VN-Index Fluctuates Around the 1,600-Point Mark

The VN-Index experienced fluctuations, spending over half the time in the red and even briefly losing the 1,600-point mark. The market lacked support from large-cap stocks as they underwent adjustments, with 16 out of the 30 VN30 stocks declining in value.

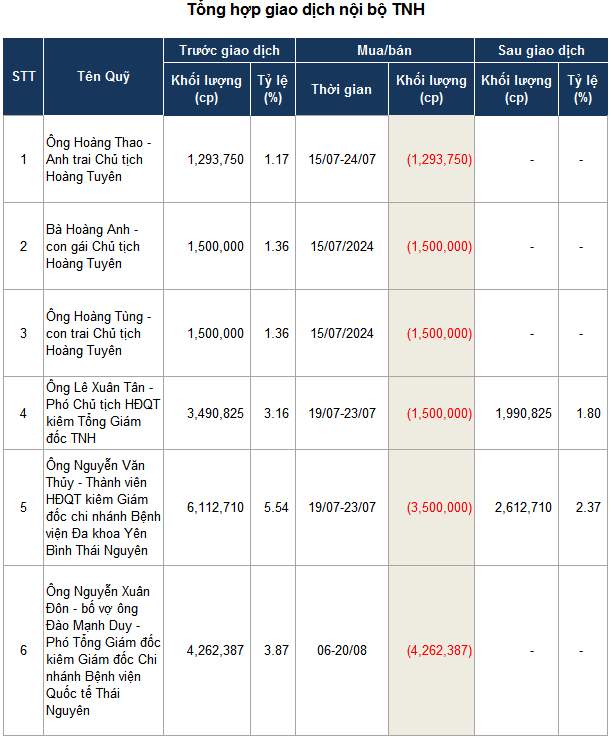

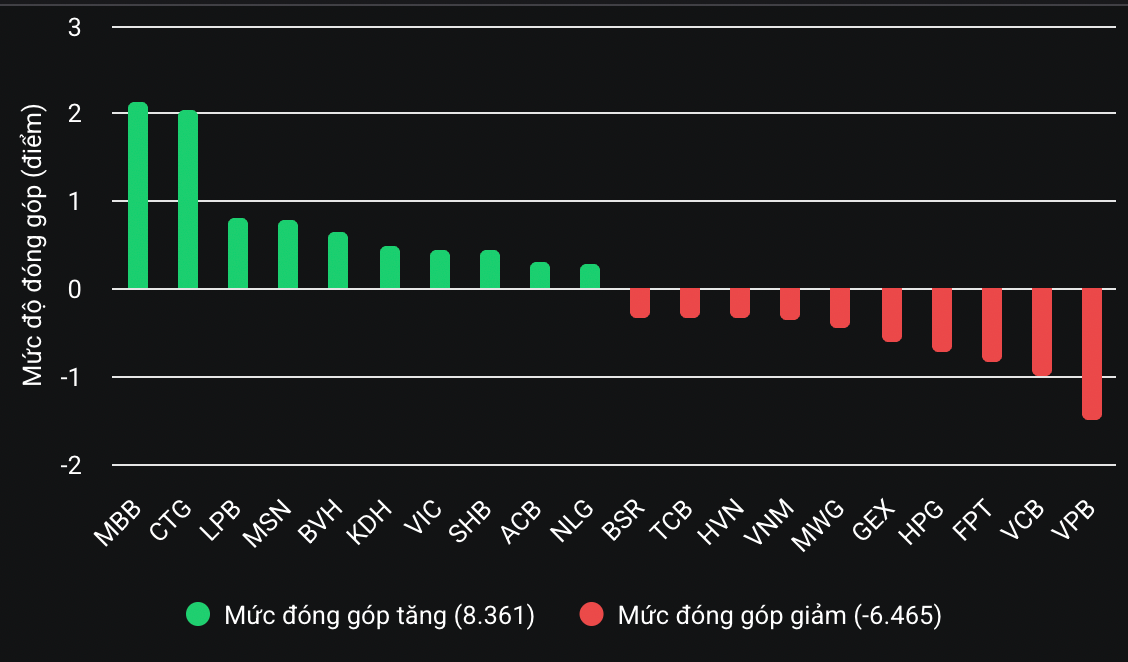

Banking stocks witnessed a clear divergence. While VPB and VCB were among the most negative influencers on the index, MBB, CTG, and LPB made positive contributions. This divergence within the banking sector saw some stocks propelled by strong buying interest while others faced profit-taking pressures and adjustments.

Banking stocks witness a clear divergence.

Money continued to flow into mid-cap and penny stocks in the real estate sector, with NLG, HDG, NBB, and CII hitting the ceiling prices. This trend wasn’t limited to real estate, as securities stocks like MBS, APS, and CTS also attracted strong buying interest and simultaneously hit ceiling prices.

Meanwhile, another securities stock, SSI, reclaimed the top spot in terms of market liquidity, with a trading value of over VND2,464 billion. The top 10 also included the presence of VIX and VND, indicating the heat spreading in the securities sector.

At the closing bell, the VN-Index gained over 3 points to reach 1,611 points, successfully reclaiming the 1,600-point mark in the afternoon session. Market liquidity remained high, surpassing VND62,400 billion.

