In its recently published report, Bao Viet Securities (BVSC) outlined the factors influencing the stock market in August. On the positive side, supportive policies such as maintaining low-interest rates, promoting credit, infrastructure investment, and public investment will continue to benefit businesses and domestic cash flow.

BVSC also believes that the US’s 20% retaliatory tax on Vietnam is no more disadvantageous than that imposed on other countries, helping to maintain the competitiveness of export goods. The market sentiment is expected to stabilize as a less turbulent external environment will help maintain cash flow in the stock market.

The analysis team anticipates that enterprises will gradually adapt to the new tax environment. Export sectors (garment, wood, seafood, etc.) may witness less positive profit growth in the latter half of 2025. Indirectly impacted sectors (banking, consumer goods, etc.) will still benefit from supportive policies promoting domestic economic growth.

BVSC expects the market to differentiate after the publication of financial reports, with cash flow concentrating on sectors benefiting from supportive policies and the new tax regime.

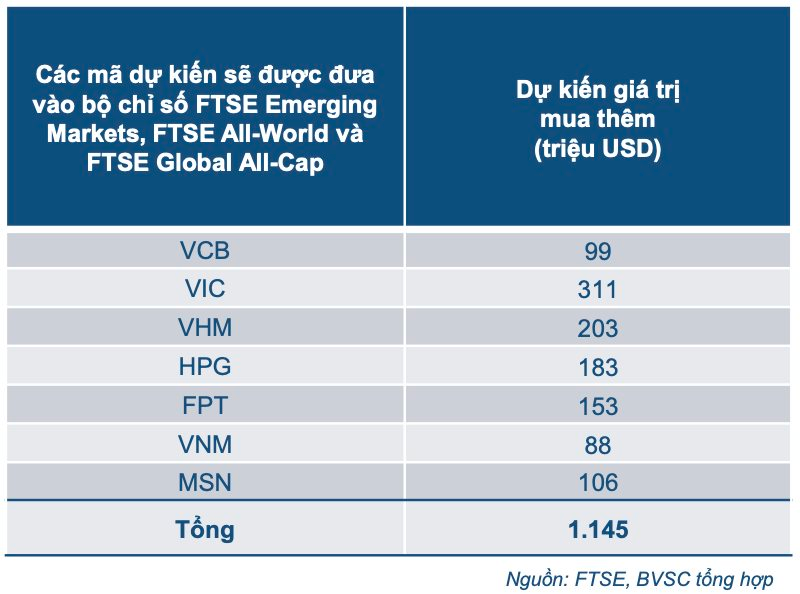

Additionally, FTSE will announce its market classification on October 7, 2025, which may benefit stocks anticipating an upgrade. A noticeable positive impact could be the influx of foreign cash flow in the billions of USD through ETFs tracking FTSE indices. According to BVSC’s calculations, over 1.1 billion USD is expected to be invested in the stocks of VCB, VIC, VHM, HPG, FPT, VNM, and MSN.

Upgrading the stock market classification is one of the most important goals for Vietnam at present. The Prime Minister has recently instructed the Ministry of Finance to urgently implement necessary measures to upgrade the stock market from a frontier market to an emerging market, promptly addressing difficulties and creating favorable conditions for capital mobilization to develop the country’s economy.

In reality, after much effort in improving criteria in terms of regulations and technical infrastructure, Vietnam’s stock market is highly likely to be upgraded by FTSE this year, according to both domestic and foreign organizations. The State Securities Commission also expressed confidence in Vietnam’s chances of being upgraded to an emerging market by FTSE in October.

Despite the positive news, BVSC cautions investors about external challenges. Less favorable US job data in July indicates potential risks to the US economy, which may increase foreign investors’ caution. Simultaneously, US import demand may slow down due to the impact of tariffs, adversely affecting some export sectors.

“Billionaire Investor: The Rise of F88 Chairman Phung Anh Tuan’s Empire with a Net Worth of Over $1 Billion”

With a market capitalization surpassing 324.88 million USD (equivalent to over 8.447 billion VND), the company has established itself as a prominent player in the industry.

Introducing HOSE’s New Investment Indexes: Unveiling the VNMITECH and VN50 Growth

On August 11th, the Ho Chi Minh City Stock Exchange (HOSE) introduced new rules for the construction and management of two new investment indices. These indices are designed to track the performance of stocks in the industrial, technological, and growth sectors. The first index, the VNMITECH, focuses on modern industrial and technology stocks, while the second, the VN50 Growth, is tailored towards capturing the growth potential of 50 carefully selected stocks.