximately VND 973 billion. The transferee is believed to be Thien Ha Trading and Investment Service Joint Stock Company, where Mr. Pham Trong Dat (born in 1997) holds the position of Chairman of the Board of Directors and legal representative.

In June, NVL continued to transfer 19% of its capital in Cuu Long Real Estate Investment and Development Joint Stock Company and 46% of its capital in Gia Duc Real Estate Joint Stock Company for VND 460 billion and VND 1,725 billion, respectively.

Contrary to the above divestment trend, in the first quarter of 2025, NVL invested more than VND 1,400 billion to hold 49% of Vung Tau Investment Joint Stock Company – a joint venture and associated company through its subsidiary, Dat Viet Development Joint Stock Company.

Overall, the strong M&A activities in real estate projects among listed companies since the beginning of the year reflect a clear restructuring strategy. Enterprises proactively divest from projects that are no longer suitable while seeking new opportunities by investing in areas with potential. This trend not only improves cash flow and optimizes portfolios but also contributes to reviving the real estate market after a long period of stagnation.

– 10:00 12/08/2025

A Rare Billion-Dollar Energy Hub in a Can Tho Ward

With an energy complex boasting an investment of over $1 billion per plant, located in a ward in Can Tho City, this will make a significant contribution to the local budget.

Prime Real Estate Auction: 100sqm Lot Reaches 7.7 Billion VND, Almost Quadruple the Reserve Price

The auction of 18 land plots in the residential area south of Tran Hung Dao Street, in Dong Hoi ward, was a resounding success, generating nearly VND86 billion. The auction witnessed an enthusiastic response, with winning bids for several plots reaching twice to 2.7 times the starting price, and in one exceptional case, a plot was secured for nearly four times the reserve price.

“North Ninh Authorities Request Police Intervention Regarding Illegal Real Estate Transactions”

The Bac Ninh Department of Construction has requested the coordination of the Public Security Agency to verify, prevent and handle the act of posting inaccurate information with signs of profiting from buying and selling, mobilizing capital, and attracting people to participate in real estate transactions when they are not eligible as prescribed.