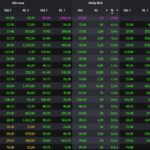

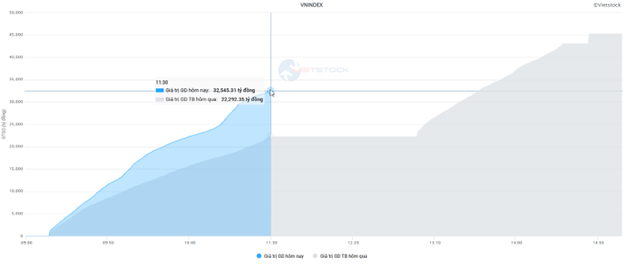

Market liquidity increased compared to the previous session, with the VN-Index matching volume reaching over 1.86 billion shares, equivalent to a value of more than 53.3 trillion VND; HNX-Index reached over 226 million shares, equivalent to a value of more than 5.1 trillion VND.

VN-Index opened the afternoon session with a rather volatile trend, but buyers gradually regained their position, helping to pull the index back to the reference level and closing in the green at the end of the session. In terms of impact, MBB, CTG, MSN, and LPB were the most positive influences on the VN-Index, with a 6-point gain. On the other hand, VPB, VCB, FPT, and HPG remained under selling pressure, taking away more than 3.9 points from the overall index.

| Stocks with the most significant impact on the VN-Index |

Similarly, the HNX-Index also had a positive performance, with the index positively influenced by the stocks MBS (+9.86%), HUT (+9.73%), SHS (+4.18%), and PVI (+4.41%)…

| Stocks with the most significant impact on the HNX-Index |

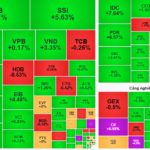

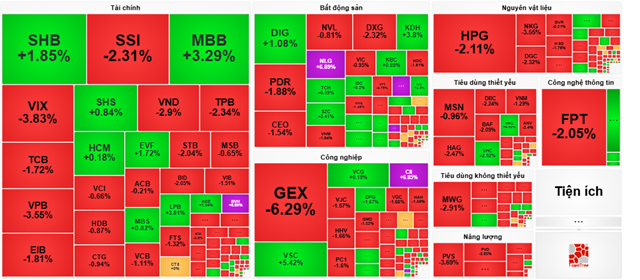

At the market close, the market was up 0.33%. The media and communications sector was the best-performing group, with a 1.81% gain, mainly driven by stocks such as VGI (+2.63%), YEG (+6.69%), SGT (+6.98%), and VNB (+0.52%). Following the recovery were the real estate and financial sectors, with increases of 0.75% and 0.71%, respectively. On the other hand, the information technology sector was the worst-performing group, falling 1.64%, mainly due to the decline in FPT (-2.23%), CMT (-0.68%), and HPT (-4.76%).

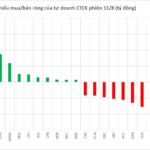

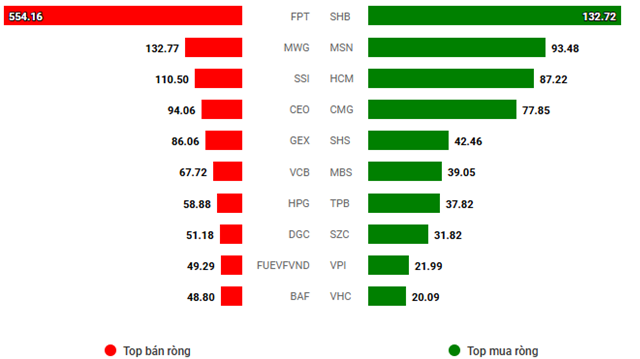

In terms of foreign trading, foreigners continued to be net sellers on the HOSE exchange, focusing on stocks such as FPT (1,077.59 billion VND), SSI (193.03 billion VND), MWG (141.85 billion VND), and HPG (106.3 billion VND). On the HNX exchange, foreigners net sold over 34 billion VND, focusing on CEO (93.7 billion VND), PVS (49.04 billion VND), LAS (5.72 billion VND), and NVB (3.18 billion VND).

| Top foreign net buys and sells for the session on August 13 |

11:30 AM: Selling pressure mounts as foreigners continue to dump FPT shares

The main indices ended the morning session in negative territory. At the midday break, the VN-Index fell more than 16 points to 1,591.51, while the HNX-Index dropped 0.46% to 275.19. The market breadth was tilted towards decliners, with 483 stocks falling and 268 advancing.

Market liquidity increased sharply this morning. Trading volume on the HOSE exchange surpassed 1.1 billion shares, equivalent to a value of over 32 trillion VND, a 46% increase compared to the previous session. HNX also recorded a volume of over 115 million shares, equivalent to 2.6 trillion VND.

Source: VietstockFinance

|

In terms of impact on the VN-Index, VPB was the most negative stock, taking away 1.9 points from the index. On the other hand, MBB was a bright spot, contributing 1.2 points to the index’s gain.

Most sectors were in negative territory. Energy was the worst-performing sector, falling 2.14% due to significant declines in stocks such as BSR (-2.4%), PLX (-1.82%), PVS (-3.69%), PVD (-2.83%), OIL (-1.6%), PVT (-1.58%), MVB (-1.64%), VTO (-1.92%), and PVC (-3.08%).

