PV: According to the Private 100 2025 rankings, which includes the top private enterprises with the largest budget contributions in Vietnam as published by CafeF, the top 30 private enterprises are mostly real estate, banking, and securities companies, with a few in the retail, consumer goods, and technology sectors. Among them, there are up to 10 private banks on the list. What are your thoughts on this picture?

Dr. Le Xuan Nghia: The economic activities of the private sector in Vietnam have only developed strongly in certain fields, with banking and real estate being the most prominent. There are also some industrial enterprises such as mechanical engineering, but their number is not significant, and most are still young and have not yet gained real strength in the market.

In Vietnam, the establishment of a true industrial conglomerate is almost solely attempted by Vingroup.

The rest are mostly state-owned enterprises. For example, corporations in the oil and gas, coal, and electricity sectors have very large assets, comparable to those of large joint-stock commercial banks.

If we talk about exports, the focus is mainly on textiles, plastics, wood products, and structural steel, which are industries that bring significant export value. However, most of these items tend to be on a downward trend.

As for the “impressive” figures such as Vietnam being a top exporter of electronic components and computers, these actually come from the FDI sector, not domestic enterprises.

The scale of domestic private enterprises also includes some large units, but most of them are concentrated in banking and real estate.

And in reality, it is natural for banks to occupy a large part of the economy, and many other countries are no exception. In the West, financial development is the pinnacle of the value chain. It creates an ecosystem that includes consumers, producers, the financial system, and accompanying technology. There are banks that play a very significant role, even reflecting the strength of a nation.

In most developed countries and those with middle incomes or higher, there is a strong banking system. The total assets of the banking system are usually 1.6 times to over 2 times the GDP, and in the case of Switzerland, the total assets of its banks are up to 4.7 times its GDP, making it the country with the highest per capita national income in the world. Thailand’s total bank assets are 1.8 times its GDP, while in Vietnam, this ratio is about 1.6 times, with private bank assets accounting for over 45%. A strong nation must have a strong and efficient banking system.

Many people have a rather negative view of the fact that the real estate and banking sectors are the two strongest industries. What do you think about this?

In Vietnam, the banking system operates mostly in the fields of real estate, industry, agriculture, and consumer finance.

Similarly, in developed countries, the proportion of real estate and consumer loans is also very high, much higher than that of production and business loans. They have developed to the point where manufacturing enterprises hardly need long-term loans from banks anymore. They mainly use their own capital and, if needed, raise capital through the stock market, with banks primarily providing working capital.

Consumer loans in these countries include home loans, car loans, and education loans. Meanwhile, direct loans for production and business account for only about 8% to 10% in Europe and slightly higher in other developed countries.

Why are there so many real estate loans? Ultimately, real estate is the largest asset market, where people accumulate their wealth. Many people tend to view the real estate market from a negative perspective, but in reality, this is the largest asset market in the economy.

For example, if we look at the capitalization of the stock market, assuming it is about 70% of GDP, then the capitalization of the real estate market is several times that of GDP. Most people invest their money in housing. When it comes to household assets, the majority lies in housing and other real estate. In simple terms, most people’s real assets consist of their homes, with some savings on the side.

If we look at the global picture, the world’s GDP is about $120 trillion. Meanwhile, the total capitalization of the global real estate market is about 3 times that, at over $350 trillion. In China, GDP is about $19 trillion, but the capitalization of its real estate market is about $57 trillion. This shows that it is not surprising if bank credit is largely focused on real estate because this is the largest market.

In a person’s life, when it comes to eating, living, transportation, and education, the “living” aspect, meaning housing and real estate, always accounts for the largest proportion of their assets. This is not only the asset of each individual but also the asset of the community and the nation. We need to re-examine our perception of real estate to get a clearer understanding.

Currently, the reality is that Vietnam’s private enterprises are mainly focused on banking and real estate, which is in line with the natural order of things. This is the initial accumulation process for the development of industry and services.

How will this transition take place specifically?

If we look at VinGroup’s calculations, this becomes clear. We cannot rely on the banking system to enter the industrial sector because the loans are small, the terms are short, and the interest rates are high. To make this work, VinGroup has to use real estate to accumulate capital. And to engage in modern industry, at least two major things must be done.

The first is to build a high-quality human resource base and attract talent from both inside and outside the country.

