Liquidity in the market increased compared to the previous session, with the VN-Index matching volume reaching over 2.01 billion shares, equivalent to a value of more than 57.4 trillion VND; HNX-Index reached over 199 million shares, equivalent to a value of more than 4.5 trillion VND.

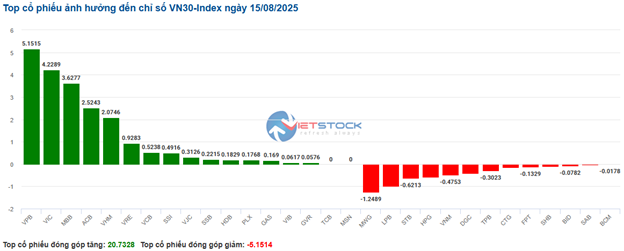

VN-Index opened the afternoon session on a less favorable note as sellers maintained their dominant position, causing the index to fluctuate below the reference level and gradually plunge towards the end of the session. In terms of impact, BID, VCB, CTG, and TCB were the most negative influences on the VN-Index, with a loss of over 6.4 points. On the other hand, VJC, BSR, MBB, and VIX remained in the green and contributed over 4.3 points to the overall index.

| Top 10 stocks with the highest impact on the VN-Index on August 15, 2025 |

Similarly, the HNX-Index also witnessed a rather pessimistic performance, with negative influences from stocks such as HUT (-4.88%), CEO (-4.71%), KSF (-2.2%), and KSV (-1.25%)…

|

Source: VietstockFinance

|

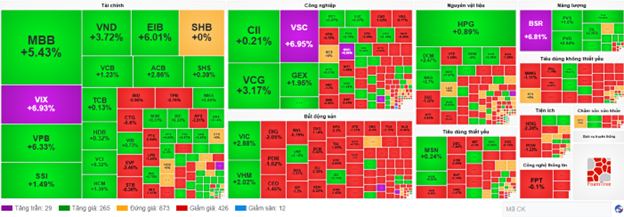

At the close, the media and communications sector was the worst-performing group in the market, falling 2.45%, mainly due to losses in VGI (-2.35%), FOX (-3.46%), VNZ (-0.3%), and CTG (-1.5%). This was followed by the information technology and materials sectors, which declined by 2.4% and 1.29%, respectively. On the other hand, the energy sector was the only group to remain in positive territory, rising by 2.68%, driven by gains in BSR (+6.81%), PLX (+1.58%), COM (+6.89%), and VTV (+0.85%).