In the industrial sector, several stocks experienced selling pressure, including ACV, MVN, HVN, VJC, VGC, VEF, GMD, VTP, GEE, and GEX.

Conversely, utilities were the only sector to remain in positive territory, rising 0.08% thanks to the positive contributions of stocks such as HDG, which hit the daily limit-up, POW (+1.24%), PGV (+1.69%), BWE (+1.12%), and TDM (+1.72%).

Source: VietstockFinance

|

Foreigners continued to be net sellers, offloading over 1,300 billion VND across the three exchanges. The selling pressure was concentrated in FPT, with a net sell value of 554.16 billion VND, far exceeding the net sell value of other stocks. Meanwhile, SHB led the net buy list with a value of 132.72 billion VND.

Source: VietstockFinance

|

10:30 AM: Market loses steam as VN-Index turns negative

A cautious sentiment prevailed in the market as selling pressure intensified, causing the main indices to diverge. As of 10:30 AM, the VN-Index fell 1.07 points to around 1,607, while the HNX-Index fluctuated and managed to stay slightly in positive territory, trading around 278 points.

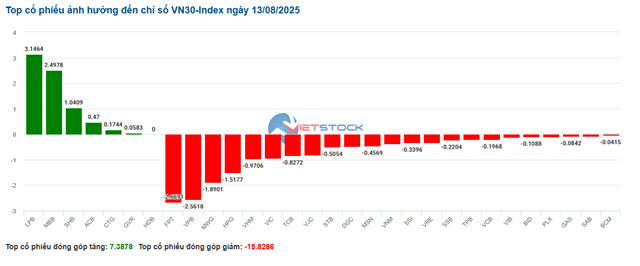

Stocks in the VN30 basket faced strong selling pressure, resulting in a loss of more than 15 points for the overall index. On the negative side, FPT, VPB, MWG, and HPG took away 2.67 points, 2.56 points, 1.89 points, and 1.51 points, respectively. Conversely, only a few banking stocks managed to stay in positive territory on the positive side, including LPB, MBB, SHB, and ACB, contributing over 7 points to the index.

Source: VietstockFinance

|

As of 10:30 AM, most sectors were in the red. Notably, the information technology sector witnessed strong selling pressure, with most stocks in the industry trading negatively. Specifically, FPT fell 1.67%, ELC declined 1.27%, POT dropped 1.6%, and HPT decreased 4.46%.

Next was the energy sector, which also turned red as leading stocks such as BSR fell 1.53%, PLX declined 1.43%, PVS dropped 2.64%, and PVD slipped 1.74%…

Conversely, the financial sector managed to stay afloat despite significant divergence. Within the sector, large-cap banks faced selling pressure, with VCB falling 0.48%, BID declining 1.08%, TCB dropping 0.53%, and VPB decreasing 2.36%… Meanwhile, stocks such as CTG (+0.42%), MBB (+4.53%), ACB (+0.82%), and LPB (+3.94%) received buying support and remained in positive territory.

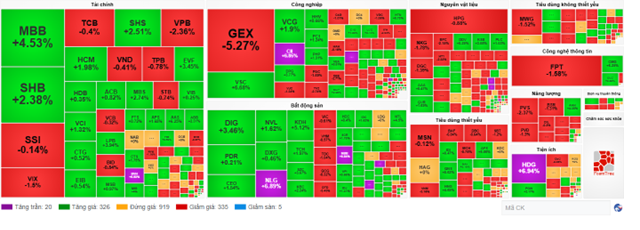

Compared to the beginning of the session, the market shifted from a positive to a divergent trend, with sellers gaining the upper hand. There were 335 declining stocks and 326 advancing stocks.

Source: VietstockFinance

|

9:30 AM: VN-Index starts positively, cash flow favors banking stocks

As of 9:30 AM on August 13, the VN-Index rose 6.49 points to trade around the 1,614.71 level, while the HNX-Index gained 1.28 points to trade around 277.75 points.

The media and communications sector was among the top-performing sectors in the early session, with leading stocks such as VGI (+1.13%), VNZ (+0.66%), and CTR (+0.42%) showing positive momentum.

Following closely was the financial sector, which also witnessed a sea of green in most stocks. Specifically, in the banking industry, MBB rose 4.94%, BID gained 0.48%, TCB increased by 0.53%, and CTG climbed 0.73%… Additionally, securities stocks also exhibited strong performance, with SSI advancing 0.41%, VND rising 0.41%, and MSB surging 2.74%…

Apart from these two sectors, many large-cap stocks also traded positively, including MSN, VRE, HDB, GAS, and PLX.

Market Mayhem: Navigating the Storm

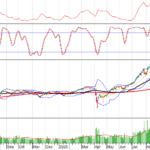

The VN-Index experienced vigorous tug-of-war action with above-average trading volume. The MACD indicator continues its upward trajectory, providing a buy signal and reinforcing the positive short-term outlook. However, intense fluctuations within the session are likely to persist as the index forges new peaks.

The Billionaire’s Boom: A Tale of Soaring Success.

Thanks to MSN’s surge during today’s trading session (August 11), Nguyen Dang Quang, Chairman of Masan Group, saw his wealth increase by approximately $75 million, reaching a total of $1.2 billion according to Forbes data. This places him at a global ranking of 2,799th.