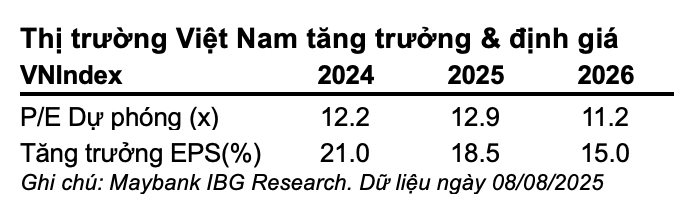

In a recent report, Maybank Securities expects market-wide profit growth to slow down but improve in quality in the second half of 2025. Meanwhile, Maybank Investment Bank has upgraded its full-year growth forecast to 18.5% year-on-year.

According to Maybank Securities, Q2 market profits were robust, with a +34% year-on-year growth driven by strong performance across most sectors. Export-oriented industries such as maritime logistics benefited from early deliveries, while service exports like IT were negatively impacted by weak demand due to deferred IT projects amid trade tensions.

Domestically, sectors benefiting from infrastructure investment, such as steel and real estate, were boosted by the government’s push for infrastructure development. This policy also supported strong bank credit growth, despite increased competition affecting NIM and bank sector profit growth. Consumer sectors continued to lag, but effective cost management helped maintain positive results. Meanwhile, aviation logistics remained robust due to the tourism boom.

