The Ho Chi Minh City Stock Exchange (HOSE) has introduced the Vietnam Growth 50 Index (VN50 Growth), a new index comprising 50 carefully selected stocks from the VNAllshare index.

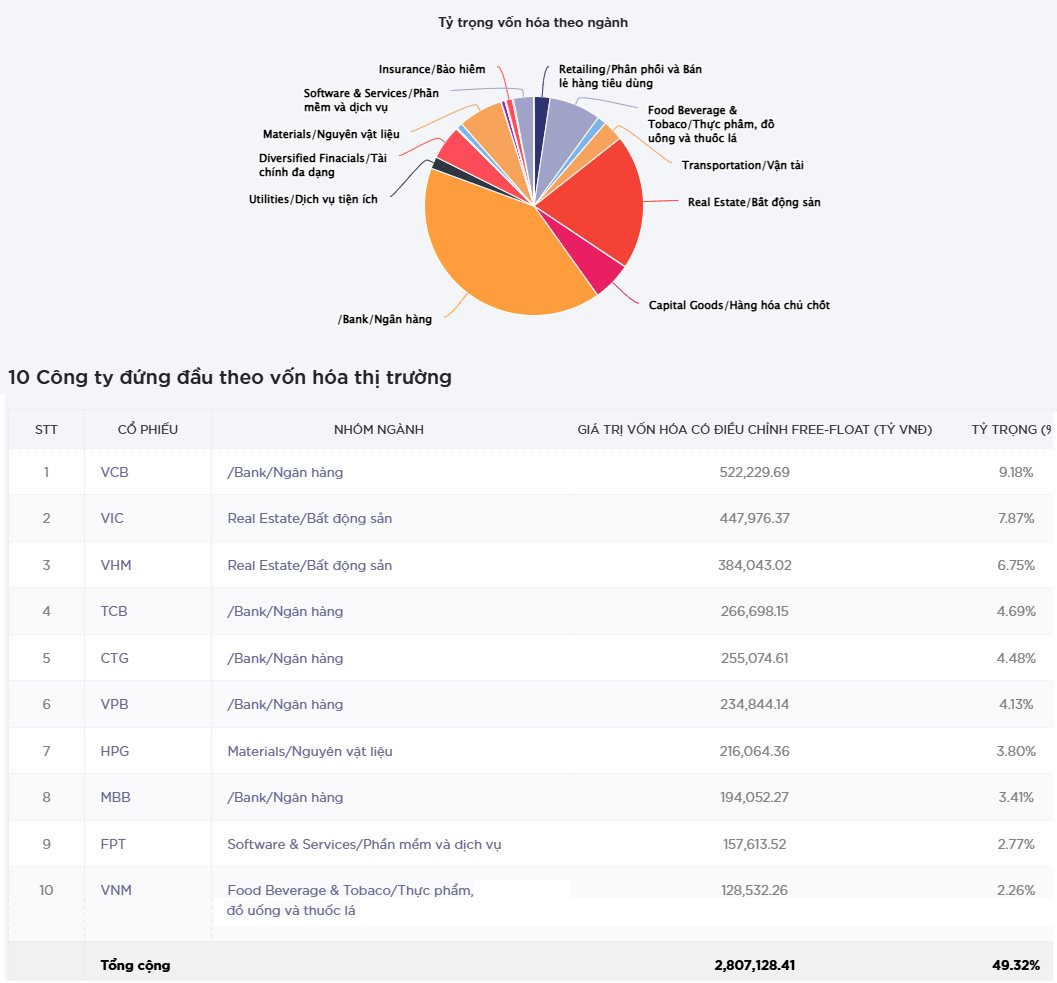

The VN50 Growth index specifically includes stocks that meet stringent criteria, with a minimum adjusted free-float market capitalization of VND 2,000 billion and a minimum matching trading value of VND 20 billion. The 50 stocks with the largest adjusted free-float market capitalization will be included in the main index, with priority given to higher matching trading values in cases of equal capitalization. Additionally, a reserve index will feature the next 10 stocks with the largest adjusted free-float market capitalization.

According to HOSE, the VNAllshare sector index currently encompasses 312 stocks, with a total market capitalization of over VND 5,690,000 billion.

Furthermore, HOSE has introduced the VN50 Growth Total Return Index (VN50 GROWTH TRI), which is based on the price index of VN50 Growth and reflects both price changes and dividends reinvested in the index. This total return index is calculated once and announced at the end of the trading day, with a base value of 1000.

In addition to the VN50 Growth index, HOSE has also unveiled the VNMITECH index, focusing on modern industrial and technology stocks. This index includes a minimum of 30 and a maximum of 50 stocks selected from the VNAllshare Materials, VNAllshare Industrials, and VNAllshare Information Technology sector indices, meeting specific screening criteria.

Introducing HOSE’s New Investment Indexes: Unveiling the VNMITECH and VN50 Growth

On August 11th, the Ho Chi Minh City Stock Exchange (HOSE) introduced new rules for the construction and management of two new investment indices. These indices are designed to track the performance of stocks in the industrial, technological, and growth sectors. The first index, the VNMITECH, focuses on modern industrial and technology stocks, while the second, the VN50 Growth, is tailored towards capturing the growth potential of 50 carefully selected stocks.

Adding TAL Stock to the List of Margin-Ineligible Securities: A Strategic Move by HOSE

The Ho Chi Minh Stock Exchange (HoSE) has announced that it will add the ticker symbol TAL, representing Taseco Real Estate Investment Joint Stock Company, to the list of securities ineligible for margin trading. This decision has been made due to the company’s short listing period of less than six months.

“F88 to List on UPCoM on August 8, with a Share Price of VND 634,900”

The Hanoi Stock Exchange (HNX) has announced that August 8th will be the first trading day for the registered shares of F88 Investment Joint Stock Company (F88).

Who is the Woman Behind the 6-Month-Old Enterprise That Just Invested 300 Billion VND in VIB?

Quang Kim Investment and Development JSC, established on May 23, 2024, purchased 17.2 million VIB shares during the November 11 trading session. This substantial acquisition elevated the company’s holdings, along with those of its affiliated shareholder group, to a notable 9.836% stake in the bank’s capital. The legal representative of Quang Kim Investment and Development JSC is Ms. Do Xuan Ha, the sister of Mr. Do Xuan Hoang, who serves as a member of the board of directors of VIB Bank.