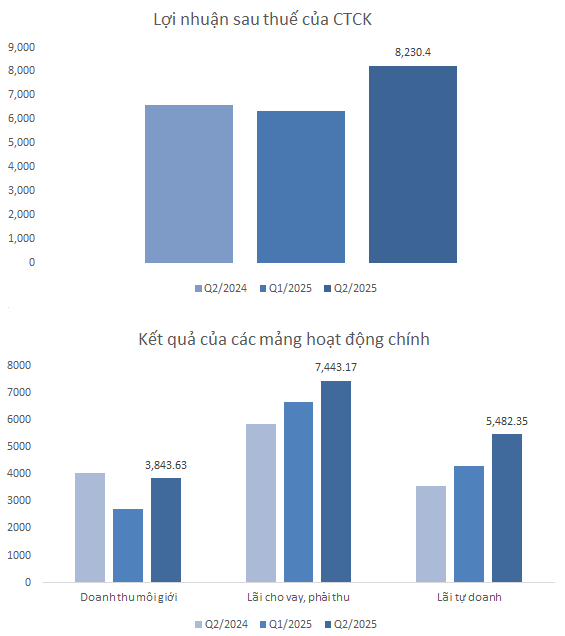

In Q2 of 2025, the securities group recorded an impressive after-tax profit of over 8.2 trillion VND, marking a significant improvement from the same period last year and the previous quarter, with increases of 25% and 30%, respectively.

The profit results of the securities group were mainly driven by three business areas: revenue, lending, and proprietary trading. All three areas performed positively in Q2.

|

Q2 2025 Business Results of the Securities Group

(Unit: Billion VND)

Source: VietstockFinance

|

Brokerage revenue for Q2 reached 3.8 trillion VND, a more than 40% increase from the previous quarter. Improved market liquidity in Q2 positively impacted the brokerage business. The average trading value on the HOSE and HNX exchanges was 23.4 trillion VND per session. However, brokerage revenue was slightly lower compared to the same period last year, with a 5% decrease.

The remaining two areas showed positive results compared to both the previous quarter and the same period last year. Lending has been a stable growth driver for securities companies. Interest income and receivables have shown a consistent upward trend over the quarters. In Q2 2025, lending income and receivables of the securities group exceeded 7.4 trillion VND, a 12% increase from the previous quarter and a 27% increase year-on-year.

The proprietary trading segment witnessed a strong breakthrough in Q2, with trading profits reaching nearly 5.5 trillion VND. The market’s significant rise from the 1,100-point region (early April) to 1,370 points (end of June) provided a solid foundation for proprietary trading activities. Proprietary trading profits in Q2 amounted to nearly 5.5 trillion VND, a 54% increase from the same period last year and a 27% increase from the previous quarter.

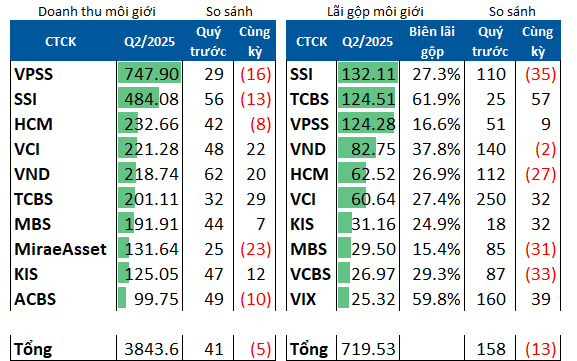

Brokerage Segment: VPSS Leads in Revenue, SSI Tops in Profits

In the brokerage segment, the top performers demonstrated a clear gap with the followers. Out of the group, nine companies achieved a revenue of 100 billion VND each. Among them, VPS Securities (VPSS) led with revenue close to 750 billion VND, followed by SSI Securities (SSI) at 484 billion VND.

Trailing behind were Ho Chi Minh City Securities (HCM), Vietcap Securities (VCI), VNDIRECT Securities (VND), and Techcom Securities (TCBS), with brokerage revenues ranging from 100 to 230 billion VND.

However, when considering gross profit, VPSS was no longer the front-runner. SSI took the lead in gross profit for brokerage, earning over 130 billion VND, equivalent to a gross profit margin of 27.3%.

Techcom Securities (TCBS) ranked second in gross profit for brokerage, with a result of 124 billion VND and an impressive gross profit margin of 61%.

VPS Securities (VPS) came in third, with a gross profit of 124.3 billion VND, but lagged behind in efficiency, achieving a gross profit margin of only 16.6%.

