Vietnam’s stock investors experienced a surprising trading session on August 13th. The VN-Index initially plunged, losing over 20 points and dipping to 1,585. However, a surge in bottom-fishing demand towards the end of the session pushed the index back into positive territory. It closed at a peak of 1,611.6, a slight gain of 3.38 points. Turnover was high, with a matching value of over 55.3 trillion VND on the HoSE.

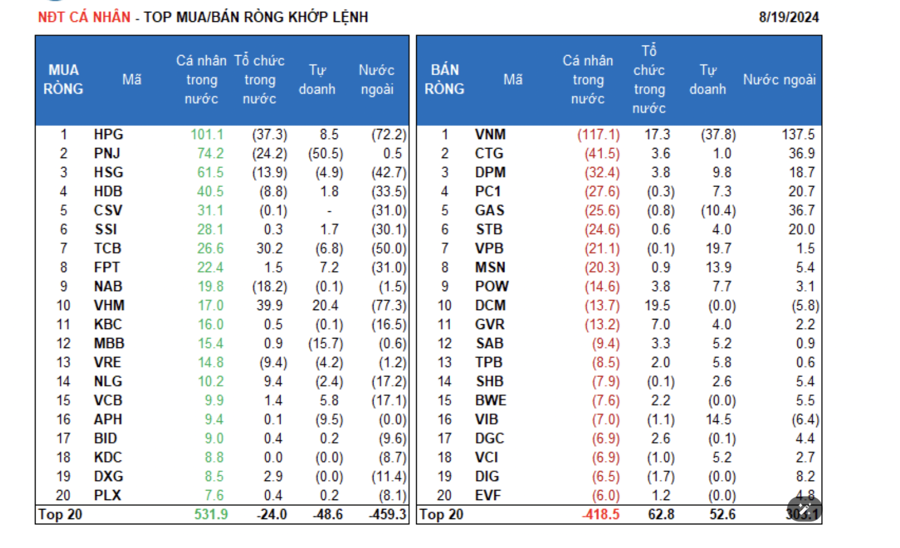

In terms of foreign investment, foreign investors continued their net selling trend, offloading a substantial 1,551 billion VND across the market, focusing on a range of Bluechip stocks.

Foreign Investors’ Net Selling on HoSE Exceeds 1,479 Billion VND

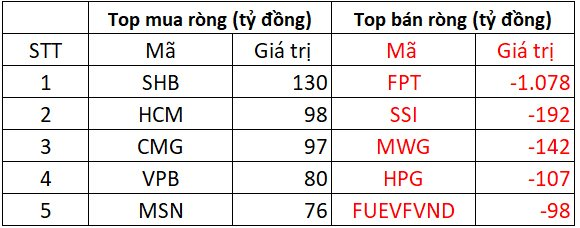

On the buying side, SHB, a bank stock, witnessed the largest net buying by foreign investors, with a net purchase value of 130 billion VND. HCM, CMG, VPB, and MSN also attracted notable net buying, ranging from 76 to 98 billion VND.

Conversely, FPT experienced a dramatic shift, becoming the most net-sold stock with a net sell-off of 1,078 billion VND. MWG, SSI, and HPG followed suit, with net selling values of 192 billion, 142 billion, and 107 billion VND, respectively. Additionally, foreign investors divested from FUEVFVND, an ETF, worth 98 billion VND.

Foreign Investors’ Net Selling on HNX Reaches Approximately 31 Billion VND

On the HNX, SHS emerged as the top net bought stock, attracting 63 billion VND in net purchases, followed by MBS with 44 billion VND. IDC, TIG, and PVI also witnessed net buying in the range of 3 to 12 billion VND.

Conversely, CEO experienced a net sell-off of 93 billion VND, while PVS witnessed net selling of around 49 billion VND. LAS, NVB, and VTZ faced net selling in the range of 3 to 5 billion VND.

Foreign Investors’ Net Selling on UPCOM Reaches 41 Billion VND

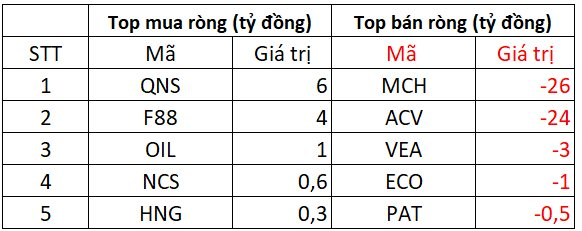

On the UPCOM, QNS and F88 were the top net bought stocks, with net purchases of 4 to 6 billion VND. OIL and NCS witnessed modest net buying, while HNG attracted net purchases of up to 1 billion VND.

In contrast, ACV and MCH faced significant net selling, with values of 24 to 26 billion VND. VEA, PAT, and ECO also experienced net selling, although to a lesser extent.

Stock Market Update: Riding the Wave or Missing Out?

Today’s session (August 13th) saw the VN-Index fluctuate around the 1,600-point mark multiple times. The intense back-and-forth movement at this strong resistance level has put investors in a tricky situation: buying now risks buying at the peak, but selling early could mean missing out on potential gains. Experts suggest that if the market undergoes a technical correction until the end of August, it would present an opportunity to enter instead of rushing to buy at higher prices.

A Rogue Bank Code: The Sudden Surge of Prop Trading in Vietnam’s Stock Market

The HoSE witnessed a notable trading session on Thursday, with foreign investors and securities companies taking center stage. While foreign investors displayed confidence in the market by snapping up stocks, securities companies offloaded a substantial amount, amounting to a net sell value of VND 621 billion. This contrasting behavior between the two key market players has left market participants intrigued, with many wondering what the future holds for Vietnam’s stock market.

“VN-Index Targets 1,800: 3 Stock Categories to Watch in H2 2025”

“Maybank Investment Bank has upgraded its forecast for the overall market profit growth in 2025 to an impressive 18.5%. This upgraded prediction signifies a positive outlook for the industry, indicating a potential surge in profitability that businesses and investors should take note of. With such a substantial increase in expected profits, it is essential for companies to strategize accordingly and capitalize on this projected growth.”

The VN-Index Rides High: What Investors Need to Know to Avoid Getting Caught in the Tide

“One of the key warning signs is the Relative Strength Index (RSI), when the RSI of the VN-Index basket exceeds the 30-40% threshold, the market has seen significant corrective waves, as witnessed in 2020, 2022, and most recently in 2023 and 2024,” the expert pointed out.