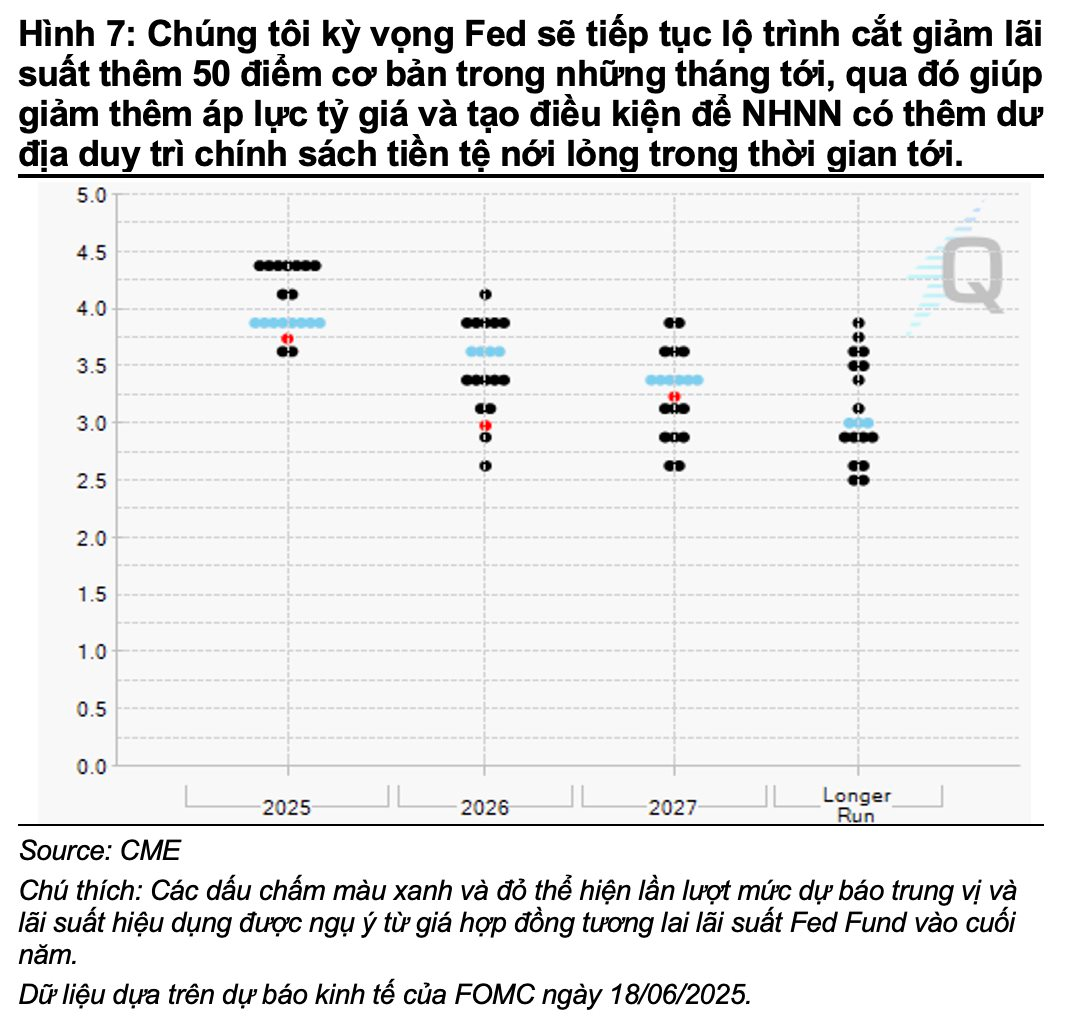

The analyst team expects profit growth to slow down but improve in quality in H2 2025. The government is aggressively pursuing an 8% GDP growth target through proactive fiscal measures. Maybank Investment Bank forecasts domestic deposit rates may increase by 0-50bps due to higher funding needs, but the State Bank will likely maintain an accommodative policy stance if the Fed cuts rates further.

Government and corporate investment will remain the primary growth drivers in the second half, while personal consumption is expected to recover later, supported by improved consumer confidence, accommodative policies (e.g., potential personal income tax reforms), and wealth effects from rising real estate and stock markets. This will enable more balanced and improved growth quality in the next six months. Thus, Maybank Investment Bank has upgraded its market profit growth forecast for the year to 18.5%.

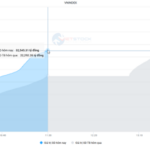

Turning to the stock market, Maybank Investment Bank notes that the VN-Index is experiencing one of its most impressive rallies in history and has reached new highs. Average liquidity hit a record of VND 32.8 trillion in July 2025, supported by expectations of an upgrade and ample liquidity.

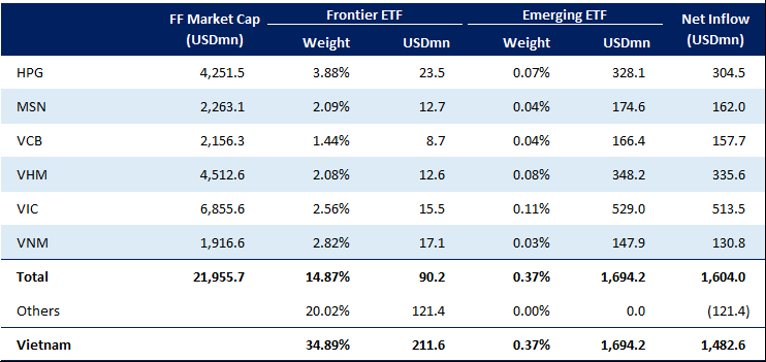

The analyst team believes that the positive sentiment surrounding the anticipated upgrade will continue to drive the market in August-September 2025. Specifically, this assessment, coupled with positive developments such as the meeting between the Prime Minister and FTSE representatives and the VN-Index being the best-performing market in ASEAN year-to-date, is likely to support FTSE’s decision to officially upgrade Vietnam to Emerging Market status in September 2025. Maybank Securities predicts six stocks, including HPG, MSN, VCB, VHM, VIC, and VNM, will qualify for inclusion in the FTSE Emerging Markets indices.

Source: Maybank IBG Research Collection and Estimation.

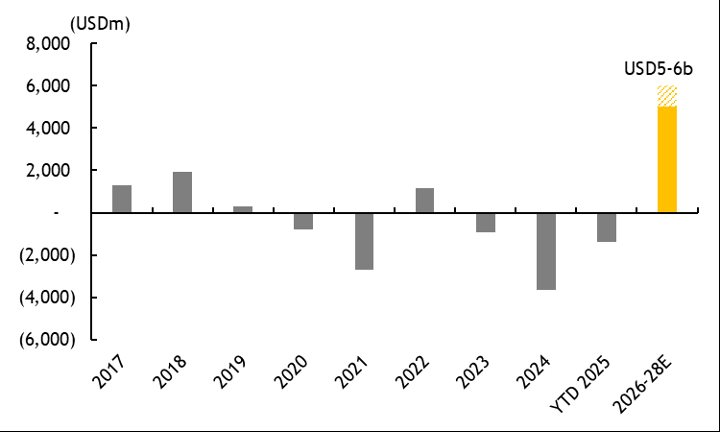

According to FTSE, the upgrade could attract approximately $1 billion from passive funds and $4-5 billion from active funds into Vietnam.

