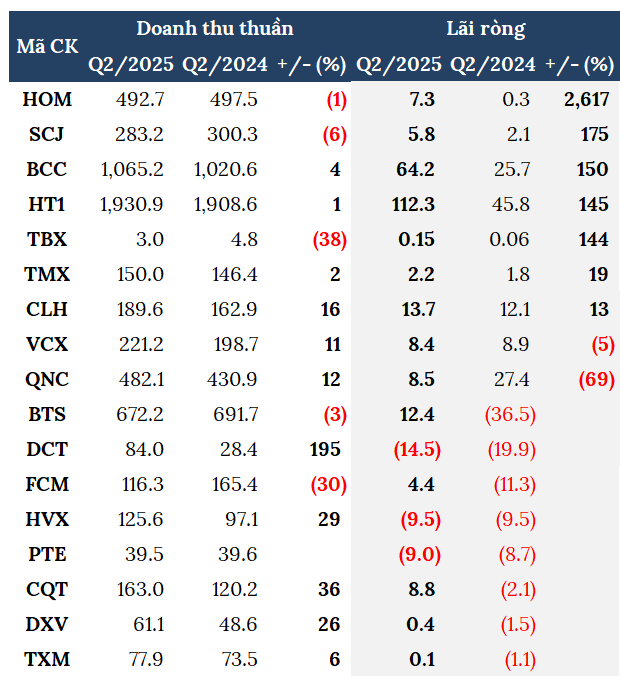

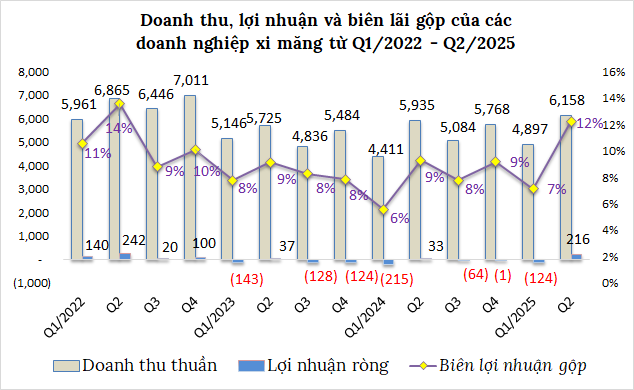

After several consecutive challenging quarters, the group of 17 cement companies listed on the stock exchange has announced their Q2 2025 financial statements, revealing a notable recovery. Data from VietstockFinance shows that the industry’s net profit reached 216 billion VND, a 6.4x increase from the same period last year, the highest since Q3 2022. Revenue reached 6,158 billion VND, a 4% increase, peaking since Q1 2023.

Source: VietstockFinance

|

Exponential Growth for Businesses

Among them, five businesses experienced exponential growth, with VICEM Hoàng Mai Cement (HNX: HOM) standing out with a net profit of over 7 billion VND, a 27x increase from the previous year, the highest since Q3 2022. This remarkable result is attributed to the company’s substitution of a portion of coal with alternative materials such as wood chips, tree bark, and solid waste, leading to an increase in clinker price by 130,000 VND/ton at the factory. In the first half of the year, HOM earned a profit of nearly 8 billion VND, while in the same period last year, it incurred a loss of 40 billion VND, achieving more than half of its annual plan.

Bỉm Sơn Cement (HNX: BCC) also reported its highest profit in 13 quarters, exceeding 64 billion VND, a 2.5x increase from the previous year, thanks to a significant reduction in production costs. In the first six months, BCC earned a net profit of over 5 billion VND compared to a loss of nearly 23 billion VND in the same period, but this only accounts for 6% of its annual plan.

The “giant” Vicem Hà Tiên Cement (HOSE: HT1) returned to the milestone of over a hundred billion profits after 11 gloomy quarters, thanks to increased sales volume, controlled production costs, reduced raw material prices, and revenue from the fee for the capital recovery project for the construction of the road connecting Nguyễn Duy Trinh to Phú Hữu Industrial Park, Ho Chi Minh City. In the first half of the year, HT1 earned a net profit of over 103 billion VND, nearly 5 times higher than the same period last year, achieving more than half of its annual plan.

|

Financial Performance of Cement Enterprises in Q2 2025 (in billion VND)

Source: VietstockFinance

|

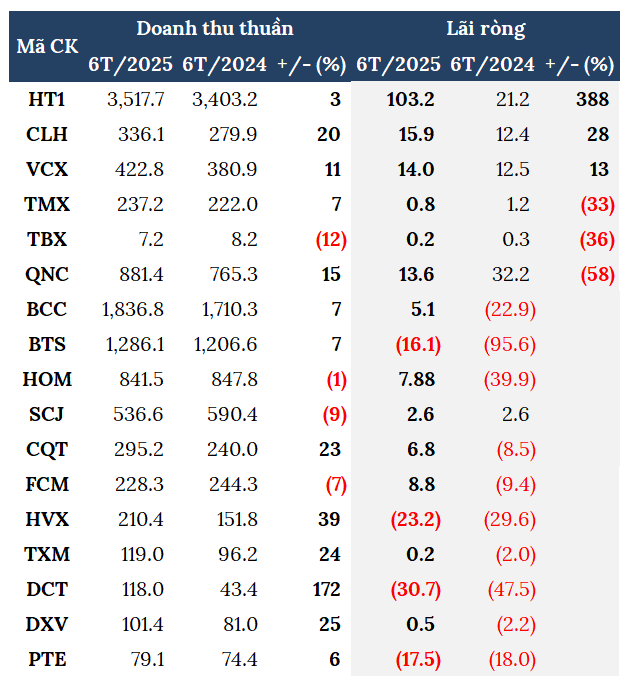

From Loss to Profit

While revenue did not increase and the market remained challenging, VICEM Bút Sơn Cement (HNX: BTS) surprisingly reported a Q2 profit of over 12 billion VND, ending a streak of 10 consecutive quarters of losses. This positive turnaround in Q2, however, was not enough to offset the weak performance in the first quarter. In the first six months, BTS still incurred a net loss of over 16 billion VND, but this loss was significantly narrowed compared to the nearly 96 billion VND loss in the same period last year.