Mr. Tran Hoang Son, Market Strategy Director at VPBank Securities, commented that the VN-Index reaching the 1,600-point threshold is a milestone that the market has long aspired to. Based on the current trend and compared to the end of 2024 and previous waves, it’s evident that we’re witnessing a massive wave.

Since the April lows, the VN-Index has surged over 50% in two phases. The 1,600-1,650-point range is a strong resistance zone, coinciding with the extended line connecting the peaks of 2022-2023. Investors need to pay close attention to this zone.

Historically, the strong waves of 2016-2018 typically underwent corrections of around 10% after climbing 20-30%. In contrast, the phase of 2020-2022 saw corrections of 13-16% following increases of 37-52%. Recently, the market experienced a decline of 60-70 points, accompanied by numerous floor prices, signaling the potential for a prolonged correction phase lasting 1-2 weeks.

Exercise Caution When Buying at High Prices

Regarding technical indicators, Mr. Son drew attention to the VN-Index’s RSI (Relative Strength Index) surpassing 70 and approaching the 78 level in the previous phase. When the proportion of stocks in the VN-Index basket with an RSI above 70 exceeds 20-40%, the market often experiences strong corrective waves, as witnessed in 2020, 2022, 2023, and 2024. By the end of last week, this figure had reached 18.4%.

The distance between the VN-Index and the MA50 line is currently at 1.11 times – a zone where historical statistics suggest the market tends to undergo corrections to “smoothen” the price path. In terms of valuation, after the strong rally, the VN-Index’s P/E and P/B ratios have approached the 10-year average, indicating a shift from a cheap to a fairly valued market, often accompanied by a period of consolidation.

Analysts suggest that most positive news has already been priced into stock prices.

However, Mr. Son believes that the uptrend could extend into 2026, supported by factors such as economic growth, improving corporate earnings, and favorable macroeconomic policies. If the market undergoes a technical correction until the end of August, it will present an opportunity for investors to participate rather than hastily chasing purchases at high prices.

Following the hot rally driven by Q2 business results, the banking, securities, and real estate sectors continue to exhibit positive signals in terms of price, technicals, and liquidity. However, money is starting to flow into infrastructure, oil and gas, chemicals, retail, and seafood export sectors.

According to Mr. Son, the market is in a phase of capital rotation. The pillar stocks continue to attract capital but show signs of profit-taking and allocation into sectors that haven’t witnessed significant increases. This shift enables multiple stocks to appreciate, providing investors with an opportunity to rectify mistakes even if they bought at high prices. However, it’s crucial to closely monitor the overall market signals to avoid the risk of deep corrections, as witnessed in the previous two weeks.

Notably, new market entrants often lack experience, constantly chasing waves and engaging in enthusiastic trading while ignoring warning signals. This group may engage in buying sprees at very high levels, only to be forced to sell when the market unexpectedly corrects, resulting in selling at the bottom.

SGI Capital opined that with most positive news already reflected in stock prices, careful stock selection and enhanced risk management should take precedence. The surge in liquidity has led to margin usage surpassing the 2022 peak. However, the cash balance in investor accounts is increasing at a slower pace, currently sufficient for only 1-2 trading sessions, lower than the 2-4 sessions during the 2022 peak.

The market valuation is approaching the 10-year average. While some sectors and stocks have surged to high price levels, trading 3-5% of their market cap daily indicates the reactivation of stock supply. Nevertheless, SGI Capital points out that there are still attractively priced stocks that could lure money amid low-interest rates and the upcoming upgrade timing.

A Rogue Bank Code: The Sudden Surge of Prop Trading in Vietnam’s Stock Market

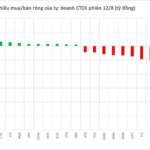

The HoSE witnessed a notable trading session on Thursday, with foreign investors and securities companies taking center stage. While foreign investors displayed confidence in the market by snapping up stocks, securities companies offloaded a substantial amount, amounting to a net sell value of VND 621 billion. This contrasting behavior between the two key market players has left market participants intrigued, with many wondering what the future holds for Vietnam’s stock market.

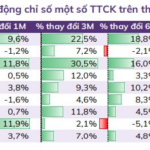

VN-Index: Testing Old Peaks Before Aiming for New Heights at 1,800 Points

Based on mid-term trend analysis, factoring in money flow and amplitude, ABS predicts that the VN-Index has the potential to reach an optimistic target range of 1,792 – 1,864 points.

“VN-Index Targets 1,800: 3 Stock Categories to Watch in H2 2025”

“Maybank Investment Bank has upgraded its forecast for the overall market profit growth in 2025 to an impressive 18.5%. This upgraded prediction signifies a positive outlook for the industry, indicating a potential surge in profitability that businesses and investors should take note of. With such a substantial increase in expected profits, it is essential for companies to strategize accordingly and capitalize on this projected growth.”

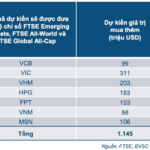

7 Stocks That Could Attract Over $1.1 Billion in Foreign Capital as Vietnam’s Market is Upgraded

The story of the market’s upgrade has an obvious silver lining: it could attract billions of dollars in foreign capital into Vietnam’s stock market.