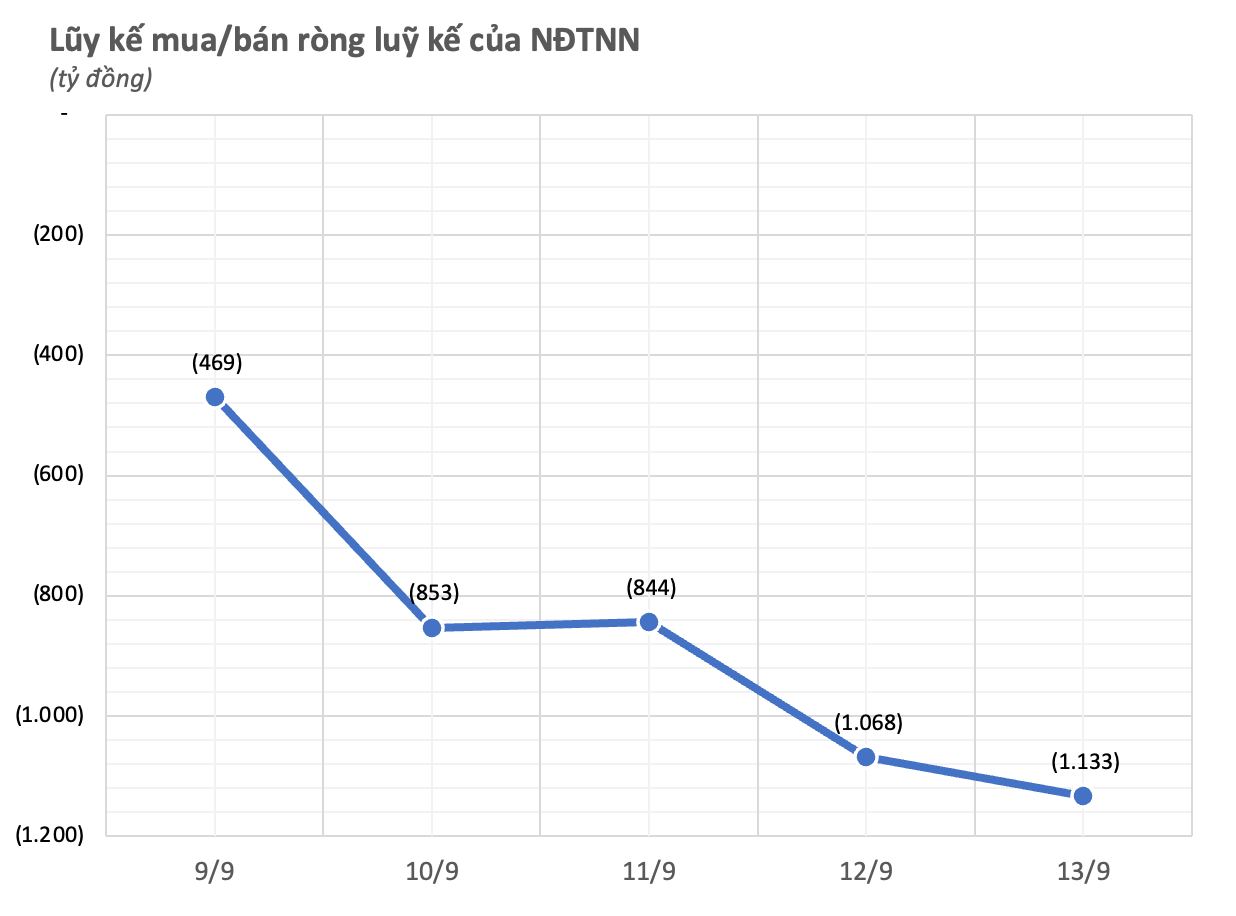

In terms of foreign trading activities, foreign investors continued to be net sellers on the HOSE exchange, offloading stocks such as HPG (700.13 trillion VND), FPT (507.68 trillion VND), MBB (493.93 trillion VND), and VPB (279.95 trillion VND). On the HNX exchange, foreign investors net sold over 31 billion VND, focusing on IDC (60.48 billion VND), PVS (14.77 billion VND), NTP (14.22 billion VND), and SHS (8.63 billion VND).

| Foreign Trading Activities – Net Buying/Selling |

Morning Session: Profit-taking pressure intensifies, VN-Index turns red

Selling pressure increased, causing the main indices to dip into negative territory by the end of the morning session. At the midday break, the VN-Index hovered near the reference level at 1,639.45 points, while the HNX-Index fell to 282.49 points, down 0.93%. The number of declining stocks gradually increased, with 540 stocks decreasing and 207 stocks increasing.

In terms of impact on the VN-Index, BID was the most negative influence, dragging the index down by 1.3 points. On the other hand, VIC was a bright spot, contributing over 2 points to the index’s gain.

The red color returned to many sectors. Media and communications and non-essential consumer goods were the two sectors that witnessed the most significant declines, with notable stocks such as VGI (-1.49%), YEG (-3.53%), SGT (-2.63%), VNB (-1.56%), TTN (-2.2%), and MFS (-3.39%); MWG (-2.09%), PNJ (-1.59%), FRT (-2.31%), VGT (-1.53%), HHS (-4.11%), and HUT (-4.39%).

On the other hand, the energy sector temporarily led the market with a remarkable gain of 2.76%, thanks to positive contributions from stocks such as BSR (+6.15%), PLX (+1.98%), and MVB (+1.1%).

Source: VietstockFinance

|

Foreign investors continued to be net sellers, offloading stocks worth nearly 1.7 trillion VND across all three exchanges. The selling pressure was concentrated on HPG, with a net sell value of 351.26 trillion VND, far exceeding the net sell value of other stocks. On the buying side, VIX led the net buying with a value of 94.6 trillion VND.

| Top 10 stocks with the highest foreign net buying/selling in the morning session of August 15, 2025 |

10:30 am: Money flow hesitates at the 1,655-point threshold

Investors displayed hesitation as trading volume failed to improve, and the main indices fluctuated after an initial upward surge. As of 10:30 am, the VN-Index maintained a gain of nearly 16 points, hovering around 1,656 points. The HNX-Index edged slightly higher, trading around 285 points.

