Rạng Đông Holding Faces Insolvency

On August 13, Rang Dong Holding Joint Stock Company (stock code: RDP) announced to the Hanoi Stock Exchange (HNX) that it had received a bankruptcy proceeding decision on June 25, 2025, from the Ho Chi Minh City People’s Court.

Rạng Đông Holding’s Insolvency

According to the decision, the court found sufficient grounds in the petition filed by Rang Dong Films Joint Stock Company (a subsidiary of Rang Dong Holding) to prove that Rang Dong Holding is insolvent as defined by law.

Within 30 days from the last day of the publication of this decision, creditors of Rang Dong Holding must submit proof of their claims to the designated insolvency practitioner/asset management enterprise as instructed by the court.

The total debt that Rang Dong Holding has to repay includes due and overdue debts, secured and unsecured debts, interest, and contractual compensation (if any). Creditors must also provide documents and evidence supporting these claims.

Rạng Đông Holding’s Challenges

Rang Dong Holding (formerly known as Rang Dong Plastic Joint Stock Company) was established in the 1960s and was once a prominent company in the market, renowned for its Rang Dong Plastic brand. However, in recent years, the company has faced successive difficulties.

On April 24, the RDP stock was delisted from HOSE due to serious violations of information disclosure obligations. As a result, over 49 million shares were transferred to UPCoM on May 9 but were halted from trading on the same day. Currently, the RDP stock price stands at only VND1,300 per share.

Prior to this, on April 22, the 2025 Annual General Meeting of Shareholders of Rang Dong Holding was unsuccessful, with an attendance rate of only 14.98%, failing to meet the quorum requirements.

Headquarters of Rang Dong Holding. Source: Rang Dong Holding

The absence of the entire Board of Directors, Management Board, and Supervisory Board frustrated many shareholders, who felt disrespected by the company’s leadership. The second attempt to hold the meeting also failed due to low attendance.

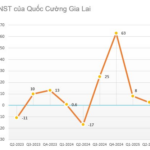

Financially, Rang Dong Holding experienced a prosperous period, generating tens of billions of dong in after-tax profits annually. In 2021, the company recorded a net profit of VND 38 billion, and in 2022, it achieved VND 13 billion.

However, since 2023, the situation has taken a turn for the worse as the company lost a lawsuit against Sojitz Pla-net Corporation (Japan) and was ordered to repay VND 157 billion plus related costs.

Mounting Losses and Debts

According to the latest financial report released at the end of Q2/2024, Rang Dong Holding incurred a loss of over VND 64.5 billion in the first half of 2024, bringing the accumulated loss as of June 30, 2024, to VND 266 billion.

In addition to losses, Rang Dong Holding is burdened with short-term loans and financial lease debts amounting to over VND 1,034 billion, along with long-term debts of nearly VND 198 billion. These debts are mostly bank loans, and the total financial debt is 4.4 times the company’s equity.

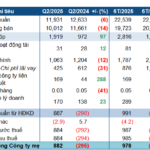

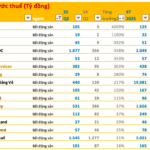

A String of Businesses ‘Wipe Out’ Profits Compared to the Same Period in 1H 2025

At the top of the list are Vinaship (VNA) and Nha Tu Liem (NTL), with a staggering near-100% decline in pre-tax profits year-over-year.

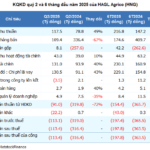

HAGL Agrico: Overburdened by Financial Debt of 10.2 Trillion VND, Gross Profit Falls Short of Covering Interest Expenses

HAGL Agrico has turned a corner with two consecutive quarters of positive gross profits, marking a significant shift from its historical trend of operating below cost. However, the weight of substantial financial debts, totaling over VND 10,200 billion, primarily owed to its largest shareholder, Thaco Agri, continues to burden the company with interest expenses that erase these hard-earned profits.

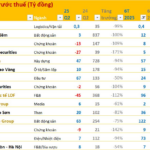

The Top 10 Real Estate Developers Reporting Massive Profit Increases in Q2 2025: A Company’s Profit Soars by an Astonishing 4,009%

“In contrast, there remain a handful of businesses that are undergoing restructuring and reporting losses, notably Novaland (NVL) and LDG Investment Joint Stock Company (LDG). These companies are navigating through challenging times and working towards getting back on a profitable path.”