The second is to have the capital to invest in research and development and put it into application. But where will this capital come from? It is almost impossible to mobilize such a large loan domestically. It is difficult to find a bank willing to lend half a billion dollars, let alone a billion dollars, and even more so for a long-term loan of 15 to 20 years.

Moreover, it should be noted that industry is a field where one could be in the red for the first 5 to 7 years. VinFast, for example, is still in the startup phase and is expected to break even by 2030. This is a very challenging path for any industrial enterprise.

In South Korea, the initial accumulation also came from real estate and finance. In China, they developed state-owned banks into giant financial institutions, from which they began to strongly develop industry and technology.

In reality, the industrialization process in many Southeast Asian countries is facing significant obstacles, if not outright failure, compared to Northeast Asian countries. One of the important reasons for this is that industrial projects, such as automobile manufacturing, machinery, and shipbuilding, require huge amounts of capital, long investment periods, and, most importantly, low-interest rates to ensure feasibility.

To achieve this, there must be large-scale banks that are willing to provide long-term loans. Industrialization cannot be achieved with only short-term loans of a few thousand billion or a few tens of thousand billion dong. Industrial investment takes at least 4 to 5 years to start operations, so short-term loans are of no help.

Another important issue is interest rates. To withstand the pressure of interest rates, they must be kept at a low level. This can only be achieved if there are only 5 to 10 large banks, without excessive competition. However, Vietnam currently has more than 27 banks, and the competition for deposit interest rates is very intense, while labor productivity is low, averaging only a quarter of that of banks worldwide.

So, why are our interest rates so high?

It is because the banks are competing with each other. To attract more deposits, they have to offer higher interest rates. Even some “small” banks are joining the race, offering high deposit rates. As a result, people rush to deposit their money where the interest rates are highest, forcing the larger banks to also increase their rates, thus pushing up the overall market rates. With such high-interest rates, it is challenging to engage in industry or science and technology. Only speculation and real estate can withstand these rates.

Currently, we have 27 domestic banks, not including 9 wholly foreign-owned banks. Foreign banks mobilize very little capital in Vietnam due to the high-interest rates, and they mainly use local capital.

As for domestic banks, due to the competition in a small market, they are willing to push up deposit interest rates to attract funds. Even large state-owned banks, despite wanting to maintain stability, cannot stand idly by. If they don’t increase their rates, customers will immediately withdraw their money and transfer it to banks offering higher rates. In the end, they are forced to “inch up a little,” even if it is not their intention to engage in this rate race. This is the very real vortex of the market.

There are three ways to lower lending rates.

The first is to increase the money supply, that is, to inject more money into the economy. But if we do this, the risk of inflation will be significant, and it is currently difficult to control.

The second, more decisive, way is to restructure the entire banking system. That is to reduce the number of banks to about 10 large banks. But doing this now is almost impossible because each bank has already formed its own ecosystem.

The third way is to strictly control the minimum capital adequacy ratio (CAR) and apply a strict deposit insurance mechanism, not insuring 100% of deposits as is currently the case in Vietnam. On this basis, banks must be transparent, reduce costs, improve labor productivity, and accelerate the digitization of the banking sector.

The credit balance of the entire Vietnamese economy is currently about 140% of GDP. Some people believe that this is a risky level. However, we are in the process of removing the mechanism of controlling credit growth by setting limits. What are your thoughts on this?

Actually, removing the credit limit in Vietnam is not a new concept. We have done this before for a period of time. Nowadays, almost no country in the world applies this measure.

Because the credit ceiling is just an administrative measure. Even with the limit in place, credit still increases rapidly because we have repeatedly relaxed the limit, leading to inflation.

Many experts have suggested for decades that we should remove the credit limit and instead manage it with more effective tools. For example, managing it through the minimum capital adequacy ratios (CAR) according to the Basel standards: Basel I, Basel II, and currently, Basel III, with Basel IV and Basel V on the horizon. If a bank wants to increase its mobilization, it must increase its own capital. Only when a bank has increased its mobilization can it lend more.

At that time, if a bank wants to mobilize more capital, it must have sufficient equity and strong financial capacity. And when it has mobilized 10 units of capital, it can only lend a maximum of 8 units or 8.5 units, depending on the ratio prescribed by the State Bank of Vietnam.

These ratios and other safety indicators that the State Bank of Vietnam has promulgated for a long time are sufficient to keep all commercial banks under control because these numbers are entirely within the purview of the State Bank’s supervision.

