Strong 6-month credit growth, GDP sets a 14-year record

According to Deputy Governor of the State Bank of Vietnam Pham Thanh Ha, in the first half of 2025, the interest rate management framework was maintained stable, helping credit institutions access cheap capital. Along with the promotion of digital transformation and cost-saving measures, this move created room for lowering the average lending rate for new transactions to 6.29%/year, a decrease of 0.64% compared to the end of 2024, thus supporting the economy.

As a result, by the end of June, total credit outstanding across the economy had surpassed VND 17.2 quadrillion, up 9.9% from the end of 2024 – equivalent to nearly VND 1.6 quadrillion of credit capital injected into the economy. Compared to the same period last year, the 19.32% increase was the highest since 2023.

The combination of loose monetary policy and abundant credit capital contributed to a 7.52% GDP growth in the first six months compared to the same period, the highest in the 2011-2025 period, approaching the government’s growth target of 8.3 – 8.5% for the year.

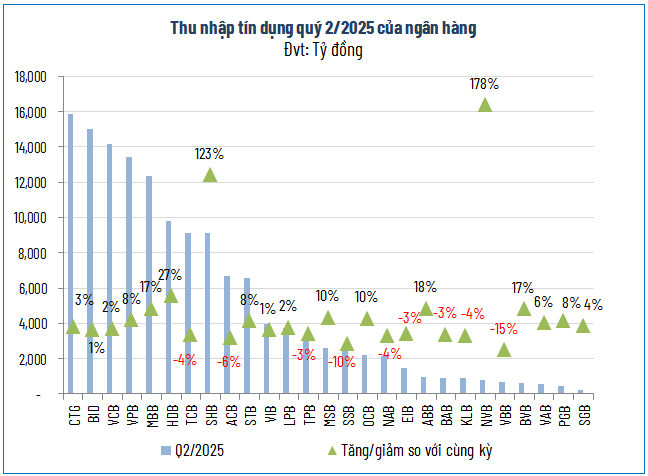

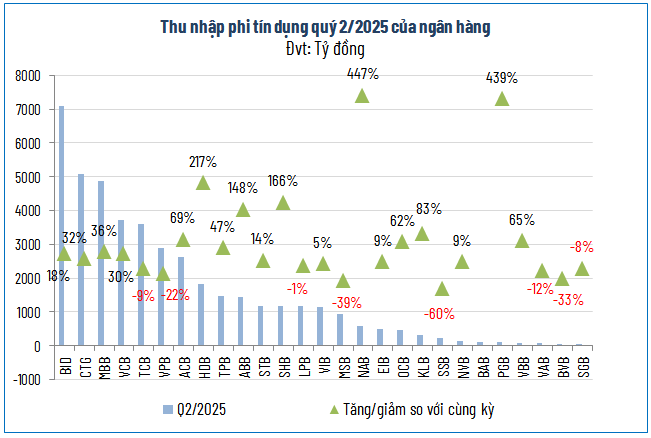

Q2 – Profit acceleration

