Mr. Doan Nguyen Duc (known as “Bầu Đức”), Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (stock code: HAG), has recently registered to sell 25 million HAG shares from August 15 to September 13 for ownership restructuring purposes.

Should the transaction be successful, Mr. Duc’s ownership in HAG will decrease from nearly 330 million shares to approximately 305 million shares, equivalent to 28.84% of the charter capital. It is estimated that Bầu Đức will receive VND 395 billion if all 25 million HAG shares are sold.

During this period, Bầu Đức’s son, Mr. Doan Hoang Nam, registered to purchase 27 million shares through matching or put-through orders. It is likely that Mr. Nam will acquire 25 million shares from his father and the remaining through matching orders. If successful, Mr. Nam will own 2.55% of HAG’s charter capital. However, he will need to invest approximately VND 427 billion to complete this transaction.

Bầu Đức plans to sell 25 million HAG shares for ownership restructuring. Image: Reatimes.

The buying and selling activities of Bầu Đức and his son occur as HAG’s share price reaches its highest peak in the past three years. Since the beginning of the year, HAG’s share price has increased by 28%.

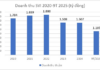

In the second quarter of this year, Hoang Anh Gia Lai Joint Stock Company recorded over VND 2,300 billion in net revenue, a 53% increase compared to the same period last year. This growth is mainly attributed to the company’s banana business.

Despite a 14% decrease in financial income to VND 78 billion and significant increases in financial expenses (up 75% to VND 285 billion), selling expenses (up 24% to VND 108 billion), and other losses (up from VND 18 billion to VND 34 billion), the company’s gross profit surged, resulting in a net profit of VND 483 billion, an impressive 86% increase year-on-year.

For the first six months of 2025, HAG achieved more than VND 3,700 billion in net revenue (a 34% increase) and a net profit of VND 824 billion (a 72% increase compared to the same period last year). These results account for 67% of the annual revenue target and 78% of the annual profit target.

Notably, HAG eliminated its accumulated losses, reporting undistributed post-tax profits of nearly VND 400 billion by the end of the second quarter. Previously, HAG had incurred losses of over VND 1,000 billion in the fourth quarter of 2020, amounting to more than VND 7,500 billion by the second quarter of 2021.

As of the second quarter, HAG’s total assets reached over VND 26,000 billion, a 17% increase from the beginning of the year. Short-term assets amounted to nearly VND 11,000 billion, a 29% increase. Cash holdings stood at VND 194 billion, up 29%. Inventories reached VND 738 billion, a 6% increase. Meanwhile, short-term debt accounted for VND 13,700 billion, a 23% increase, and constituted the majority of the company’s total liabilities.

Has Duc Sold 25 Million HAG Shares to His Son?

“Doan Nguyen Duc, commonly known as ‘Bầu Đức’, has set his sights on offloading 25 million shares, while his son, Doan Hoang Nam, has registered to purchase 27 million HAG shares. This intriguing move has sparked interest among investors, who are now keenly observing the father-son duo’s strategies and their potential impact on the market.”

What is the Extent of Duc Bau’s Daughter’s Ownership in HAG Shares?

“Ms. Doan Hoang Anh, daughter of Doan Nguyen Duc (Bầu Đức), Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (HAGL), has just announced the completion of the purchase of 2 million HAG shares.”

The Empire of ‘Bau Duc’: Is the Company’s Future in Jeopardy?

The company, Hoang Anh Gia Lai Joint Stock Company, chaired by Mr. Doan Nguyen Duc (commonly known as Chairman Duc), has incurred a cumulative loss of over VND 957 billion. With its current liabilities exceeding current assets, the auditors have expressed a ‘significant doubt’ about the company’s ability to continue as a going concern.