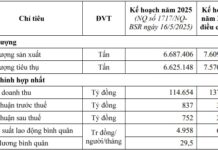

The challenging situation continued in Q2

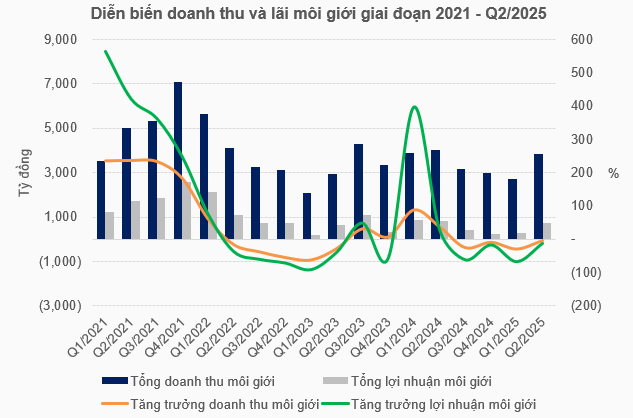

According to VietstockFinance, in Q2/2025, the total securities brokerage revenue was approximately VND 3,843 billion, down 5% over the same period last year. Accumulated in the first half of this year, the total brokerage revenue reached more than VND 6,561 billion, down 17% compared to the first half of 2024. After deducting operating expenses, gross profit in the brokerage segment was VND 719 billion in Q2, down 13%, and more than VND 997 billion in the first half, down 41%.

This result goes against the general business trend of the industry. Specifically, the industry’s net revenue grew by 25%, to nearly VND 25,886 billion in Q2 and increased by 15%, to more than VND 45,333 billion in the first half. Gross profit in Q2 increased by 29%, to over VND 15,510 billion, and in the first half, it increased by 17%, to over VND 27,695 billion.

Source: VietstockFinance

|

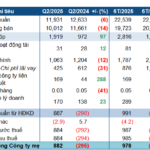

Looking at the group of leading companies in terms of brokerage revenue scale in Q2/2025, VPS took the lead with nearly VND 748 billion, followed by SSI with nearly VND 484 billion and HSC with nearly VND 232 billion. However, all three companies experienced a decline in brokerage revenue compared to the same period last year, at 16%, 14%, and 8%, respectively.

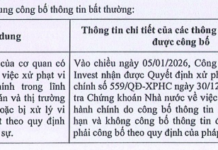

For VPS, the decline in brokerage revenue reflects the downward trend in market share in the recent period. In Q2/2025, the company recorded a market share of 15.37% on HOSE, 18.82% on HNX, 16.57% on UPCoM, and 46.39% on the derivatives market, all of which decreased compared to the previous quarter and the same period last year.

Nevertheless, thanks to the growth in other key segments such as lending, proprietary trading, and reduced losses in financial activities, the leading market share company recorded a net profit of over VND 702 billion, up 35% over the same period. The scenario of other business segments “carrying” the brokerage segment is also happening in many securities companies.

|

VPS’s brokerage market share continues to decline

Source: VietstockFinance

|

Key segments operate effectively, VPS reports a 35% increase in Q2 net profit

In terms of brokerage gross profit, the securities industry recorded 40 profitable companies. SSI led with nearly VND 132 billion, down 35% over the same period last year. In second place, TCBS brought in nearly VND 125 billion, up 57%, thanks to a significant increase in revenue while slightly reducing expenses. TCBS has long been known for its “no brokerage” model, thus saving a large amount of labor costs.

Source: VietstockFinance

|

On the opposite side, the industry also had 38 businesses with expenses exceeding revenue. Shinhan Securities Vietnam (SSV) was the company with the heaviest loss, at more than VND 22 billion, followed by KAFI Securities with a loss of nearly VND 17 billion.

In terms of growth rate, the industry had 13 cases of gross profit growth in brokerage, with UP Securities (UPSC) leading with a Q2 brokerage gross profit of 12 times higher than the same period, reaching over VND 2.4 billion. In the leading group, there was another notable name, Mirae Asset Vietnam Securities, with a profit of over VND 19 billion, 2.8 times higher, and Tien Phong Securities (TPS) with a profit of over VND 2.3 billion, 2.6 times higher.

The industry also recorded 8 cases of turning from loss to profit, including: Petroleum Securities (PSI), Bao Viet Securities (BVSC), SmartInvest Securities (Smartsc), SmartMind Securities (SMDS), ASAM Securities, Vietnam Construction Securities (CSI), Eurocapital Securities (ECC), and Hai Phong Securities (HAC).

On the contrary, there were 19 businesses with declining profits. The most significant decrease was Asean Securities (Aseansc), which fell by 91%, to nearly VND 128 billion; FPT Securities decreased by 71%, to over VND 8 billion; and Bao Minh Securities decreased by 66%, to over VND 2 billion.

The industry also recorded 7 cases of turning profit into loss, including: KAFI Securities, APG Securities, VPBank Securities (VPBankS), AIS Securities, Navibank Securities (NVS), Thanh Cong Securities (TCSC), and Vietnam Financial Investment Securities (VICS).

