Hung Thinh Loi Gia Lai Co., Ltd. has successfully raised VND 1,000 billion through a bond issuance. The company offered 10,000 bonds with the code HTL12501, each with a face value of VND 100 million and a term of up to August 8, 2028, at a fixed interest rate of 10.5% per annum.

Hung Thinh Loi Gia Lai’s bonds are guaranteed for payment, allowed for early repurchase according to the issuance terms, and committed to bondholders. OCBS Securities Joint Stock Company acts as the registrar and depository for these bonds.

Hung Thinh Loi Gia Lai Co., Ltd. specializes in crop cultivation and animal husbandry. The company is majority-owned by Hoang Anh Gia Lai Joint Stock Company (stock code: HAG), which holds over 98% of its charter capital.

As of July 31, the company had 50 registered employees. Its charter capital stands at VND 1,285 billion, with Hoang Anh Gia Lai Joint Stock Company holding 98.77%. The remaining stakes are held by Mr. Thuy Ngoc Dung (0.61%) and Mrs. Le Thi Lieu (0.61%).

Hung Thinh Loi Gia Lai Co., Ltd. is a subsidiary of HAG, specializing in crop cultivation and animal husbandry.

The company is directed by Ms. Vo Thi My Hanh, who serves as its Director and legal representative. Notably, Ms. Hanh is also a member of the Board of Directors and Vice President of Hoang Anh Gia Lai Joint Stock Company.

In October 2024, Hung Thinh Loi Gia Lai successfully matured a VND 350 billion bond issuance with a four-year term and a 10% interest rate, for which TPBank served as the depository.

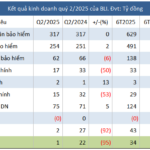

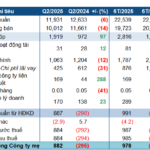

For the second quarter of this year, Hoang Anh Gia Lai Joint Stock Company recorded more than VND 2,300 billion in net revenue, a 53% increase from the previous year. This growth was primarily driven by its banana business.

Despite a 14% decrease in financial income to VND 78 billion and significant increases in financial expenses (up 75% to VND 285 billion), selling expenses (up 24% to VND 108 billion), and other losses (up from VND 18 billion to VND 34 billion), the company’s gross profit surged, resulting in a net profit of VND 483 billion, an impressive 86% increase year-over-year.

For the first six months of the year, HAG posted more than VND 3,700 billion in net revenue (up 34%) and a net profit of VND 824 billion (up 72% year-over-year). These results account for 67% and 78% of the company’s full-year revenue and profit targets, respectively.

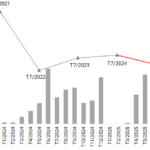

Notably, HAG has eliminated its accumulated losses, reporting nearly VND 400 billion in undistributed post-tax profits as of the end of the second quarter. Previously, the company had faced accumulated losses, including a loss of over VND 1,000 billion in the fourth quarter of 2020, which amounted to more than VND 7,500 billion as of the second quarter of 2021.

As of the end of the second quarter, HAG’s total assets exceeded VND 26,000 billion, a 17% increase from the beginning of the year. Short-term assets amounted to nearly VND 11,000 billion, a 29% increase. Cash holdings stood at VND 194 billion, up 29%, while inventory reached VND 738 billion, a 6% increase. Meanwhile, short-term debt accounted for VND 13,700 billion, a 23% increase, and constituted the majority of the company’s total liabilities.

“PetroVietnam Drills into Profits with Reduced Costs and Interest Expenses”

In Q2 2025, EVNGENCO3, listed on the Ho Chi Minh Stock Exchange (HOSE: PGV), witnessed a remarkable surge in profits compared to the previous year’s loss-making quarter. This impressive turnaround can be attributed to a significant reduction in both cost of goods sold and borrowing expenses.