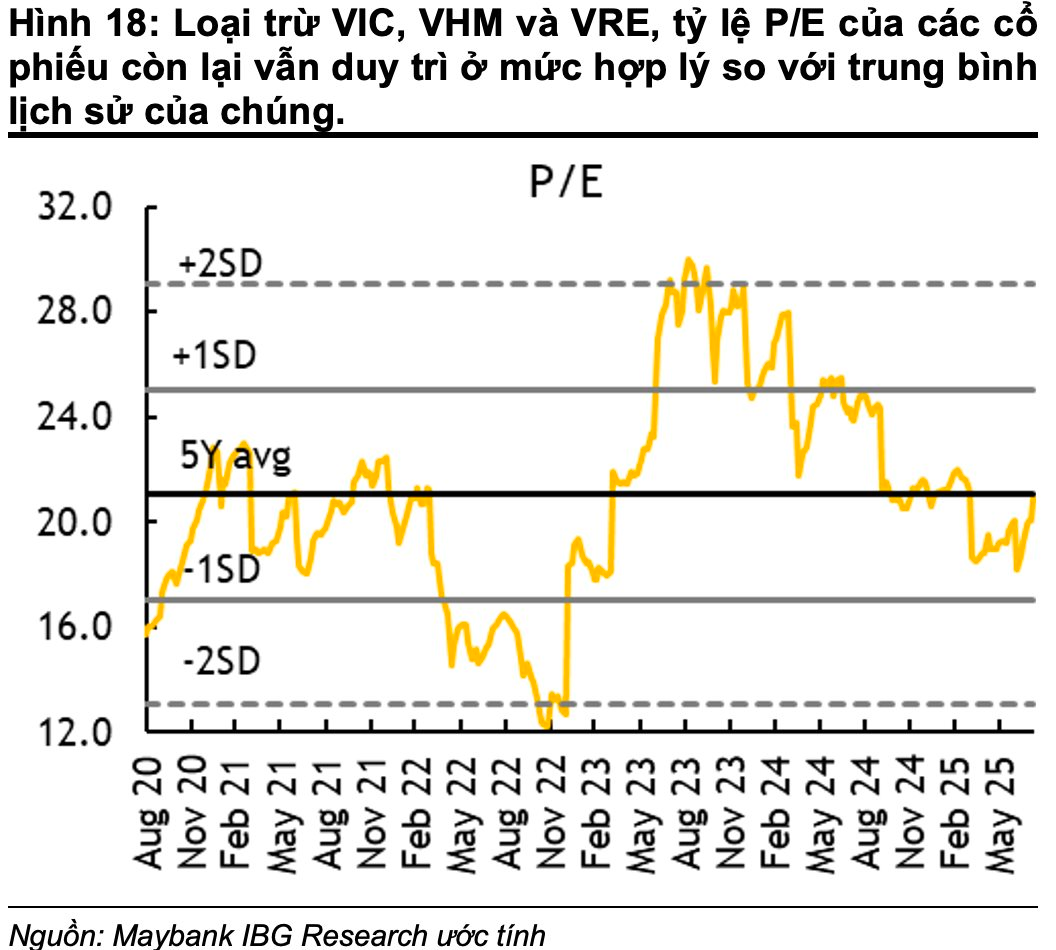

However, in the short term, historical data from previous market upgrades suggests that the market typically experiences a “sell on news” reaction, with an average decline of 4-5%, and this trend can last up to three months. Nonetheless, overall, despite two-thirds of the year’s gains already realized, market valuations remain around the five-year average and are not stretched, allowing the uptrend to persist.

Maybank Investment Bank maintains a positive outlook for the second half, upgrading its year-end VN-Index target by 20% to 1,800 points, based on a target P/E of 14.5x (equivalent to the five-year average) and an estimated full-year 2025 EPS growth of 18.5%. The top three preferred sectors are infrastructure beneficiaries (steel, real estate), strong credit growth (banks), and structural demand (IT, aviation).

The VN-Index Rides High: What Investors Need to Know to Avoid Getting Caught in the Tide

“One of the key warning signs is the Relative Strength Index (RSI), when the RSI of the VN-Index basket exceeds the 30-40% threshold, the market has seen significant corrective waves, as witnessed in 2020, 2022, and most recently in 2023 and 2024,” the expert pointed out.

Market Beat: VN-Index Hangs on at 1,611 Points, Foreigners Sell FPT en Masse.

The market closed with positive gains, as the VN-Index rose by 3.38 points (+0.21%), reaching 1,611.6. Similarly, the HNX-Index climbed 3.22 points (+1.16%) to 279.69. The market breadth tilted towards the bulls, with 397 advancing stocks against 387 declining ones. However, the large-cap VN30 index painted a different picture, with 16 stocks in the red, 11 in the green, and 3 unchanged.

Market Mayhem: Navigating the Storm

The VN-Index experienced vigorous tug-of-war action with above-average trading volume. The MACD indicator continues its upward trajectory, providing a buy signal and reinforcing the positive short-term outlook. However, intense fluctuations within the session are likely to persist as the index forges new peaks.