Vietnam Stock Market Review: Foreign Sell-Off Continues as VN-Index Recovers to Hit All-Time High

The Ho Chi Minh Stock Exchange (HoSE) witnessed a strong recovery in the latter half of the trading session on August 12th, with the VN-Index regaining lost ground to close at 1,608.22 points, an increase of 11.36 points. This marks a new all-time high for the benchmark index. Turnover value remained robust, reaching approximately VND 43,760 billion.

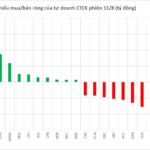

However, foreign investors continued their selling spree, offloading a net VND 726 billion worth of shares on the market. Here’s a breakdown of their activity:

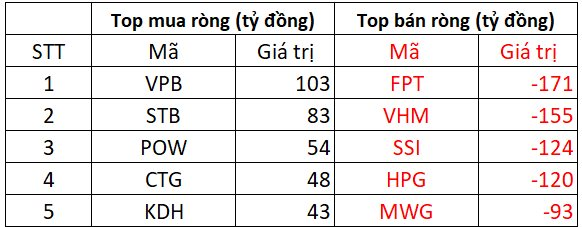

Foreign Investors’ Activity on HoSE: Net Sell Value of over VND 688 Billion

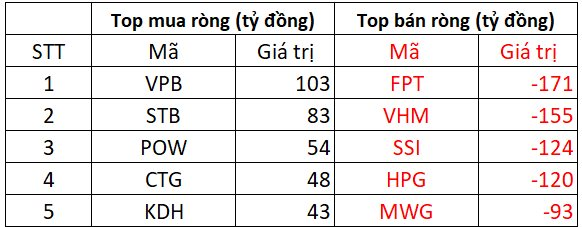

In terms of buying, foreign investors showed strong interest in VPB and STB, with net buying values of VND 103 billion and VND 83 billion, respectively. POW, CTG, and KDH also made it to the top bought list, with net buying values ranging from VND 43 billion to VND 83 billion.

On the selling side, FPT witnessed the highest net sell value of VND 171 billion. VHM, SSI, and HPG followed suit, with net sell values of VND 155 billion, VND 124 billion, and VND 120 billion, respectively. MWG also saw significant foreign selling, with a net sell value of VND 93 billion.

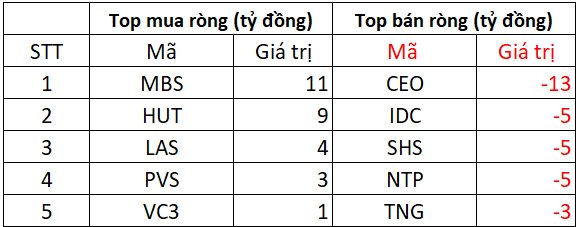

Hanoi Stock Exchange (HNX): Net Foreign Selling of approximately VND 17 Billion

MBS attracted the highest net buying value on the HNX, with VND 11 billion. HUT, LAS, and PVS also saw net buying in the range of VND 3 billion to VND 9 billion. VC3 witnessed modest net buying as well.

On the selling side, CEO witnessed the highest net sell value of VND 13 billion. IDC, SHS, and NTP followed suit, with net selling in the range of VND 5 billion for each stock.

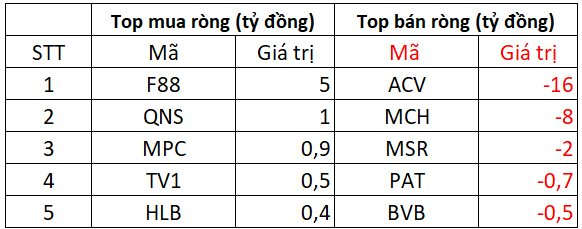

UPCoM: Net Foreign Selling of over VND 20 Billion

In terms of buying, F88 attracted the highest net buying value of VND 5 billion. QNS, MPC, TV1, and KLB saw modest net buying, ranging from a few hundred million to VND 1 billion.

Conversely, ACV and MCH witnessed strong net selling, with values of VND 8 billion and VND 16 billion, respectively. MSR, PAT, and BVB also experienced net selling, but to a lesser extent.

Market Beat: VN-Index Hangs on at 1,611 Points, Foreigners Sell FPT en Masse.

The market closed with positive gains, as the VN-Index rose by 3.38 points (+0.21%), reaching 1,611.6. Similarly, the HNX-Index climbed 3.22 points (+1.16%) to 279.69. The market breadth tilted towards the bulls, with 397 advancing stocks against 387 declining ones. However, the large-cap VN30 index painted a different picture, with 16 stocks in the red, 11 in the green, and 3 unchanged.

Market Mayhem: Navigating the Storm

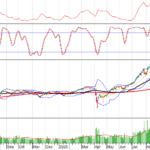

The VN-Index experienced vigorous tug-of-war action with above-average trading volume. The MACD indicator continues its upward trajectory, providing a buy signal and reinforcing the positive short-term outlook. However, intense fluctuations within the session are likely to persist as the index forges new peaks.

“Technical Analysis for August 13: Proceeding With Caution”

The VN-Index and HNX-Index both witnessed a decline during the morning session, with an increase in trading volume. This indicates a cautious sentiment among investors, who are carefully navigating the market and assessing their investment strategies.