VN-Index Surges to New Historic Highs as Banking and Securities Sectors Shine

In a surprising turn of events, the VN-Index witnessed a gap increase at the start of the session on August 14th, buoyed by a consensus among banks and securities firms. The index maintained its positive momentum throughout the day, closing at a new historic peak. The session’s trading value on HoSE reached an impressive 50.6 trillion VND.

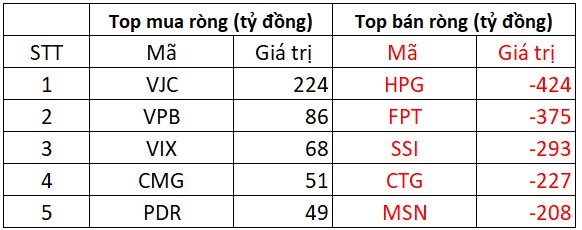

However, foreign transactions painted a contrasting picture, with a sudden and significant net sell-off of 2.409 trillion VND. Here’s a breakdown of the foreign trading activities:

HoSE witnessed a massive net sell-off of over 2.366 trillion VND by foreign investors

On the buying side, VJC airline stocks topped the market with a net buy value of 224 trillion VND. Following closely were VPB, VIX, CMG, and PDR stocks, with net buys ranging from 49 to 86 trillion VND.

Conversely, HPG stocks experienced a dramatic net sell-off of 424 trillion VND, while FPT stocks witnessed a substantial dump of 375 trillion VND. SSI, CTG, and MSN stocks also faced significant net selling, with values of 293 trillion, 227 trillion, and 208 trillion VND, respectively.

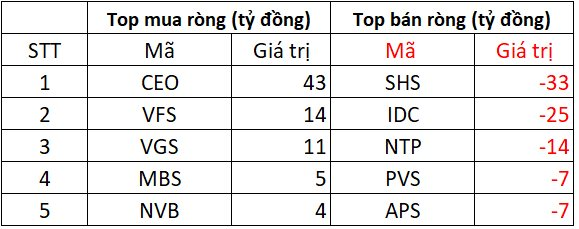

Foreign investors net sold approximately 23 trillion VND on the HNX

CEO stocks led the HNX in net buying, with an impressive 43 trillion VND. VFS and VGS stocks also witnessed robust net buying, ranging from 11 to 14 trillion VND. MBS and NVB stocks attracted net buying of around 4 to 5 trillion VND each.

On the selling side, SHS stocks experienced a net sell-off of 33 trillion VND, while IDC and NTP stocks were dumped to the tune of 25 trillion and 14 trillion VND, respectively. PVS and APS stocks also faced net selling of around 7 trillion VND each.

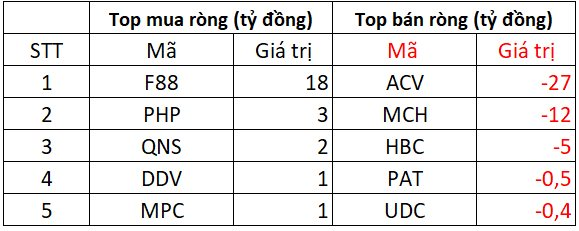

Foreign investors net sold 19 trillion VND on UPCOM

F88 stocks led the net buying on UPCOM, with a substantial 18 trillion VND. PHP, QNS, DDV, and MPC stocks also witnessed net buying in the range of a few trillion VND.

In contrast, ACV and MCH stocks experienced heavy net selling, with values of 12 and 27 trillion VND, respectively. HBC, PAT, and UDC stocks also faced net selling, although to a lesser extent.

Market Beat: Profit-Taking Pressure Mounts, VN-Index Retreats

The selling pressure intensified, causing key indices to plunge into the red at the end of the morning session. By the mid-session break, the VN-Index hovered near the reference level, settling at 1,639.45 points; while the HNX-Index posted a 0.93% loss, landing at 282.49 points. The decline intensified, with 540 declining stocks outweighing 207 advancing ones.