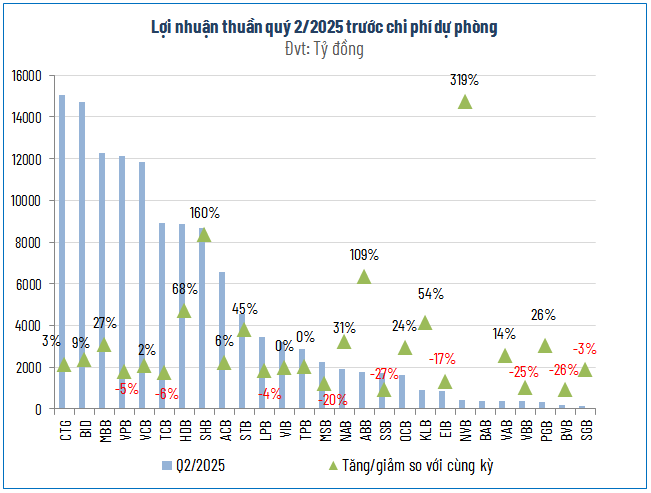

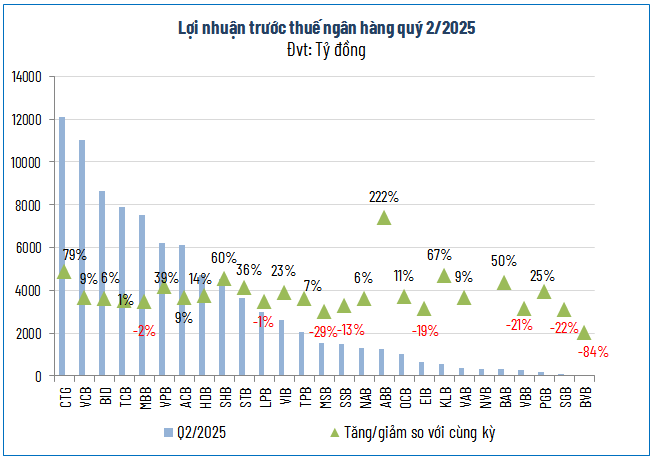

In the context of continued credit growth acceleration, the Q2 profit picture of the banking industry was more brilliant as many banks grew strongly thanks to both credit and non-credit segments improvement. Out of 27 listed banks, the total pre-tax profit in Q2 reached more than VND 89,300 billion, up over 17% compared to the same period and higher than the 14% increase in the previous quarter, according to data from VietstockFinance.

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

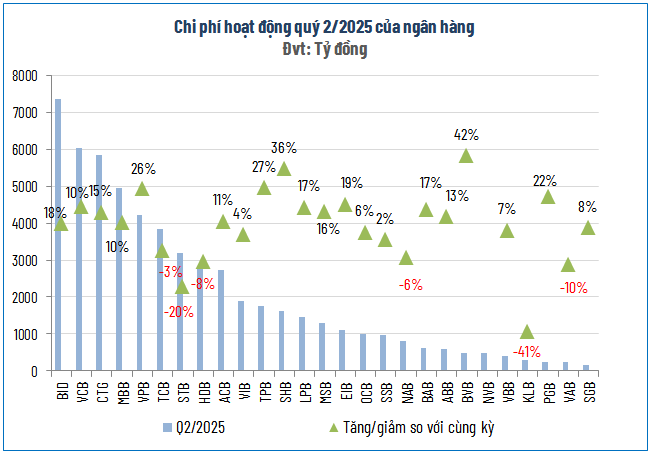

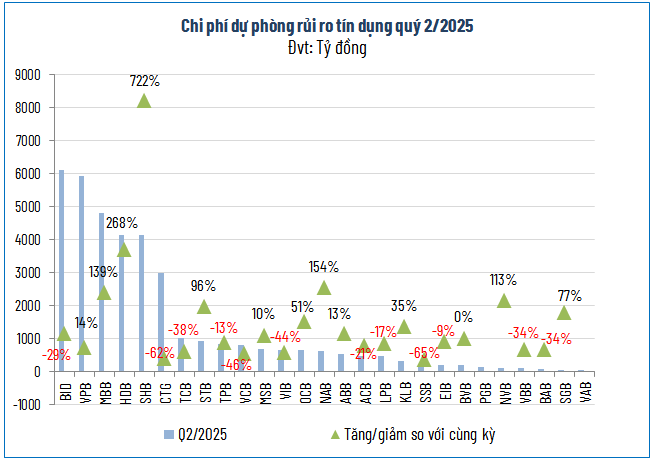

Income from credit increased by 9% while non-interest income surged by 24%. On the other hand, operating expenses rose by 8% and credit risk provision expenses increased by only 5%.

Source: VietstockFinance

|

Source: VietstockFinance

|

NVB, ABB, CTG, KLB, and SHB stood out with outstanding pre-tax profit growth, thanks to improved net interest income and significantly reduced credit risk provisions.

On the contrary, BVB witnessed an 84% plunge in profit despite credit growth. The main reason was a deep decline in non-interest income and soaring operating expenses.

