An illustrative image of a wood production line

|

Lump-sum profits, with most businesses on the sidelines

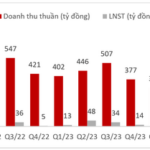

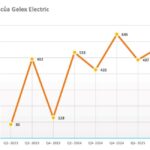

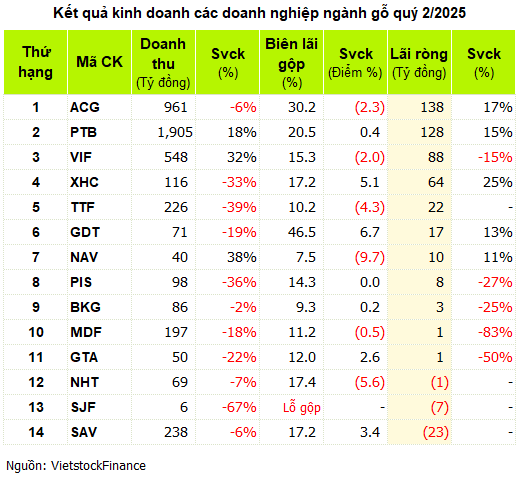

According to data from VietstockFinance, the combined revenue of 14 listed wood companies in Q2 2025 amounted to over VND 4,600 billion, almost unchanged from the same period last year. The industry’s average gross profit margin was 20.5%, slightly down from 20.8%, while total net profit reached VND 449 billion, only a 1% decrease year-on-year.

However, the notable aspect is not in the average figures but in the strong polarization, with nearly 80% of the industry’s profits concentrated in the top three large companies: Phu Tai (PTB), An Cuong (ACG), and Vinafor (VIF).

While the majority of the remaining businesses struggle with cost-cutting, production adjustments, or rely on financial activities to maintain profits, the leading names have managed to maintain stable profit margins, partly due to their effective control over the supply chain and consumer markets.

The second quarter coincided with the US’s temporary suspension of a 46% retaliatory tariff on imports from Vietnam (from April 9 to July 10). However, unlike the textile industry, which can increase production to rush orders, the wood industry, with its long order cycles, slow and inflexible production processes, could not take advantage of the 90-day “tax holiday.”

Who can sustain momentum from core operations?

Only 3 out of 14 businesses recorded revenue growth, with Navifico (NAV) leading the way with a 40% increase, followed by Vinafor (VIF) with a 32% rise, and Phu Tai (PTB) with an 18% improvement. PTB achieved the highest revenue in the industry at VND 1,905 billion, with the wood segment contributing VND 1,034 billion (up 16%) and a gross profit margin of 19.2%. This was also the main driver behind PTB‘s reported profit of VND 128 billion, the highest in 12 quarters, marking a 15% increase year-on-year.

|

An Cuong (ACG) maintained its top position in the industry in terms of profit, with VND 138 billion, a 17% increase. However, it is noteworthy that this profit was largely derived from financial activities, mainly from the divestment of shares in Thang Loi Homes, rather than core business growth.

Some other companies turned a profit by reducing costs rather than increasing sales. Duc Thanh Wood (GDT), despite a 20% decline in revenue, increased profit by 13% to VND 17 billion by effectively managing operations and achieving a nearly 40% gross profit margin, the highest in the industry.

Xuan Hoa (XHC)’s achievement was a record quarterly profit of VND 64 billion (up 25%), mainly from dividends from an associated company, while net revenue decreased by 33% due to intense competition in the furniture industry.

The common thread among the high-profit companies in the second quarter was their ability to control costs, possess stable markets, and have a closed supply chain. The high gross profit margins were not due to better selling prices but rather superior operational efficiency.

In contrast, businesses relying on orders from trading partners, lacking proactive supply chains, or dependent on logistics faced challenges. Some companies turned a profit, but it was not sustainable as it did not originate from their core operations, such as Go Truong Thanh (TTF), which still carries accumulated losses of over VND 3,200 billion despite reversing losses this quarter with a profit of VND 22 billion from investment liquidation.

