Red Capital JSC recently registered to sell all 18 million shares of SEA, equivalent to 14.4% of the charter capital of the Vietnam Seafood Corporation (Seaprodex).

The transaction is expected to be executed by matching or agreement from August 14 to September 5.

It is known that Ms. Do Thi Phuong Lan, a member of the Board of Directors and General Director of Red Capital, is also a member of the Board of Directors of Seaprodex.

Red Capital acquired 18 million SEA shares on August 6, 2024. At that time, SEA shares closed at VND 28,710 per share.

As of the closing price on August 13, 2025, SEA shares stood at VND 38,000 per share. Taking this as the transaction price, it is estimated that Red Capital could make a profit of over VND 149 billion after one year of holding these shares.

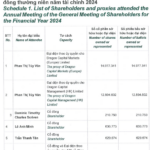

As of June 30, 2025, in addition to Red Capital, Seaprodex had two other major shareholders: the State Capital Investment Corporation (SCIC) owning 63.38% of charter capital and Gelex Group Joint Stock Company (GEX on HoSE) owning 9.52%.

Seaprodex owns prime real estate at 2-4-6 Dong Khoi, Saigon Ward, Ho Chi Minh City

In terms of business performance, in the second quarter of 2025, Seaprodex recorded revenue of VND 195.6 billion, up 5% over the same period, with after-tax profit reaching VND 62.6 billion, unchanged from the previous year. While gross profit increased, net profit remained flat due to cost pressures.

Accumulated in the first half of 2025, Seaprodex recorded revenue of VND 336 billion, up 8% over the same period, with after-tax profit reaching VND 108 billion, up 6% over the same period last year.

For 2025, Seaprodex set a plan for total revenue of VND 155.58 billion, up 8.4% over the same period, with a pre-tax profit of VND 77 billion, up 1.2% compared to the performance in 2024, and a expected dividend rate of 5%.

As of the end of the second quarter of 2025, Seaprodex had achieved 145.8% of its full-year 2025 plan, with pre-tax profit of VND 112.3 billion.

As of June 30, 2025, Seaprodex’s total assets increased by 7.6% compared to the beginning of the year, reaching VND 2,784.6 billion.

This includes VND 1,250 billion in long-term financial investments, VND 692.8 billion in long-term work-in-progress, and VND 440 billion in cash and cash equivalents.

Accordingly, Seaprodex still records work-in-progress expenses mainly related to the land use right value of VND 692 billion at 2-4-6 Dong Khoi, Saigon Ward, Ho Chi Minh City (formerly Ben Nghe Ward, District 1).

In terms of capital structure, short-term borrowings increased by 180% compared to the beginning of the year, reaching VND 119.37 billion.

The Laundry Powder Company, Aged 60, Fined and Taxed for Over $130,000 in Penalties.

“Businesses have engaged in misdeclaration, resulting in an underpayment of taxes due, as well as misdeclarations that did not result in a deficit of taxes owed. This misconduct has implications for both their reputation and legal standing.”

155 Masan Employees Get a Great Deal on ESOP Shares

“Masan has concluded its distribution of 7.56 million ESOP shares to 155 employees. The offering price was VND 10,000 per share, a significant 86% discount on the market price. This move underscores Masan’s commitment to recognizing and rewarding its talented workforce, fostering a culture of ownership and long-term commitment to the company’s success.”