Consistent with the revenue rankings, most of the top-performing companies in gross profit were also among the leaders in revenue. However, Mirae Asset Securities and KIS Securities, despite having revenue within the top 10, did not make it to the top in gross profit. Conversely, VCBS Securities and VIX Securities excelled in gross profit but did not lead in revenue.

|

Top 10 Brokerage Revenue and Gross Profit in Q2 2025

(Unit: Billion VND)

Source: VietstockFinance

|

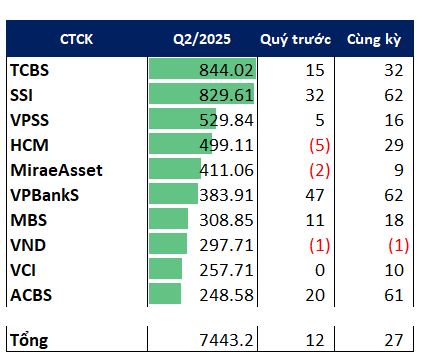

TCBS Leads in Lending

In the lending segment, the market share leaders also dominated in revenue. TCBS demonstrated its strength in lending, with interest income and receivables in Q2 reaching up to 844 billion VND, leading the group.

SSI closely followed in second place, with a similar performance of 830 billion VND. VPS lagged in this segment, generating only about 530 billion VND.

The market share leaders, including HCM, VCI, and VND, also showcased their advantage in lending.

Notably, the top performers included several securities companies with a banking background, such as VPBank Securities (VPBankS), MB Securities (MBS), and ACB Securities (ACBS).

|

Top 10 Lending Income and Receivables

(Unit: Billion VND)

Source: VietstockFinance

|

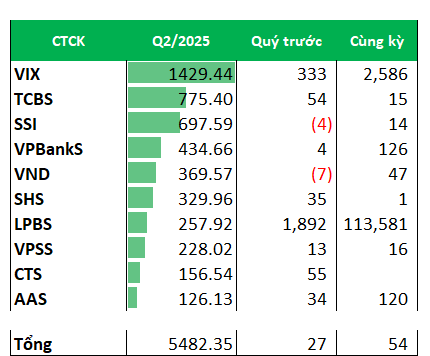

VIX Tops in Proprietary Trading with Billion-VND Profits

The proprietary trading segment witnessed breakthroughs from several companies. VIX Securities reported a fourfold increase in proprietary trading profits compared to the previous quarter and a 27-fold surge from the same period last year, amounting to 1.4 trillion VND.

|

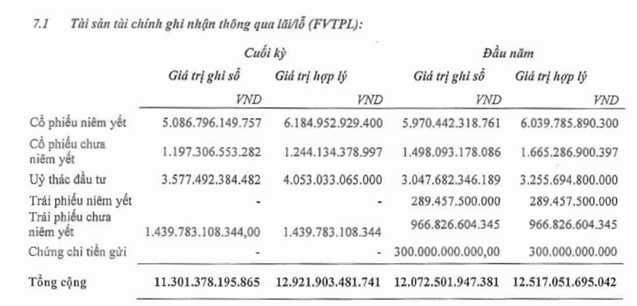

VIX Financial Statement as of June 30, 2025

|

Ranking seventh in proprietary trading profits, LPBS Securities (LPBS) reported a 20-fold increase from the previous quarter and a nearly 115-fold rise from the same period last year. This remarkable performance brought in nearly 258 billion VND in profits for LPBS‘s proprietary trading business.

Familiar names such as TCBS, SSI, VND, and VPSS also made it to the top 10. However, the ranking showcased diversity, with several companies outside the market share leaders excelling in proprietary trading profit size. These included Saigon-Hanoi Securities (SHS), Vietinbank Securities (CTS), and Smart Invest Securities (AAS).

|

Top 10 Proprietary Trading Profits in Q2 2025

(Unit: Billion VND)

Source: VietstockFinance

|

– 10:00, August 13, 2025

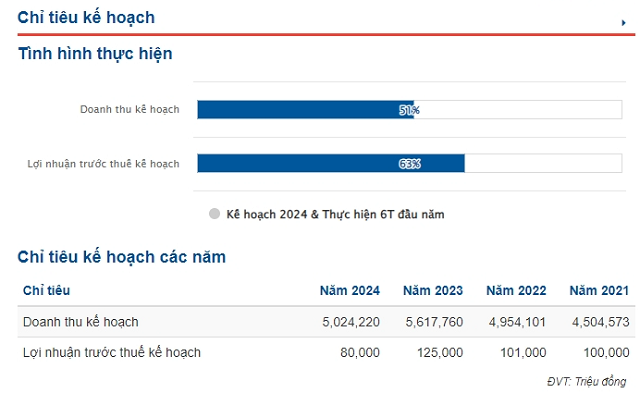

The Golden Touch: Unlocking Revenue Growth with PNJ’s 24K Magic

As of May 10, 2024, PNJ reported remarkable growth with a revenue of 32,371 billion VND, reflecting a 22.7% increase compared to the same period last year. The company’s net profit also rose to 1,600 billion VND, representing a 4.4% year-over-year growth.

The Stockbroker’s Dilemma: When Brokers Miss Out and Traders Get Lazy.

The brokerage revenue across securities companies in Q3 2024 witnessed a 28% decline year-over-year and a 23% drop from the previous quarter.