The market continued its growth momentum, with the VN-Index recording gains in the early trading session of August 13. However, the benchmark soon faced corrective pressure, with many large-cap stocks experiencing strong selling at higher prices. The VN-Index dipped to 1,585 points before recovering. It eventually closed with a gain of 3.38 points (+0.21%), ending the day at 1,611.6 points. Foreign investors net sold heavily on the overall market, focusing on Bluechip stocks, to the tune of VND 1,551 billion.

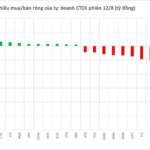

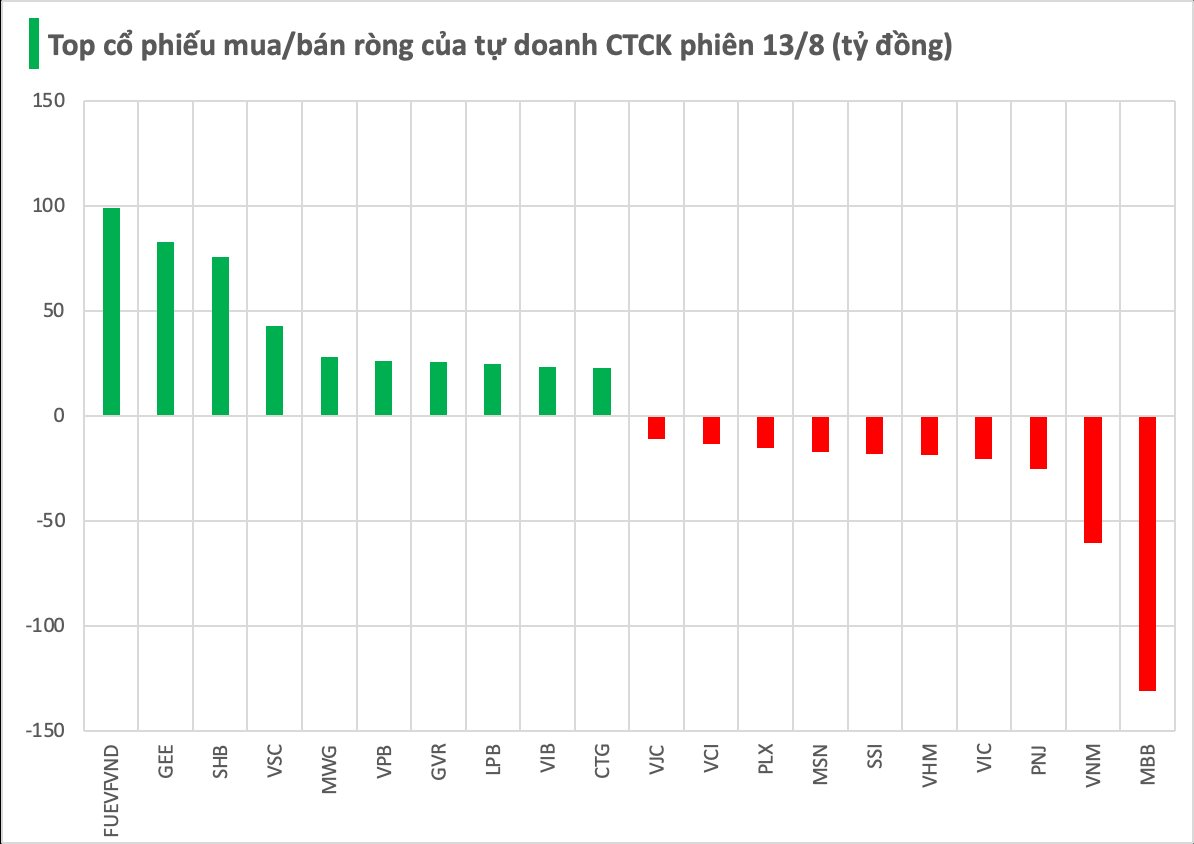

In contrast, securities companies’ proprietary trading activities returned to net buying with a value of VND 253 billion on the HoSE.

The FUEVFVND experienced the strongest net buying, with a value of 99 billion VND, followed by GEE (83 billion) and SHB (76 billion VND). Securities companies also net bought VSC (43 billion), MWG (28 billion), VPB (26 billion), GVR (26 billion), LPB (25 billion), VIB (23 billion), and CTG (23 billion VND).

On the other hand, MBB witnessed the heaviest net selling by securities companies, amounting to 131 billion VND, far surpassing other stocks. VNM and PNJ followed suit, with net selling values of 60 billion and 25 billion VND, respectively. Several other large-cap stocks also faced notable net selling, including VIC (-21 billion), VHM (-19 billion), SSI (-18 billion), MSN (-17 billion), PLX (-15 billion), VCI (-13 billion), and VJC (-11 billion VND).

Stock Market Update: Riding the Wave or Missing Out?

Today’s session (August 13th) saw the VN-Index fluctuate around the 1,600-point mark multiple times. The intense back-and-forth movement at this strong resistance level has put investors in a tricky situation: buying now risks buying at the peak, but selling early could mean missing out on potential gains. Experts suggest that if the market undergoes a technical correction until the end of August, it would present an opportunity to enter instead of rushing to buy at higher prices.

A Rogue Bank Code: The Sudden Surge of Prop Trading in Vietnam’s Stock Market

The HoSE witnessed a notable trading session on Thursday, with foreign investors and securities companies taking center stage. While foreign investors displayed confidence in the market by snapping up stocks, securities companies offloaded a substantial amount, amounting to a net sell value of VND 621 billion. This contrasting behavior between the two key market players has left market participants intrigued, with many wondering what the future holds for Vietnam’s stock market.

“VN-Index Targets 1,800: 3 Stock Categories to Watch in H2 2025”

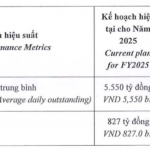

“Maybank Investment Bank has upgraded its forecast for the overall market profit growth in 2025 to an impressive 18.5%. This upgraded prediction signifies a positive outlook for the industry, indicating a potential surge in profitability that businesses and investors should take note of. With such a substantial increase in expected profits, it is essential for companies to strategize accordingly and capitalize on this projected growth.”