6 months – Outstanding growth

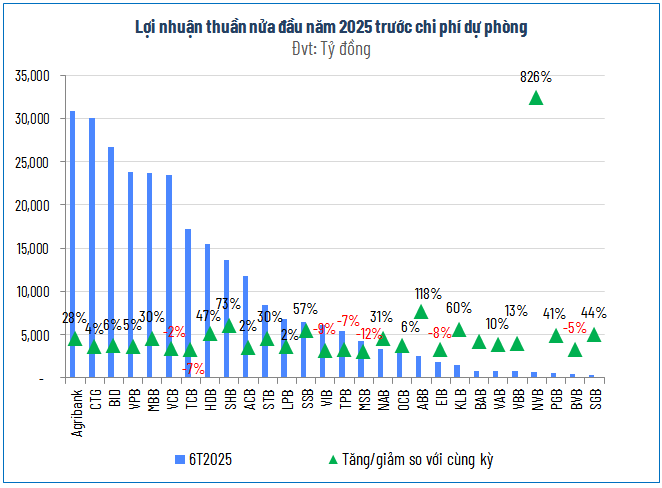

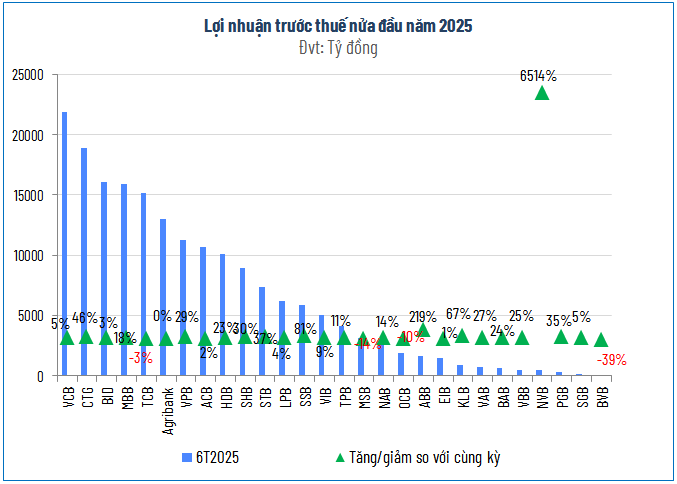

In the first half of the year, the pre-tax profit of 28 banks, including Agribank, reached nearly VND 185,000 billion, up 15% over the same period.

Source: VietstockFinance

|

Source: VietstockFinance

|

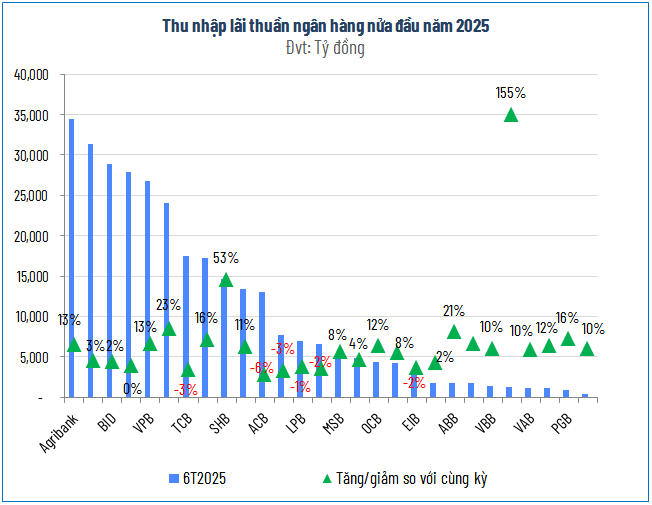

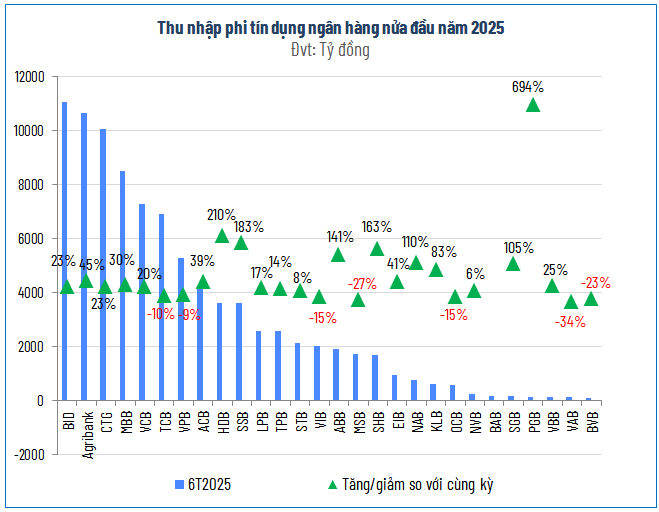

Income from credit continued to play a leading role with more than VND 303,500 billion (up 8%), while the non-interest segment also made a significant contribution, increasing by 26% over the same period to VND 89,595 billion.

