At the program “Vietnam and the Indices: Financial Prosperity”, Mr. Tran Hoang Son, Market Strategy Director of VPBank Securities Joint Stock Company (VPBankS), remarked: “There has been a very positive signal with VN-Index reaching the 1,600-point threshold – a number that the market has long dreamed of.”

Based on the current trend compared to the end of 2024 and previous waves, the expert believes that this could be a mega uptrend.

Last week, the market’s average liquidity hit a new record of VND 56,000 billion per session. Additionally, the market also witnessed a record session of over VND 80,300 billion (over USD 3 billion). Positive sentiment continues to spread, with many sectors rebounding.

For instance, while bank stocks experienced slower cash flow, there are signs of quick spillover to real estate, construction, and public investment. These signals indicate a strong upward trend in the indices and a broad-based rally across the market.

In the short term, the expert believes the market remains positive, supported by strong cash flow. Mr. Son expects the market to steadily rise during this period. However, there have been some signals to monitor in August.

The “wave” continues

Looking back at the uptrend from 2020 to 2022, this period witnessed massive stimulus packages post-COVID-19 pandemic. Simultaneously, central banks injected significant amounts of money into the economy.

Today, the indices and liquidity have surpassed the previous record-high wave and are even reaching new peaks. Two significant indicators of this robust performance are the VN-Index surpassing 1,600 points and average liquidity of VND 56,000 billion.

The VPBankS expert evaluates that there are numerous reasons, both domestic and international, explaining the market’s upward momentum . The first international factor is the central bank’s accommodative policy after the inflationary period was curbed. Many central banks have been eager to lower interest rates in exchange for growth, notably the European Central Bank (ECB), which has cut rates eight times.

The Federal Reserve also reduced interest rates by approximately 100 basis points in 2024 but paused in the first half of 2025 due to lingering inflation. The market anticipates the Fed to resume rate cuts by year-end. The global monetary easing policy has significantly supported asset and stock markets in the first half of 2025.

Secondly, market sentiment has turned positive again after Trump’s tariff shock. The negotiations resulted in lower tariffs, stabilizing sentiment and allowing the market to regain its upward trajectory after the sharp drop in April. The April 2025 crash resembled the market downturn during the COVID-19 pandemic. Typically, after a substantial adjustment phase, the market bounces back vigorously.

Thirdly, the weakening of the US dollar has prompted capital shifts, reducing holdings in USD-denominated assets and redirecting them to emerging and frontier markets. The shift towards hotter assets like stocks and cryptocurrencies is a very positive signal. This dynamic explains why the US stock market has performed well recently, and the cryptocurrency market continues to reach new highs.

Domestically, the Vietnamese economy has rebounded remarkably due to aggressive monetary and fiscal easing policies. The economy has shown robust recovery across most indices, especially in the second quarter of 2025, with a GDP growth rate of 7.96%, the highest among post-COVID-19 quarters.

The expert believes this indicates a strong economic recovery following the turbulent year of 2023. The second-quarter GDP growth was significantly boosted by accommodative monetary policies. As of July, credit growth in the system reached approximately 9.64% – the highest in the post-COVID era. The influx of liquidity propelled the overall market to new highs.

Moreover, public investment disbursement in the first six months increased by 25% year-on-year, completing over 40% of the plan. Supportive policies for market upgrades also played a catalytic role. In the first half of 2025, the government improved the legal framework to foster the development of the stock market and addressed bottlenecks related to the upgrade process (eliminating the requirement for pre-funding in margin trading).

Simultaneously, the successful implementation of the KRX system led to a surge in trading volume and a transformation in market structure. During this heated period, the market no longer experiences sluggishness or order congestion.

“I anticipate that the upcoming changes in the trading system will greatly benefit the market, especially with the potential introduction of new products or the reduction of settlement time to T+2 or T+0,” said the VPBankS expert.

Various ministries and sectors, notably the Ministry of Finance and the State Securities Commission, have engaged in negotiations and workshops with FTSE Russell to address challenges related to market upgrades. A successful upgrade will enhance the attractiveness of the Vietnamese market in the eyes of international investors.

Furthermore, corporate profits have been genuinely positive. In the second quarter, corporate profits grew impressively, achieving approximately 33% year-on-year growth (based on 90% of companies that published their reports). This is one of the highest profit growth rates since the COVID-19 pandemic.

The growth was primarily driven by stocks with low bases last year, such as real estate, electricity, retail, aviation, rubber, and fertilizers. The banking sector maintained stability, growing by about 17.5%, with financial services surging by nearly 43%.

In conclusion, Mr. Son opined: “In the short term, these factors will persist. Therefore, investors can rest assured that the ‘wave’ will extend into this year.”

Stock Market Conquest: Breaking the 1,600-Point Barrier

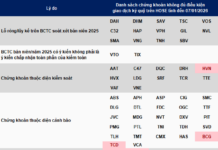

The VN-Index successfully surpassed the 1,600-point threshold despite facing strong volatility during the trading session. However, the emergence of long-shadow candles with fluctuating volumes in recent sessions indicates investor indecision. At present, the Stochastic Oscillator continues to climb deeper into overbought territory. Technical fluctuations are likely to persist in the short term as the index ventures into new highs.

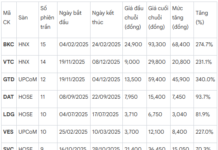

What Stocks Should You Watch in August?

SSI Research maintains an optimistic forecast for 2025, anticipating a 13.8% year-over-year growth in post-tax profits, which translates to a substantial 15.5% increase in the latter half of the year.

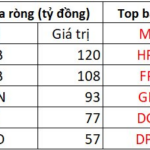

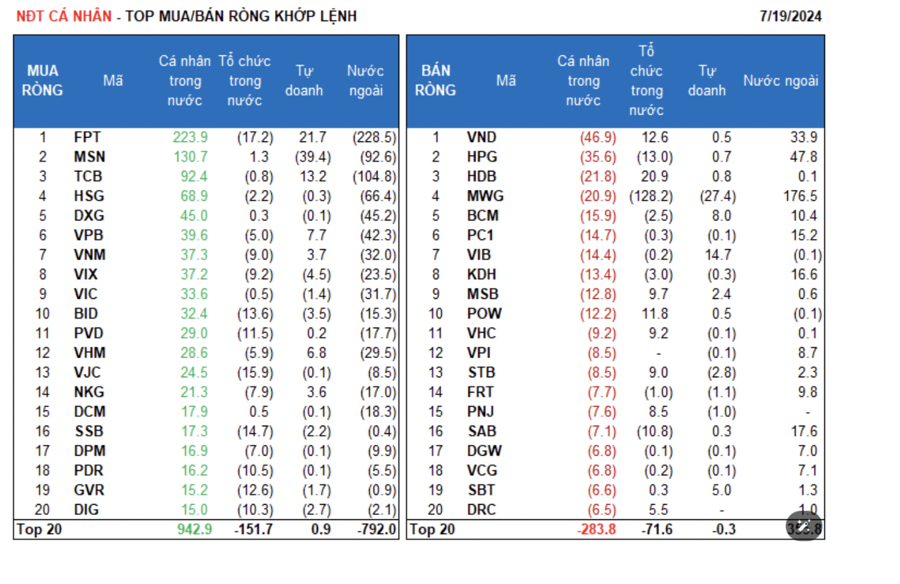

Foreign Investors Continue Selling Spree: Which Stocks Are Taking the Brunt?

In the afternoon trading session, foreign investors net bought VPB and SHB stocks the most in the market, with respective values of VND 120 billion and VND 108 billion.