Manufacturing textiles and garments at Huegatex – Illustration

|

A boost from the 90-day “golden” tax deferral period

The pressure of the temporary 46% tax rate imposed by the US from July 1st forced Vietnamese textile and garment companies to act quickly. During the previous 90-day tax deferral period, many businesses ramped up production and delivered orders early to take advantage of the lower tax rate.

At May 10, all orders for July were brought forward to the beginning of the month. “The customer requested delivery at the beginning of July, forcing us to work overtime”, said Ms. Nguyen Thi Phuong Thao, Executive Director. Similarly, Hoa Tho Textile and Garment Company also had to adjust its production plan daily to meet the urgent delivery schedule from the US.

Other companies, such as Duc Giang, chose to negotiate and share tariffs in a cooperative manner (FOB or CM), while Hue Textile and Garment Company received requests for price reductions from existing customers, forcing the company to accept a 3-5% adjustment. Chinese suppliers of auxiliary materials also provided support by reducing prices by 25-27%, helping Vietnamese businesses retain their customers.

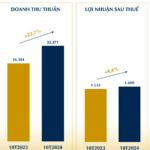

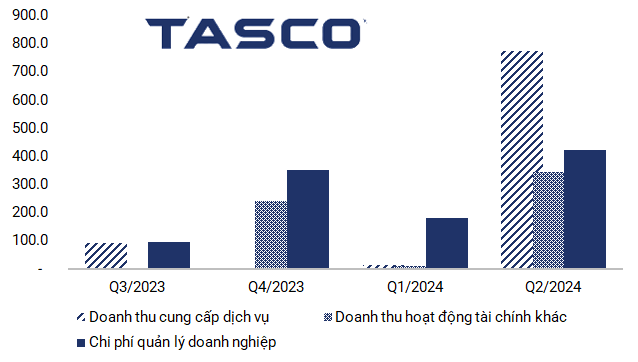

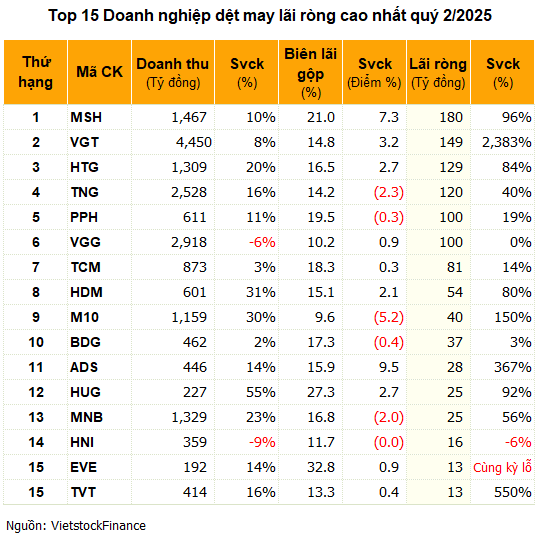

The positive impact of this strategy is evident in the financial results. According to data from VietstockFinance, 32 listed companies in the textile and garment industry reported a total revenue of nearly VND 22,400 billion in the second quarter of 2025, a 10% increase compared to the same period last year. The average gross profit margin increased from 13.2% to 14.9%, contributing to a total net profit of over VND 1,100 billion, a surge of 94%.

Concurrently, Vietnam’s textile and garment exports in the first six months of the year are estimated at $21.8 billion, up 10.6% over the same period. Imports of raw materials increased by 9.3% to $12.7 billion, resulting in a trade surplus of $9.1 billion. It is forecasted that for the whole year, textile and garment exports may reach $46-47 billion.

|

Large companies quickly recorded record profits

Leading the growth was Vinatex (VGT), which reported a net profit of nearly VND 149 billion, a remarkable increase of 2,390% thanks to improved gross profit margin and early delivery of orders. Hoa Tho Textile and Garment Joint Stock Company (HTG) earned a net profit of VND 129 billion, a 70% increase and the highest quarterly profit in the company’s history, thanks to cost control and higher selling prices. Hue Textile and Garment Company (HDM) also set a quarterly record with a profit of nearly VND 54 billion, an increase of 80%.

A series of other companies also recorded historical highs in profits, including TNG, which achieved VND 120 billion, a 39% increase; Song Hong Garment Joint Stock Company (MSH) with VND 180 billion, a significant 96% increase. Viet Tien Garment Corporation (VGG) maintained its performance with a net profit of over VND 100 billion in the second quarter, one of the three rare quarters to surpass this milestone since 2021.

Thanh Cong Textile Garment Investment Trading Joint Stock Company (TCM) reached an 11-quarter high with a profit of VND 81 billion, up 14%. May 10 (M10) increased its net profit by 150% to VND 40 billion, the second-highest in its history, thanks to cost savings and financial improvements.