Source: VietstockFinance

|

Source: VietstockFinance

|

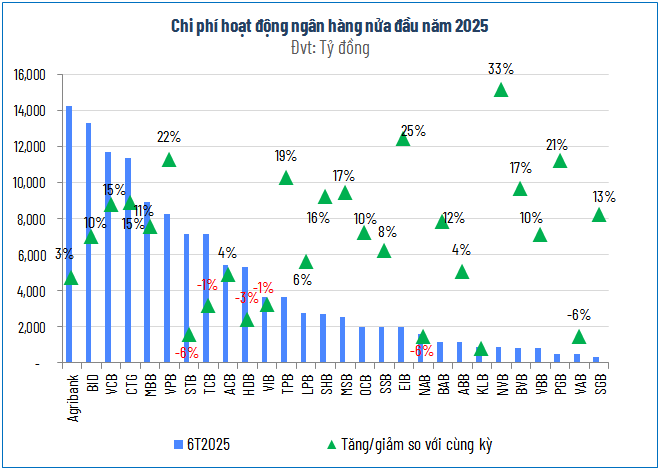

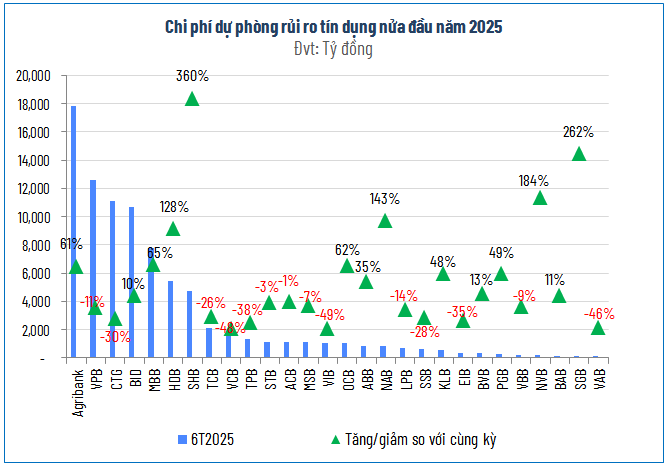

Meanwhile, operating expenses (VND 122,256 billion) and credit risk provisions (VND 85,726 billion) increased at a slower pace, rising by only 8% and 10%, respectively, compared to the same period.

Source: VietstockFinance

|

Source: VietstockFinance

|

Some banks witnessed remarkable breakthroughs, such as NVB with a more than 66-fold increase, ABB with a 3.2-fold increase, CTG with a 46% rise, and SSB with an 81% jump thanks to a boost from Q1.

The fierce race for the profit crown

Source: VietstockFinance

|

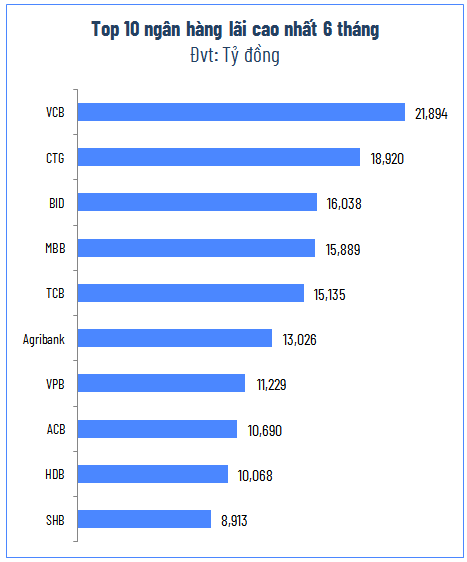

Agribank surprised the market by taking the lead in net interest income with more than VND 34,400 billion (up 13% year-on-year), surpassing Vietcombank in the first six months. However, the pressure of credit risk provisions, which surged by 61%, caused Agribank to lose the top position, giving way to Vietcombank in terms of pre-tax profit.