Heading towards a big win in Q3

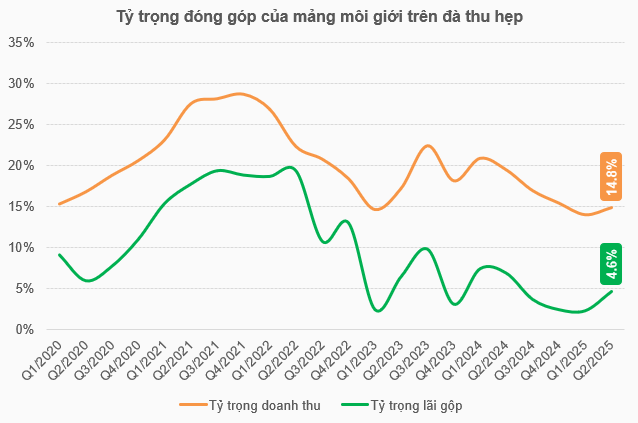

Not only lagging in growth rate, but the contribution ratio of the brokerage segment to total revenue also narrowed, from 19.5% in Q2/2024 to 14.8% in Q2/2025. Similarly, the gross profit ratio also decreased from 6.9% to 4.6%.

Currently, the revenue structure of a securities company is diversified, with the most common being the “three-legged” model, including brokerage, margin, and proprietary trading. In recent years, the brokerage segment seems to be losing its importance.

Source: VietstockFinance

|

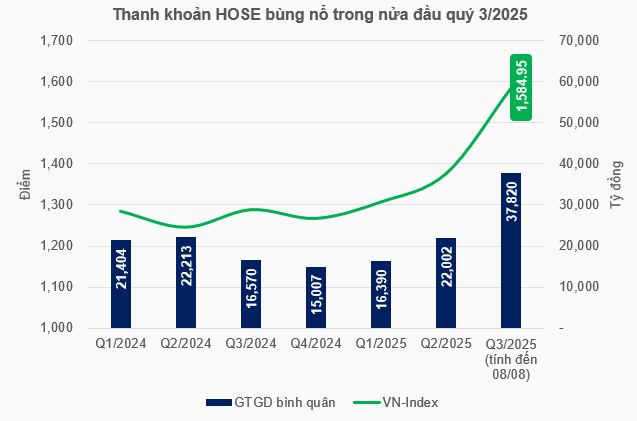

Looking at historical data, market liquidity in the last quarter was not much different from the same period last year. On HOSE, the average trading value reached VND 22,002 billion/session in Q2/2025, slightly lower than the figure of VND 22,213 billion/session in Q2/2024.

However, revenue and profit in the brokerage segment decreased much more than liquidity. It is not difficult to see that the wave of reduced/free trading fees, also known as “zero fee”, is pushing securities companies into fierce competition for market share.

Facing this context, different approaches started to emerge. FPTS oriented its consulting services independently from the transaction fees of customers as other companies do, but instead would charge consulting fees. According to Mr. Nguyen Van Dung, Chairman of the Board of Directors, this roadmap has been implemented by the company for several years, and by 2025, it has basically been completed. Consulting specialists no longer receive commissions based on customer transactions but charge fees directly according to the consulting registration model.

Mr. Dung, Chairman of FPTS, also stated that the “zero fee” trend has narrowed the traditional revenue model from transaction fees.

Despite the challenges, the brokerage segment may soon welcome a “passing shower” that will end the “drought,” as market liquidity is currently booming. Just in the first half of Q3, up to August 08, the average trading value on HOSE soared to VND 37,820 billion/session, along with a series of new historical point number records.

Notably, the market marked a trading session of over VND 80,000 billion on July 29 (across all three exchanges). Just one week later, liquidity once again exploded to nearly VND 85.8 trillion in the session on August 05.

Vietnamese stocks only took 1 week to break the liquidity record of VND 80,000 billion

The high market liquidity reflected the dynamic participation of both domestic and foreign investors. At the same time, this also indicated that the market breadth has expanded significantly compared to the past.

Source: VietstockFinance

|

According to Mr. Dao Hong Duong, Director of Industry and Stock Analysis of VPBankS, the gross profit margin in brokerage tends to recover with liquidity, so it will be more positive in Q3. With the booming market and liquidity, the prospects for securities companies will continue to be positive.

Clearly, companies with large market share and able to maintain their “front” in fee collection will directly benefit from the return of billion-dollar trading sessions, not to mention the story of upgrading and new products being deployed.

– 12:00 15/08/2025

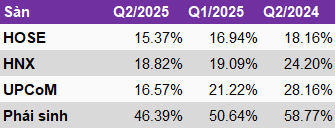

The Attention-Grabbing Move of the Company Associated with Duc Hoang Anh

“The thriving Hung Thinh Loi Gia Lai Company, with a majority stake held by Hoang Anh Gia Lai Joint Stock Company, has just launched an enticing investment opportunity. The company has issued 10,000 bonds, coded HTL12501, offering a fixed interest rate of 10.5% per annum. These bonds have a maturity date of August 8, 2028, presenting a stable and attractive investment prospect for discerning investors.”

Market Beat: Afternoon Session Perseveres, VN-Index Reaches New Heights

The VN-Index defied the challenging morning session and staged a remarkable comeback in the afternoon, surging to a new record high of 1,608 points at the closing bell.

“Former “King of Shrimp Fry” in Vietnam Reports Unexpected Losses in the First Half of 2025 Despite Previous Annual Profits of Hundreds of Billions”

“King of Shrimp Fry” is an apt title for Viet Uc, as they dominate the market with over 30% of the country’s market share. Their success story is a testament to their expertise and leadership in the industry, solidifying their number one spot in Vietnam.