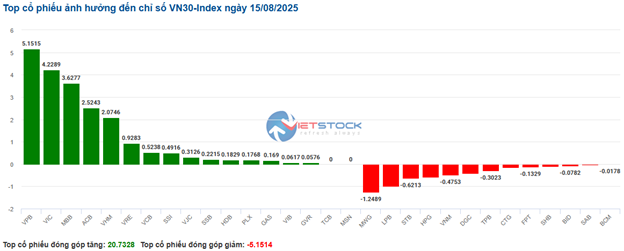

Stocks within the VN30 basket exhibited mixed performances, but buying pressure slightly outweighed selling pressure. Specifically, VPB, VIC, MBB, and ACB contributed 5.15 points, 4.22 points, 3.62 points, and 2.52 points to the index, respectively. Conversely, MWG, LPB, STB, and HPG faced strong selling pressure, deducting nearly 4 points from the VN30-Index.

Source: VietstockFinance

|

The breadth of sectors shifted towards a mixed performance, with the green color slightly dominating. The energy, real estate, and financial sectors provided strong support to the market recovery, increasing by 3.75%, 1.28%, and 1.19%, respectively.

In the energy sector, most stocks witnessed positive performances. Notably, BSR hit the upper limit, PLX rose by 3.69%, PVS climbed by 1.33%, and PVD gained 2.84%… Conversely, only a few stocks, such as VTO, TMB, MVB, and POT, faced selling pressure, but the declines were not significant.

Following the energy sector was the real estate sector, which also recorded positive performances despite some internal divergences. Buying pressure mainly focused on large-cap stocks such as VIC, which climbed by 3.21%, VHM advanced by 1.92%, VRE rose by 2.16%, and SSH inched up by 0.1%… On the other hand, most of the remaining stocks, including BCM, KDH, NVL, and PDR, remained in negative territory, declining by 0.71%, 2.08%, 0.79%, and 1.02%, respectively.

In a less optimistic development, the non-essential consumer goods sector remained in negative territory. Selling pressure mainly targeted large-cap stocks, including VPL, which fell by 0.36%, MWG dropped by 1.25%, PNJ slipped by 1.14%, and FRT decreased by 1.05%…

Compared to the beginning of the session, sellers held a more dominant position. There were 426 declining stocks and 265 advancing stocks.

Source: VietstockFinance

|

Opening: Money flow favors the financial and industrial sectors

As of 9:30 am, the VN-Index gained over 20 points, trading around 1,661 points. The HNX-Index rose by more than 2 points, hovering around 287 points.

The market witnessed a sea of green across most sectors. The banking and securities sectors continued to shine. Specifically, MBB hit the upper limit, VPB rose by 3.41%, ACB climbed by 3.82%, VCB advanced by 1.99%, MBS gained 2.95%, SSI increased by 0.54%, and VIX surged by 6.16%… Conversely, only a few stocks, such as STB, which fell by 0.36%, TPB, down by 0.76%, and VCI, decreasing by 0.32%, recorded slight declines.

The industrial sector continued to attract investors’ attention, with most leading stocks surging from the beginning of the session. Notable gainers included VCG, which rose by 4.29%, VSC hitting the upper limit, CII climbing by 1.93%, and VJC advancing by 1.91%….

On the other hand, the media and communications sector faced selling pressure. The red color prevailed among large-cap stocks, with VGI falling by 0.5%, FOX slipping by 0.83%, and YEG decreasing by 0.96%…

– 15:25 15/08/2025

Stock Market Review: Foreign Investors Ramp Up Pressure

The VN-Index’s upward trajectory stalled as it dipped in the week’s final session. This pause is a necessary adjustment, allowing the market to consolidate gains and build a stronger foundation for future growth. However, the mounting selling pressure from foreign investors is a notable concern. If this trend persists, the index may face heightened challenges in the coming periods.

“Port of Nghe Tinh Reports Increased Profits Post-Audit Thanks to Land Lease Concessions, Shares Plummet Post-Three Peak Sessions”

Following a review, the Ha Tinh Port Joint Stock Company (HNX: NAP) has upwardly adjusted its profit by 5% due to a reduction in land lease costs. This pushes the company’s first-half 2025 profit to over VND 15 billion, the highest in its history. NAP’s stock has recently undergone a significant correction after reaching a peak of VND 16,000 per share.

The Vietnam Stock Exchange is Considering Implementing Intra-Day Trading, T+0

The Vietnamese stock market is set to introduce several notable products and features in the near future. These include extended trading hours, with the potential for uninterrupted trading through the lunch break, the implementation of T+0 trading, and allowing the sale of securities “on the way home.” The necessary legal framework and systems are in place, and the market eagerly anticipates the rollout decision from the relevant authorities.