A common factor among companies that proactively managed logistics and raw materials was their superior gross profit margin, such as TCM (18.4%), TNG (14.2%), and VGT (14.8%), compared to the typical range of 8-12% for FOB manufacturing enterprises.

Not all businesses were able to catch up

Despite the industry’s impressive performance, not all companies benefited. Businesses that lacked production capacity or stable customers continued to face challenges.

Garmex Saigon (GMC) incurred an additional loss of over VND 4 billion in the second quarter, bringing its cumulative loss to VND 116 billion. Garment manufacturing activities have been stagnant since May 2023 due to a lack of orders, while revenue mainly comes from the pharmacy business and joint ventures. Since the beginning of 2022, Garmex has only reported profits in two rare quarters.

Century Yarn Joint Stock Company (STK) suffered a loss of VND 6 billion despite a significant increase in gross profit margin to 19%. Financial burdens amounting to nearly VND 55 billion, mainly due to foreign exchange losses from its subsidiary and the Unitex project, wiped out the gross profit.

SGI reversed into a loss of VND 22 billion, compared to a profit of VND 18 billion in the same period last year, due to increased fixed costs and a lack of extraordinary income. A group of companies remains in the red, including HSM (loss of VND 1 billion), NDT (loss of VND 4 billion), and FTM (loss of VND 9 billion).

In contrast, some businesses returned to profitability after facing difficulties for several quarters, such as Everpia (EVE) and Tu Hai Ha Nam (THM), with profits of VND 13 billion and VND 2 billion, respectively, mainly due to increased orders in specialized industries.

High inventory levels and a “preemptive” tax strategy

Many businesses proactively purchased raw materials in the first quarter to prepare for the production acceleration phase in the second quarter. While this helped control costs and increase profit margins, it also led to high inventory levels.

As of the end of June 2025, TNG had a 45% increase in inventory compared to the beginning of the year, amounting to VND 1,557 billion, mainly due to raw materials costing over VND 687 billion (a 66% increase). VGG‘s inventory stood at VND 1,933 billion, a 29% increase, with unfinished production and business costs accounting for more than VND 1,028 billion.

Vinatex maintained its leading position in terms of inventory levels across the industry, with over VND 3,300 billion in inventory, including VND 1,435 billion in raw materials (a 28% increase) and VND 669 billion in finished products (a 16% increase).

However, not all companies were able to expedite deliveries. STK‘s inventory increased by 24% to VND 765 billion, of which VND 598 billion was finished products (a 45% increase). MSH had an inventory of VND 849 billion (a 32% increase), with finished products accounting for VND 394 billion.

A cautious but optimistic outlook for the second half of the year

The 46% tax rate was later adjusted by the US to 20% from the beginning of August, reducing cost pressures on businesses. However, policy risks remain. “Vietnam does not have a clear advantage over many competitors in the US market, especially if the administration changes”, said Mr. Le Tien Truong, Chairman of the Board of Vinatex, at the August workshop.

Some markets, such as the EU, Japan, and South Korea, are showing slight signs of recovery but remain below the 2022-2023 levels. Risks related to exchange rates, logistics costs, labor, and interest rates continue to pose significant challenges. Many businesses aim to complete at least two-thirds of their annual profit plans.

Mirae Asset Securities commented: “The Vietnamese textile and garment industry still holds many advantages due to its ability to proactively manage orders and supply chains. However, tariff and raw material risks remain significant challenges in the second half of 2025”.

In summary, the second quarter of 2025 demonstrated the agility and adaptability of Vietnam’s textile and garment industry. Nonetheless, it is essential to recognize that these results were largely situational and may not be easily replicated in the near future.

Instead of relying on short-term policy opportunities, many businesses are focusing on long-term investments in supply chains, product diversification, expansion into non-traditional markets, and upgrades to ESG standards.

Hue Textile and Garment Company forecasts that the fourth quarter will face significant pressure as customers increasingly demand social responsibility and technical standards. Even with a high volume of orders, failing to meet these standards could result in losing customers. Businesses must remain cautious yet optimistic, proactively developing response strategies in an increasingly unpredictable global market.

– 09:17 13/08/2025

The Hydration Industry’s Hottest New Bond Offering: A Dehydrated Perspective.

The company, which is over 94% owned by Biwase, JSC – Binh Duong Water – Environment Corporation (Biwase, HOSE: BWE), has successfully raised a significant amount of bonds with an impressively low-interest rate of just 5.5% per annum, undercutting the bond interest rates offered by many other enterprises.

Profiting from the Penny-Pinchers: How Electrical Appliance Retailers Thrive by Targeting the Thrifty

As observed by our reporters, electronics and appliance stores have seen a decline in foot traffic in recent years, with the television, air conditioner, washing machine, and refrigerator sections looking particularly forlorn. However, there’s a buzz of activity in the home appliance section, indicating a shift in consumer interests.