The Board of Directors of SZC passed a resolution on September 5, 2024, to finalize the list of shareholders eligible for the 2024 dividend payout. The ex-dividend date was set as September 4, and the expected payment date is October 7. As per the plan, SZC will distribute a cash dividend of 10% (VND 1,000 per share), in line with the ratio approved at the 2025 Annual General Meeting of Shareholders.

With nearly 180 million circulating shares, SZC is estimated to disburse approximately VND 180 billion for this dividend payout. As of June 30, 2025, the Industrial Zone Development Joint Stock Company (UPCoM: SNZ) held a 46.84% stake in SZC and is expected to directly receive over VND 84 billion in dividends. Additionally, Sonadezi Long Thanh Joint Stock Company (HOSE: SZL) holds a 10.08% stake and will receive more than VND 18 billion.

SNZ is the biggest beneficiary. SZL is a wholly-owned subsidiary of SNZ, with a 52.75% ownership interest. Simultaneously, SNZ recognizes SZC as an indirectly held subsidiary, with a 57.72% voting interest and a 52.58% beneficial interest as of June 30, 2025.

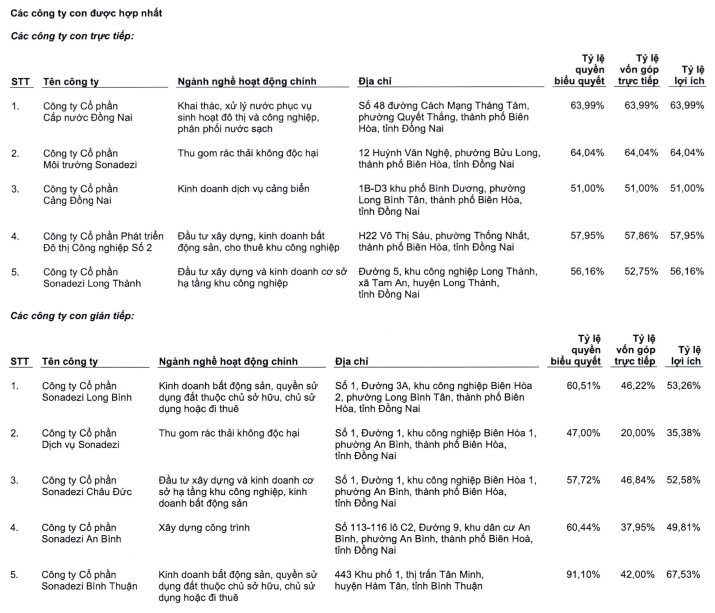

As of the end of the second quarter, SNZ was the direct parent company of five other companies, including Dong Nai Water Supply Joint Stock Company (UPCoM: DNW), Sonadezi Environment Joint Stock Company (UPCoM: SZE), Dong Nai Port Joint Stock Company (HOSE: PDN), Industrial Urban Development No. 2 Joint Stock Company (HOSE: D2D), and Sonadezi Long Thanh Joint Stock Company (HOSE: SZL).

Meanwhile, the list of indirect subsidiaries includes five entities: Sonadezi Long Binh Joint Stock Company (HNX: SZB), Sonadezi Service Joint Stock Company (UPCoM: SDV), Sonadezi An Binh Joint Stock Company (SZA), Sonadezi Binh Thuan Joint Stock Company (SZT), and Sonadezi Chau Duc Joint Stock Company (HOSE: SZC).

In addition to its subsidiaries, SNZ also has seven directly associated companies and four indirectly associated companies.

Source: Consolidated Financial Statements for the second quarter of 2025 of SNZ

|

At SZC, Mr. Dinh Ngoc Thuan serves as the Chairman of the Board of Directors. He also holds positions as a Member of the Board of Directors and Deputy General Director of SNZ, Member of the Board of Directors of SZL, and Member of the Board of Directors and General Director of SZT.

In terms of business performance, in the second quarter of 2025, revenue from land leasing and management fees, the primary source of income for SZC, decreased by 31% compared to the same period last year, reaching over VND 161 billion. The new contribution from road toll services, amounting to nearly VND 32 billion, was not sufficient to offset the decline, resulting in a 17% decrease in net revenue to nearly VND 218 billion.

A bright spot came from financial activities, with a surge in financial income to VND 7 billion, a six-fold increase compared to the previous year. Meanwhile, financial expenses, selling expenses, and administrative expenses increased by 5% to VND 25 billion. Ultimately, SZC recorded a net profit of nearly VND 95 billion, a 7% decrease.

For the first six months of the year, SZC achieved VND 632 billion in net revenue and VND 221 billion in net profit, increases of 33% and 32%, respectively, compared to the same period last year. With these results, SZC has accomplished 68% and 73% of its annual plan.

In the stock market, after a sharp decline in early April due to the shock of US tariff policies, SZC’s share price recovered but not significantly. As of the close of the latest trading session on August 12, SZC’s market price stood at VND 38,100 per share, a decrease of nearly 9% since the beginning of the year, with an average daily trading volume of over 2.4 million shares.

| SZC share price recovers after tariff shock |

Huy Khai

– 10:16, August 13, 2025

Why the Rush to Buy Real Estate Stocks?

“The VinaCapital member fund demonstrates its confidence in the real estate sector by purchasing 850,000 KDH shares of Khang Dien House Trading and Investment Joint Stock Company. In a similar move, Mr. Pham Hong Chau, a member of the Board of Management and CEO of Van Phu – Invest Real Estate Joint Stock Company, has registered to purchase 400,000 VPI shares. This strategic acquisition will boost his stake in the company to an impressive 1.75 million shares.”

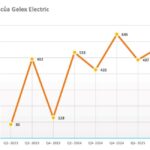

GELEX Electric (GEE) Announces Record Profits and a Cash Dividend Payout of Over VND 1,000 Billion with a 30% Ratio

Let me know if there are any other adjustments or refinements you would like!

The record date for shareholders to be entitled is August 21, 2025. The expected payment date is set for September 10, 2025.