BVBank Savings Interest Rates

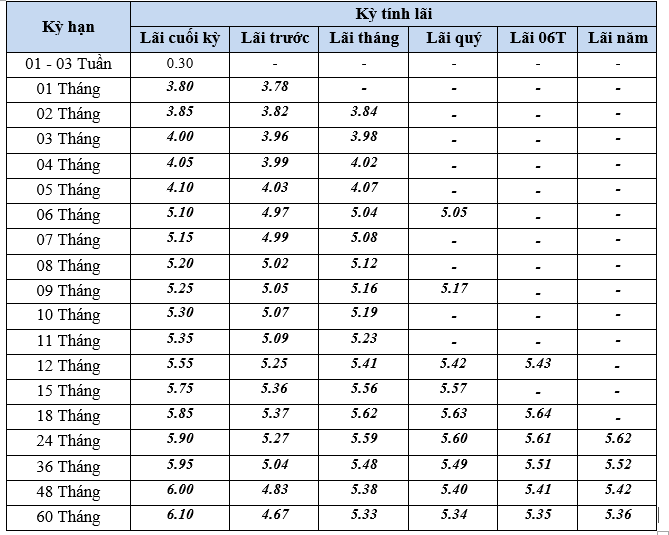

During August 2025, BVBank is offering competitive interest rates on savings accounts for individual customers, with rates ranging from 0.3% to 6.1% per annum for deposits made at the counter and with interest payable at maturity.

For the month of August, the interest rate for deposits of less than one month is set at 0.3% per annum, while deposits with a tenure of one to less than two months will earn an interest rate of 3.8% per annum. The bank is offering an interest rate of 3.85% per annum for deposits of two to less than three months, 4.0% per annum for three to less than four months, 5.1% per annum for six months, and 5.25% per annum for nine months.

BVBank’s interest rates for longer-term deposits are as follows: 12-18 months (5.55% to 5.85% per annum), and 24-48 months (5.90% to 6.0% per annum). The highest interest rate offered by the bank is 6.10% per annum for a 60-month tenure.

In addition to the standard option of receiving interest at maturity, BVBank also provides flexible interest payment options, including quarterly interest payments (5.05% to 5.35% per annum), monthly interest payments (3.84% to 5.33% per annum), and advance interest payments (3.78% to 4.67% per annum).

BVBank Counter Deposit Interest Rates

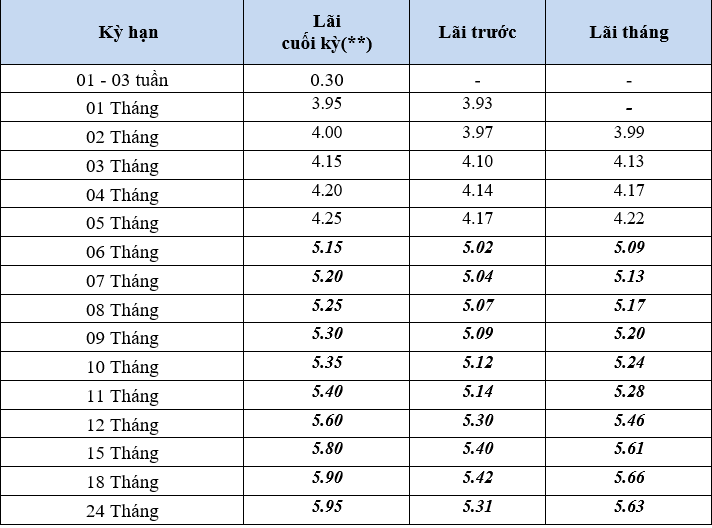

Online Deposit Interest Rates

BVBank is currently offering promotional interest rates for online savings accounts, with bonus points of up to 150,000 points, equivalent to VND 150,000. Additionally, customers who open group accounts will enjoy an additional interest rate of up to 0.4%.

The interest rates for online deposits with interest payable at maturity range from 0.3% to 5.95% per annum, which is slightly higher than the rates offered for counter deposits. Specifically, the interest rate for online deposits of less than one month is set at 0.3% per annum, while deposits with a tenure of one month will earn an interest rate of 3.95% per annum. BVBank is offering an interest rate of 4.0% per annum for two-month deposits, 4.15% to 4.25% per annum for three to five-month deposits, and 5.15% to 5.40% per annum for six to eleven-month deposits.

The interest rates for longer-term online deposits are as follows: 12 months (5.6% per annum), 15 months (5.8% per annum), 18 months (5.9% per annum), and the highest interest rate of 5.95% per annum for 24-month deposits.

It’s important to note that these interest rates are subject to change and may vary based on market conditions. Customers are advised to contact their nearest BVBank branch for the most up-to-date information.

Term Deposit Certificates with Interest Rates up to 6.25% per annum

In addition to competitive interest rates on regular savings accounts, BVBank also offers term deposit certificates with higher interest rates for those who are able to keep their funds in the account for longer periods, such as six months or a year.

With a minimum deposit of just VND 10 million, customers can enjoy flexible tenure options and choose to receive interest monthly or at maturity. The term deposit certificates offer both convenience and attractive returns, with interest rates of up to 6.25% per annum for an 18-month tenure (interest payable at maturity) and 6.1% for a 15-month tenure (interest payable at maturity). These certificates are a safe and secure investment option, backed by legal regulations, and can be transferred or redeemed before maturity if needed. They can also be used as collateral for loans at BVBank, providing customers with added flexibility.

The key advantages of BVBank’s term deposit certificates are the convenience of online transactions, the flexibility of transferability, and the attractive interest rates for various tenures.

BVBank Lending Interest Rates

BVBank has recently announced its average lending interest rate for new loans disbursed in July 2025. The average lending interest rate was 8.82% per annum, with a spread of 3.35% between the average lending and deposit interest rates.

Notably, BVBank has introduced special lending packages for specific customer segments, such as offering interest rates as low as 0.58% per month for loans to purchase electric vehicles and solar energy systems. The bank is also supporting students with flexible loan options and interest rates starting at 7% per annum for the upcoming school season. In addition, BVBank provides preferential lending rates for business production activities, with flexible repayment policies and high loan limits, making it easier for businesses to access capital.

The bank also regularly offers promotional lending rates for home purchases, with interest rates as low as 5.59% per annum.

The Art of Monetary Policy: Navigating Interest Rates and Exchange Rates with Agile Governance.

The government has requested that the State Bank of Vietnam proactively undertake research, evaluation, and forecasting within the scope of its functions, tasks, and authority. This includes developing monetary policy scenarios and orientations from now until the end of 2025 and for 2026. A report is to be submitted to the Government’s Standing Committee for consideration and feedback no later than August 20, 2025.

The Prime Minister Directs the State Bank of Vietnam to Enhance Credit Management Solutions for 2024

Prime Minister requests SBV to focus on more drastically and effectively performing the tasks and solutions on directing interest rates, exchange rates, credit growth, open market operations, money supply, and reducing the lending interest rate floor to provide the economy with capital at a reasonable cost.