Mr. Heng Koon How, Market Strategy Director at UOB Bank (Singapore), shared his insights on the topic “Trump’s volatile trade policies could steepen the yield curve and weaken the US dollar.”

Mr. Heng Koon How, Market Strategy Director, Market and Global Economic Research Division, UOB Bank (Singapore)

|

On August 1st, US President Donald Trump finally followed through on his pledge to impose the full range of retaliatory tariffs he had announced back in April.

Most Asian countries can breathe a sigh of relief as their tariffs were kept at 20% or lower. However, the future of these trade agreements remains uncertain.

This uncertainty, coupled with the risk of a global and US economic downturn in the second half of the year, is why the US yield curve could continue to steepen, dragging the USD down with it.

Not only in the short term, but in the long run, the impact on the USD will become more apparent as tariffs force countries to diversify their trade to other markets, reducing their reliance on the US. This will decrease the use and role of the USD in global trade, negatively affecting its value.

The future of global trade remains uncertain

Although US Trade Representative Howard Lutnick affirmed that the tariffs were finalized after August 1st, many expect the negotiations to continue for several more months.

The world’s most important trade agreement is yet to be reached. After the third round of talks, the US and China are believed to have agreed on a 90-day extension. The negotiations involve sensitive issues such as access to artificial intelligence, China’s semiconductor technology, and the export of rare earths and strategic minerals to the US. The outcome will significantly impact China’s economic health and the economic prospects of the rest of Asia.

Currently, including tariffs from both the Trump and Biden administrations, the Peterson Institute for International Economics (PIIE) estimates that the average tariff imposed by the US on imports from China is 54.9%. Conversely, China imposes an average tariff of 32.6% on imports from the US. These are very high tariffs that will undoubtedly hinder economic growth.

Additionally, trade agreements with other large economies like India, Canada, and Brazil are stalled due to foreign policy and geopolitical issues unrelated to trade.

Regarding the agreements already in place, many come with substantial investment commitments in the US, such as $350 billion from South Korea, $550 billion from Japan, and $600 billion from the European Union. However, these commitments face skepticism and opposition within these countries. The mobilization and implementation of these investments remain uncertain, and if they fall through, the trade agreements could be jeopardized.

There are also lingering questions about how taxes will be applied and aggregated for specific categories of goods. This includes industry-specific tariffs under “Section 232” for sectors like automobiles, semiconductors, and pharmaceuticals, as well as “transhipment taxes” on goods believed to be transited to avoid tariffs.

Concerns about a global economic downturn in the second half are rising

Apart from the prolonged tariff uncertainties, the US and global economies are at a critical juncture. Notably, in the first half of the year, the world economy, including the US and Asian economies, achieved impressive growth.

Singapore’s GDP growth surprised on the upside, reaching 4.2% in the first half, thanks to strong export performance. Taiwan’s GDP in the second quarter also grew by nearly 8%.

The International Monetary Fund (IMF) has upgraded its GDP growth forecast for 2025 for Emerging Markets from 3.7% to 4.1%, thanks to the resilience of the Chinese economy.

However, GDP figures reflect the past, and many agencies warn that the global economy is about to enter a ‘payback’ phase as higher tariffs start to bite.

Particularly, the front-loading of exports may have run its course, and Asian economies, including China, could start to experience a slowdown in manufacturing in the coming months. Indeed, contrary to expectations of a recovery to the 50-point level, China’s official Purchasing Managers’ Index (PMI) for the manufacturing sector fell to 49.3 in July, indicating that a downturn may have begun.

In the second quarter, the US economy recorded a 3% year-over-year growth, surpassing expectations. However, there is a heated debate about whether the negative impacts of higher trade tariffs are beginning to affect the US economy more significantly in the second half.

Fed Chair Jerome Powell stated that, so far, US importers have been able to absorb much of the tariffs. However, this will become increasingly challenging as the new tariffs from August 1st kick in, leading to higher consumer prices, reduced demand, and a drag on economic growth.

Fed rate cuts and de-dollarization trends will pressure the USD

UOB predicts that the Fed will resume rate cuts at the Federal Open Market Committee (FOMC) meeting in September, following the disappointing July jobs report. The average number of new jobs created in the past three months has been adjusted down to just 35,000, close to a “stall” level, indicating a weakening labor market.

If the Fed cuts rates again, it will pull down short-term interest rates, while long-term rates, such as US government bond yields, may remain elevated due to concerns about unsustainable public debt. As a result, the US yield curve is likely to steepen further, exerting additional pressure on the USD.

In addition to these short-term factors, the USD faces depreciation pressure from long-term structural trends.

Many economies have realized that the high trade tariffs imposed by the US are here to stay. To mitigate risks, they will need to restructure their supply chains and exports, diversify their trade to other economies, and boost intra-regional trade with neighboring countries.

This structural shift could accelerate de-dollarization and reduce the accumulation of trade revenues into US Treasuries, both of which are detrimental to the USD in the long run.

In recent months, some Asian currencies have appreciated against the USD. For instance, the Singapore dollar has strengthened to nearly S$1.3 to US$1, and it is expected to hover around this level. The Monetary Authority of Singapore (MAS) is forecast to delay monetary policy easing until October or even early next year, pending clear evidence that the front-loading of exports ahead of tariffs has ended.

The USD Index (DXY), which measures the greenback’s value against a basket of major global currencies, has dipped below 100. UOB forecasts this index to fall to 97 by the end of this year and further down to 95 by mid-next year.

As the USD faces depreciation pressure, the demand for safe-haven assets is expected to remain high. Therefore, UOB maintains a positive long-term outlook on gold prices, anticipating a rise to $3,700 per ounce by mid-next year.

US President Donald Trump will be remembered for his slogan, ‘Make America Great Again.’ However, it is less likely that he will soon be able to “make the US dollar great again.”

– 13:58 13/08/2025

“Dollar and Yuan: Ascending Together on August 13th’s Exchange Rates”

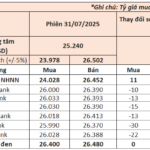

The State Bank of Vietnam has listed the mid-point rate for August 13 at 25,247 VND/USD, a slight increase of 4 VND compared to the previous day’s morning rate. In a turn of events, the exchange rate for the Chinese Yuan at banks on August 13 also witnessed an upward trend, contrary to the rates observed on the morning of August 12.

Gold Prices Maintain Uptrend Amid Fed Rate Cut Expectations

The price of gold surged on Friday after a disappointing jobs report from the U.S. Labor Department. The report, which fell short of expectations, revealed a sluggish jobs market with a mere 132,000 non-farm jobs added in July. This prompted a rush to safe-haven assets, with gold leading the charge.

The Fed’s Move: How the Central Bank’s Actions Impact the Global Economy and Your Wallet

Since the beginning of the week, the SBV has raised the central exchange rate for four consecutive sessions, reaching a new peak since the application of this mechanism in early 2016.