Thanks to its Q2 acceleration, VietinBank rose to second place with nearly VND 18,920 billion, followed by BIDV with more than VND 16,000 billion.

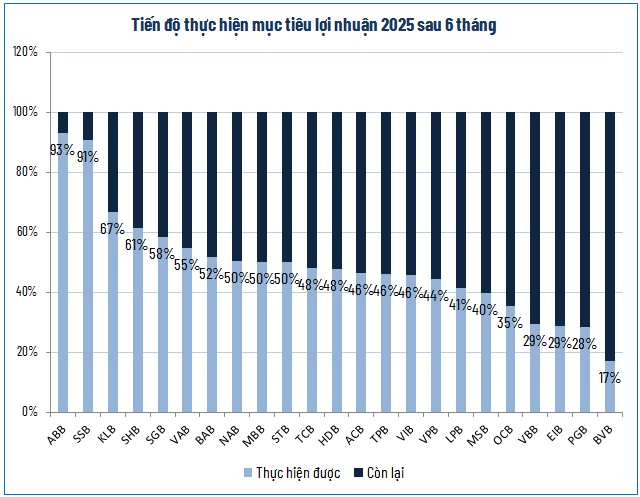

Optimistic progress towards the full-year plan

After the first half, most banks have completed over 40% of their full-year profit plans. ABB and SSB are approaching their targets, with completion rates of 93% and 91%, respectively, promising to surpass their goals ahead of schedule.

Source: VietstockFinance

|

Further interest rate reduction to boost credit growth

According to the Q3/2025 Business Trend Survey conducted by the Department of Forecasting, Statistics – Monetary and Financial Stability (SBV), credit institutions (CIs) noted that demand for loans, payments, and card usage in Q2 increased sharply compared to the previous quarter, outpacing deposit needs. In Q3 and the whole of 2025, most CIs expect credit demand to continue to increase faster than other services.

In Q2, CIs continued to reduce the average price of products and services, especially the interest rate spread – a more significant reduction than service fees. This trend is expected to last until the end of 2025, mainly driven by interest rate spread reduction, contrary to the slight increase expected in the second half of 2025 in the previous survey. The interest rate level for VND deposits and loans generally decreased slightly, especially lending rates, and is forecast to stabilize by the end of this year compared to the end of 2024.

Notably, CIs have raised their credit growth expectations for 2025 to 16.8%, higher than the actual rate in 2024. In the last six months of the year, banks plan to maintain or loosen credit standards, prioritizing enterprises and sectors such as green credit, agriculture, forestry, fisheries, manufacturing industry, supporting industries, high technology, consumer credit, and housing loans.

Regarding the outlook, most CIs believe that the pre-tax profit of the entire industry will continue to improve in the remaining quarters of 2025, and the economy’s demand for banking products and services will be the most positive factor. However, in 2025, the SBV’s credit, interest rate, and exchange rate policies are still expected to be the most important objective factors, while competition among CIs remains a significant barrier.

– 12:00 13/08/2025

“Banking on Loans: Real Estate and Stock Markets Attract Capital”

According to the State Bank of Vietnam, the credit growth of the whole system reached approximately 10% after seven months, a significant surge compared to the 6% recorded in the same period last year.

Dr. Nguyen Tri Hieu: “Lowering Interest Rates to Support Growth is Logical, but it Also Harbors the Risk of Asset Bubbles”

The banking sector is the “backbone” of the economy, providing capital and making an ever-increasing contribution to the state budget. However, behind these impressive figures lies the pressure of a high credit-to-GDP ratio, maturity and interest rate risks, and the urgent need for digital transformation to stay in the global race.

The Private Bond Market Slows in July

The vibrant activity in the private placement bond market took a downturn in July, with issuances plunging to just over VND 31 trillion, a mere one-fourth of June’s figure and the lowest in the last four months.