The stock market continued its upward trajectory on August 12, with strong money flow. At the close, the VN-Index gained 11.36 points (+0.71%) to reach 1,608.22 points, surpassing the psychological threshold of 1,600 points. A downside was the foreign investors’ trading activities, as they aggressively net sold VND 726 billion across the market.

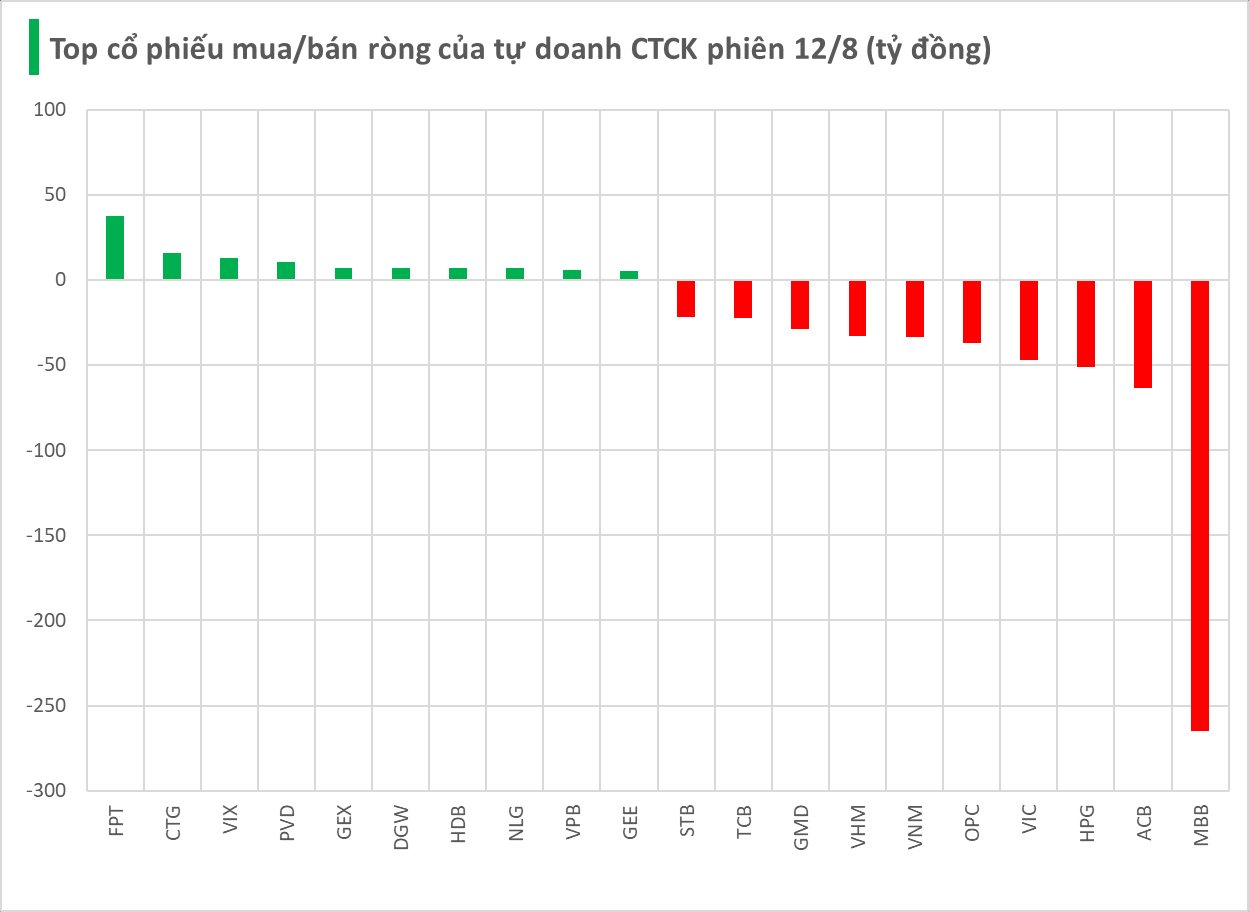

Similarly, securities companies’ proprietary trading activities resulted in a net sell position of VND 621 billion on the HoSE.

Specifically, securities companies offloaded MBB the most, with a net sell value of VND 265 billion, far surpassing other codes. This was followed by ACB and HPG, which were net sold VND 64 billion and VND 51 billion, respectively. Several other large-cap stocks also witnessed notable net selling pressure, including VIC (VND 47 billion), OPC (VND 37 billion), VNM (VND 33 billion), VHM (VND 33 billion), GMD (VND 29 billion), TCB (VND 23 billion), and STB (VND 22 billion).

On the other hand, FPT witnessed the strongest net buying with a value of VND 37 billion, followed by CTG (VND 16 billion) and VIX (VND 13 billion). Additionally, securities companies net bought PVD, GEX, DGW, HDB, NLG, VPB, and GEE, with values ranging from VND 5-10 billion.

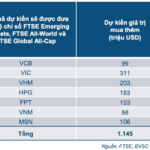

7 Stocks That Could Attract Over $1.1 Billion in Foreign Capital as Vietnam’s Market is Upgraded

The story of the market’s upgrade has an obvious silver lining: it could attract billions of dollars in foreign capital into Vietnam’s stock market.