Quán Triều VVMI Cement (UPCoM: CQT) earned a profit of nearly 9 billion VND in Q2, reversing a loss of more than 2 billion VND in the same period last year, thanks to a significant increase in sales volume. In the first six months, CQT made a profit of nearly 7 billion VND, compared to a loss of nearly 9 billion VND in the same period last year, achieving 76% of its annual plan.

Phan Vũ Hà Nam Concrete Joint Stock Company (HOSE: FCM) made a profit of over 4 billion VND, compared to a loss of 11 billion VND in the same period last year, due to a 99% reduction in financial expenses after divesting from FECON Nghi Son and accelerating debt collection. In the first half of the year, FCM earned a profit of nearly 9 billion VND, compared to a loss of over 9 billion VND in the same period last year, but this only accounts for 26% of its annual plan.

|

Financial Performance of Cement Enterprises in the First Half of 2025 (in billion VND)

Source: VietstockFinance

|

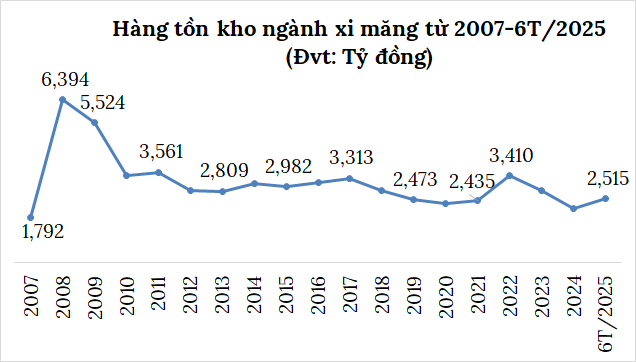

Inventory Challenges

The industry’s total inventory as of the end of Q2 was over 2,500 billion VND, a 17% increase from the beginning of the year. HT1 alone accounted for 28% of the industry’s total inventory, with more than 693 billion VND, including a 22% increase in finished goods value to over 342 billion VND.

Source: VietstockFinance

|

Opportunities and Risks for the Second Half of 2025

With public investment being promoted and supported by macroeconomic and legal factors, construction and building materials enterprises, including cement companies, are expected to benefit, especially in product consumption.

The country’s total cement output in the first six months was nearly 61 million tons, a 62% increase over the same period. Cement consumption exceeded 54 million tons, a 27% increase. Domestic consumption was a bright spot, with 37.6 million tons, a 39% increase, mainly due to the promotion of public investment, especially in transport infrastructure, irrigation, and social housing.

The Ministry of Construction forecasts that cement consumption will increase by 2-3% to 95-100 million tons this year, with domestic consumption expected to reach 60-65 million tons and exports projected at 30-35 million tons.

The VICEM Corporation predicts that in Q3 and the last months of 2025, domestic cement consumption will continue to rise due to the government’s promotion of public investment, especially in transport infrastructure and construction. Additionally, the real estate supply is expected to recover as legal solutions begin to impact the market.

However, the early arrival of the rainy season in the North and Central regions is expected to affect construction work, reducing regional cement consumption. Moreover, the cement market continues to face challenges: an imbalance in supply and demand, intensifying price competition, a shift in demand from bagged to bulk cement, and from high-priced to low-priced cement, leading to reduced production and business efficiency.

– 10:00 15/08/2025

The Future of FPT: Unveiling Adjusted Growth Plans and Their Impact on the Bottom Line

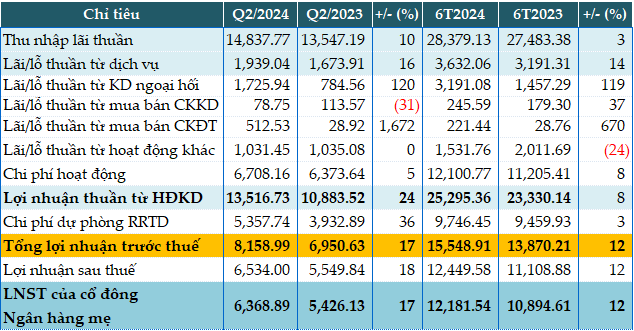

In the first seven months of the year, FPT recorded remarkable financial performance with revenue surpassing VND 38,000 billion and after-tax profit attributable to the parent company reaching VND 5,147 billion. These figures represent an impressive growth of 11.2% and 20.1%, respectively, compared to the same period in 2024.

Yuanta Securities Adjusts 2025 Business Plan

On August 12, the Board of Directors of Yuanta Securities Vietnam JSC convened a meeting to discuss and approve significant matters, including the adoption of a new business plan for 2025. This revised strategy projects an average margin lending balance of VND 5.042 trillion and a total revenue of VND 793.6 billion, reflecting a 9% and 4% decrease, respectively, from the initial plan.