Savimex (SAV) unexpectedly incurred a net loss of VND 23 billion, the first time since Q4 2023, due to a large provision for its financial investment in TCM shares. However, Savimex’s core business improved, with a gross profit margin increase of 3.4 percentage points to 13.8% through effective cost control.

Fortunately avoiding losses, Go Thuan An (GTA) reported a 50% drop in net profit to just VND 1 billion, mainly due to logistics cost fluctuations and changes in shipment schedules from customers that disrupted production. Some other companies like MDF, PIS, and BKG experienced profit declines ranging from 15% to 80%, mainly due to input cost fluctuations and increased financial expenses.

Do inventories reflect strategy?

As of the end of June 2025, the industry’s total inventory stood at over VND 4,800 billion, a 4% increase from the beginning of the year, but this does not indicate a unified strategy. Some leading companies deliberately increased their inventory significantly, such as ACG, which raised its inventory by 21% to VND 1,173 billion, with more than half consisting of raw materials, possibly in preparation for the year-end peak season.

MDF increased its inventory by 40% to nearly VND 220 billion, mainly in finished goods, more than doubling the amount from the beginning of the year, indicating a “stockpiling” strategy in anticipation of returning orders.

In contrast, Phu Tai maintained its inventory almost unchanged at VND 1,446 billion, the highest in the industry, with a 16% decrease in wood products and a 5% reduction in raw materials and supplies, demonstrating effective inventory management.

On the other hand, companies like Savimex and GTA proactively reduced their inventory by 20% and 25%, respectively, reflecting caution or a lack of expectation for demand recovery.

The current inventory levels are not just financial figures but also reflect expectations. Businesses that increase inventory are largely betting on a market recovery. However, if their predictions are incorrect, this could become a significant financial burden.

Trade policy and supply chain pressures post-Q2

Entering the third quarter, the wood industry faces positive signals from the US’s official announcement of retaliatory tariffs at the beginning of August. The tariff rate for goods originating from Vietnam was reduced to 20%, instead of the previously announced 46%, while goods transshipped through Vietnam are still subject to a 40% tariff.

This development eases the pressure on direct exporters to some extent, but it also underscores the increasingly stringent requirements for transparent supply chains, local production, and clear product traceability. In the context of intensifying international competition, this will be a significant challenge for companies that lack autonomous supply chains or remain dependent on processing orders.

“Q2’s Big Win: Vinaconex and Industry Giants Invest in the Nearly 20-Trillion Dong Highway Project”

Vinaconex reports a remarkable surge in net profit for the second quarter of 2025, reaching nearly VND 309 billion, an impressive over-threefold increase compared to the same period last year. Alongside this impressive financial performance, the company has also ventured into a significant investment, committing funds towards the development of a nearly VND 20,000-billion highway project.

Introducing the Prime Real Estate of Dong Nai: Now Open for Business

Introducing the future of real estate in Dong Nai: a transparent and accessible journey towards your dream property. The province is set to unveil auction-bound land plots through a multi-channel approach, utilizing the power of media, e-government portals, and dynamic real estate exchanges. Get ready to navigate the exciting world of real estate with ease and confidence!

“Record-breaking Revenue and Profits: Nafoods Commences Construction of NASOCO Phase 2”

Nafoods Group (HOSE: NAF) has reported record-breaking revenue and profits for the second quarter of 2025 and the first half of the year. Along with this impressive financial performance, the company is also embarking on an expansion journey with the second phase of the Nasoco project, positioning itself to capitalize on future growth opportunities.

“HAGL Faces Sanctions for Failing to Disclose Bond-Related Information”

HAG failed to disclose information on the HNX system regarding the following documents: Report on the usage of proceeds from bond issuance for bonds with outstanding debts audited by qualified auditors in 2023 and 2024, as well as the semi-annual report for 2024.