Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (Ticker: CII, HoSE) recently reported the results of its rights issue to increase charter capital from the company’s equity sources.

According to the report, as of the conclusion of the offering on August 6, 2025, CII distributed over 76.7 million bonus shares to 42,311 shareholders of the company, with 2,461 fractional shares to be canceled.

The entitlement ratio was 100:14, meaning that for every 100 shares held on the record date, shareholders received 14 new shares issued. The shares are freely transferable. The expected date for the transfer of shares is August 2025.

Illustrative image

The total issuance value, based on par value, exceeded VND 767.4 billion, with the capital sourced from share premium reserve, investment fund, and undistributed post-tax profits as per the audited financial statements for the fiscal year ended December 31, 2024.

Following this issuance, CII’s outstanding shares increased from nearly 548.2 million to over 624.9 million, corresponding to a rise in charter capital from nearly VND 5,481 billion to over VND 6,249 billion.

In terms of business performance, for the second quarter of 2025, CII recorded net revenue of nearly VND 751 billion, up 7.4% year-over-year. After deducting taxes and expenses, the company reported a net profit of VND 110.2 billion, a slight decrease of VND 2.6 billion.

For the first six months of 2025, CII achieved net revenue of nearly VND 1,446.6 billion, an 8.3% decrease compared to the same period in 2024. Profit after tax reached over VND 205.8 billion, reflecting a 53.8% decline.

As of June 30, 2025, the company’s total assets increased by 5.3% from the beginning of the year to over VND 38,681.5 billion. Fixed assets accounted for 41.2% of total assets, amounting to nearly VND 15,956 billion, while inventories stood at over VND 2,447.3 billion, and long-term assets under construction totaled nearly VND 2,799.7 billion.

On the liability side of the balance sheet, total liabilities were nearly VND 27,373.8 billion, a decrease of VND 189.5 billion from the beginning of the year. Of this, total loans and finance leases amounted to VND 22,545.7 billion, constituting 82.4% of total debt.

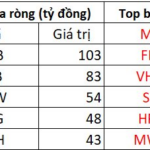

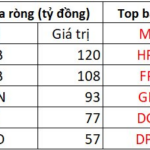

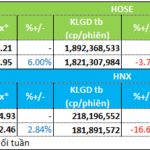

Foreign Investors Continue Selling Spree: Which Stocks Are Taking the Brunt?

In the afternoon trading session, foreign investors net bought VPB and SHB stocks the most in the market, with respective values of VND 120 billion and VND 108 billion.

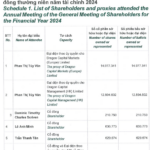

Dragon Capital to Distribute Over VND 131 Billion in Dividends This August

Dragon Capital Vietnam Fund Management Joint Stock Company (DCVFM) is set to distribute over VND 131 billion in dividends on August 21, a shift from the initial schedule of August 8.