Source: VietstockFinance

|

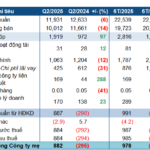

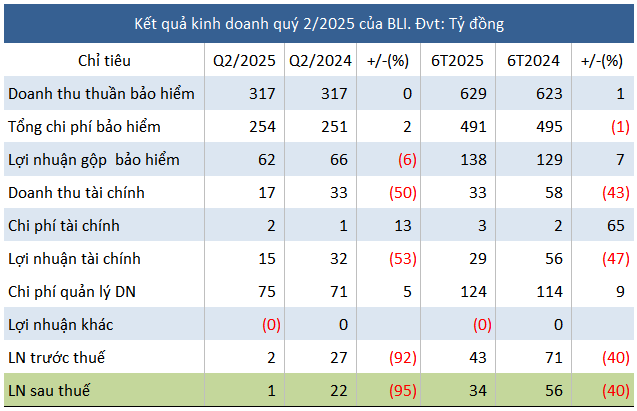

Q2 insurance revenue rose a modest 5% to VND 395 billion, while reinsurance expenses decreased by 3% to over VND 94 billion. However, reinsurance commissions plummeted 56% to VND 16 billion, resulting in nearly stagnant net insurance revenue of approximately VND 317 billion compared to the same period last year.

Insurance expenses increased by 2% to VND 254 billion, primarily due to a 3% rise in other expenses to over VND 165 billion, causing a 6% decline in gross insurance profit to VND 62 billion.

| BLI’s Q2 net profit over the years |

|

|

Notably, financial income halved to VND 17 billion, while financial expenses increased by 13% to VND 2 billion, causing a 53% plunge in profit from this segment. The decline in both core segments, coupled with rising management expenses, pushed Q2 net profit to a three-year low of just VND 1 billion.

In the first six months of the year, BLI recorded a 40% year-on-year decrease in net profit to VND 34 billion, despite a 7% increase in insurance business profit to VND 138 billion.

The significant drop in net profit was due to the inefficiency of financial activities, with profit from this segment decreasing by 47% to VND 29 billion. There was also no gain from buying and selling investment securities this year, unlike the previous year, and interest income decreased by 31% to over VND 29 billion.

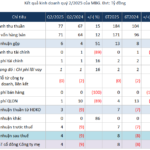

For 2025, BLI targets a pre-tax profit of over VND 56 billion, a 32% decline from 2024. After the first half of the year, the company has achieved 76% of its annual plan.

As of Q2, BLI‘s total assets amounted to over VND 2,619 billion, a slight increase of 2% from the beginning of the year. Short-term deposits accounted for more than 58% of total assets, valued at over VND 1,524 billion (up 7%).

Total liabilities stood at nearly VND 1,689 billion, mainly short-term, with the majority arising from insurance reserves of over VND 1,214 billion, a gentle 2% increase. Specifically, reserves for original insurance and reinsurance reached nearly VND 621 billion, and compensation reserves amounted to over VND 471 billion, respectively rising over 2% and 1% from the beginning of the year.

– 11:28 13/08/2025

“Hoang Quan Real Estate Plans to Issue 50 Million Shares to Swap Debt”

“Hoang Quan Real Estate plans to issue 50 million shares at VND 10,000 per share to swap VND 500 billion of debt. The list of creditors includes Chairman Truong Anh Tuan and Hai Phat Invest. This strategic move aims to strengthen the company’s financial position and consolidate its presence in the competitive real estate market.”

The Masterful Wordsmith: Crafting Captivating Copy with a Twist

“Unveiling the Secrets of Capital Retreat: A Chairman’s Tale”

Quoc Bao Van Ninh JSC has announced its plan to offload its entire stake in MBG Group JSC, amounting to 4.25 million shares or 3.54% of the charter capital. The proposed transaction, aimed at restructuring the company’s finances, is scheduled to take place between August 8 and September 5.