Moreover, supervision has been greatly digitized. An abnormal loan at any bank can immediately appear on the State Bank’s monitoring screen.

The second issue is not about technical supervision but about making banks compete on a level playing field. We should not allow a situation where people flock to banks offering high-interest rates regardless of the financial strength of those institutions.

A small bank with thin equity offering high-interest rates on deposits is actually very dangerous. We cannot let the market blindly chase interest rates like this.

Therefore, people need to be guided to choose banks based not only on interest rates but also on financial strength, safety of capital, and other factors. They should look for large banks with strong equity and high safety ratios.

This is where the importance of Vietnam’s deposit insurance fund comes into play. In theory, the law already has quite strict regulations, but in reality, this fund mainly operates with people’s credit funds, not yet intervening in deposit insurance for commercial banks.

As a result, many people still implicitly understand that the state guarantees 100% of deposits, regardless of which bank they are in. This creates a sense of subjectivity, and people will deposit their money wherever the interest rates are high, without considering the risks. If the deposit insurance law were strictly applied, each person would only be insured up to a certain maximum amount, such as VND 200 million per person per bank.

Doing this would gradually shift people’s money to larger, safer banks. And it is these large banks that will be the driving force to lower overall market interest rates.

Currently, many small banks push up interest rates to attract customers, ultimately pushing up the overall system’s interest rates. With such high-interest rates, it is impossible to engage in industry or science and technology. Only speculation and real estate can withstand these rates.

Credit management still depends heavily on ceilings, quotas, and commands rather than market tools. Therefore, removing the credit limit is necessary. However, to do this, we need to change our mindset, value market principles, and not intervene in the market. Based on this, we need to modernize the entire banking system and monetary control tools.

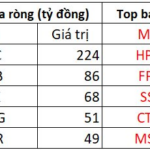

In recent years, some private banks have achieved impressive growth rates. Currently, there are 2 private banks, Techcombank and VPBank, with total assets of over VND 1 quadrillion. Besides their budget contributions, what is your assessment of the role and other contributions of the private banking sector to the development of the banking system?

First of all, private banks are the main force serving small and medium-sized enterprises, household economies, and individual economies. They are the pioneers in promoting small loans of tens of millions to hundreds of millions of VND, which the large banks were not interested in due to insufficient human resources to process or a perception that it was not worth the effort.

As a result, a large segment of the market, including small and medium-sized enterprises, micro-enterprises, and individual consumers, is being served by private banks.

Secondly, in the field of consumer loans, home loans, car loans, and personal consumption loans, private banks such as VPBank have developed strongly, and many other banks, such as TPBank and HDBank, have followed suit.

Thanks to digital transformation and data accumulation, private banks have been able to leverage AI to assess credit risk and focus on developing small-scale personal loan products in a more systematic way.

Of course, we must also acknowledge that many small private banks are currently operating within a “closed” ecosystem, channeling capital into related companies or real estate. There are loans in the name of production enterprises, but the money is then cycled into real estate investments. This poses challenges for supervision and policy regulation.

However, when the credit limit is removed but managed through safety ratios, small banks will no longer be able to “increase their virtual capital however they want” or “mobilize as much as they want.”.

Complying with safety ratios will force small banks to focus on their segments, such as household economies, consumer loans, small and medium-sized

Unleashing Digital Assets: MB and Korean Partners Gear Up for Vietnam’s First-Ever Platform

“As per the agreement, Dunamu steps in as a pivotal strategic partner for MB. This partnership entails sharing cutting-edge technology and robust infrastructure, along with expert consultation on legal compliance, investor protection, and talent development. With Dunamu’s expertise, MB is poised to elevate its operations and fortify its position in the market.”

The Rise of the First Domestic Digital Asset Exchange in Vietnam: Enter the ‘Big Boss’ – A South Korean Powerhouse Managing $80 Billion, Backed by the Company Behind the Sensational BTS

Dunamu, the powerhouse behind South Korea’s leading cryptocurrency exchange, Upbit, is a force to be reckoned with in the world of digital assets. As the operator of the country’s largest centralized crypto exchange, which ranks third globally, Dunamu boasts an impressive 80% market share in South Korea.

“Vietnam’s FPT and HCM Codes: Unexpected Inclusion in MSCI’s Largest Frontier Index”

As of July 31st, Vietnam maintained its position as the country with the highest weight in the MSCI Frontier Market Index, accounting for a significant 26.11% of the index’s composition.