SSI Securities Corporation (SSI: HoSE) has just announced the Investment Board’s resolution to approve a credit and guarantee limit of VND 18,000 billion at the Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) – Hanoi Branch.

Along with this, the SSI Investment Board has approved the use of the company’s/its branches’ owned assets as collateral for the company’s obligations arising at the bank.

Previously, on July 25, the SSI Investment Board also approved a credit limit of VND 20,000 billion at the Vietnam Bank for Investment and Development (BIDV) to supplement working capital for the company’s business activities.

The SSI Investment Board has also approved the use of owned and/or used assets of the company (and/or its branches) as collateral for the company’s obligations at BIDV.

In another development, on August 20, SSI will finalize the list of shareholders who are entitled to attend the upcoming 2025 Extraordinary General Meeting of Shareholders.

The meeting is expected to take place on September 25, 2025. The agenda for the meeting has not been disclosed, and the venue will be announced later in the invitation letter to shareholders.

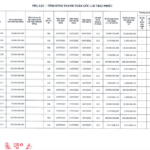

Regarding business performance, according to the company’s separate Q2/2025 financial statement, SSI recorded VND 2,909 billion in revenue, up 30% over the same period last year; after-tax profit reached VND 923 billion, up 11% over the same period.

For the first six months of the year, SSI posted VND 5,015 billion in revenue and VND 1,742 billion in after-tax profit, up 20% and 11% respectively over the same period last year.

As of the end of Q2/2025, SSI’s total assets reached nearly VND 91,000 billion, an increase of approximately VND 18,500 billion compared to the beginning of the year.

Of this, loans and receivables amounted to more than VND 33,000 billion, an increase of over VND 11,000 billion compared to the beginning of this year, and a record high.

Financial assets (FVTPL) were valued at over VND 45,260 billion in original value, an increase of nearly VND 3,000 billion from the beginning of the year; mainly invested in bonds (over VND 15,000 billion) and certificates of deposit (over VND 28,000 billion).

Unlocking Credit Opportunities for the Underserved

With total deposits of around 15 quadrillion VND as of now, the interest rates are quite low, yet banks are “desperately seeking borrowers”. Experts suggest that banks need to open up more to Fintech in the approval process and move away from the traditional “collateral requirement” mindset if they want to avoid capital stagnation. However, how much banks are willing to embrace Fintech is a challenging question due to the prevalent “all-or-nothing” mentality.

The Dark Cloud of Bad Debt

As per the latest data from the State Bank of Vietnam, the on-balance sheet bad debt ratio stood at 4.55% as of the end of Q3 2024, almost on par with the level at the end of 2023. In its recently updated report on the banking sector outlook, SSI Research noted that the bad debt ratios at state-owned and joint-stock commercial banks rose to 1.49% and 2.59%, respectively, in Q3 2024.