In terms of impact on the VN-Index, BID was the most negative influence, taking away 1.3 points from the index. On the other hand, VIC was a bright spot on the positive side, contributing over 2 points.

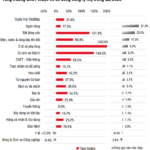

The red is returning to many sectors. Media and non-essential consumer services were the two sectors that saw the biggest declines with notable stocks such as VGI (-1.49%), YEG (-3.53%), SGT (-2.63%), VNB (-1.56%), TTN (-2.2%), and MFS (-3.39%); MWG (-2.09%), PNJ (-1.59%), FRT (-2.31%), VGT (-1.53%), HHS (-4.11%), and HUT (-4.39%).

In contrast, the energy sector temporarily led with a superior increase of 2.76% thanks to the positive contributions of stocks such as BSR (+6.15%), PLX (+1.98%), and MVB (+1.1%).

Source: VietstockFinance

|

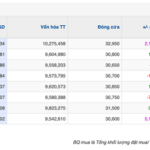

Foreign investors continued to sell off with a value of nearly VND 1.7 trillion on all three exchanges. The selling pressure was concentrated in HPG with a value of VND 351.26 billion, far exceeding the rest. Meanwhile, the top net buyer was VIX with a value of VND 94.6 billion.

| Top 10 stocks that foreign investors bought/sold the most in the morning session of August 15, 2025 |

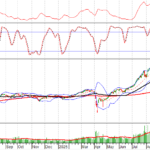

10:30 a.m.: Money flow hesitates at the 1,655-point threshold

Investors were hesitant as trading volume did not improve and the main indices fluctuated after rising at the opening. As of 10:30 a.m., the VN-Index maintained a gain of nearly 16 points, trading around 1,656 points. HNX-Index gained slightly, trading around 285 points.

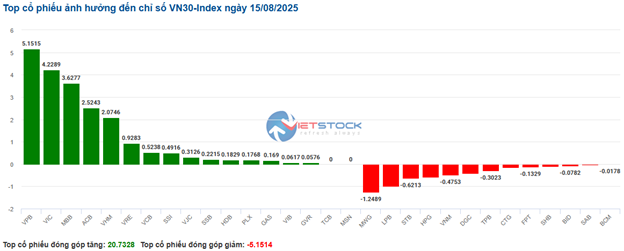

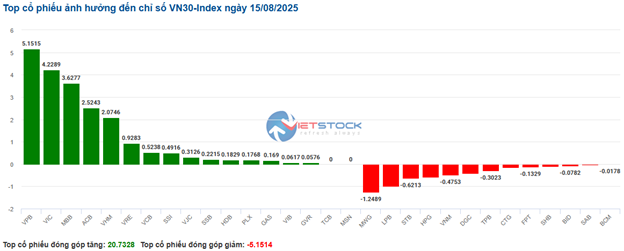

Stocks in the VN30 basket were mixed, but buying pressure was slightly stronger. Specifically, VPB, VIC, MBB, and ACB added 5.15 points, 4.22 points, 3.62 points, and 2.52 points to the overall index, respectively. In contrast, MWG, LPB, STB, and HPG faced strong selling pressure, taking away nearly 4 points from the VN30-Index.

Source: VietstockFinance

|

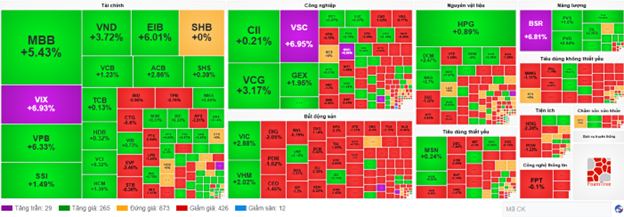

The breadth of sectors gradually shifted to a mixed performance, with the greens slightly dominating as the energy, real estate, and financial sectors provided strong support to the overall recovery, rising 3.75%, 1.28%, and 1.19%, respectively.

Energy stocks saw greens in most codes. Notably, BSR hit the ceiling price, PLX rose 3.69%, PVS added 1.33%, and PVD climbed 2.84%… In contrast, only a few stocks like VTO, TMB, MVB, and POT remained under selling pressure, but the declines were insignificant.

Following was the real estate sector, which also witnessed positive developments despite a somewhat polarized performance. Buying power was mainly focused on large-cap stocks such as VIC rising 3.21%, VHM up 1.92%, VRE gaining 2.16%, and SSH climbing 0.1%… Conversely, most other codes like BCM falling 0.71%, KDH losing 2.08%, NVL dipping 0.79%, and PDR decreasing 1.02%… remained in the red.

In another less positive development, the non-essential consumer sector remained pessimistic. Selling pressure was mainly focused on large-cap stocks such as VPL down 0.36%, MWG falling 1.25%, PNJ losing 1.14%, and FRT dipping 1.05%…

Compared to the opening, sellers had a clear advantage. There were 426 declining stocks versus 265 advancing stocks.

Source: VietstockFinance

|

Opening: Money flow favors financial and industrial groups in the early session

As of 9:30 a.m., the VN-Index rose over 20 points, trading around 1,661 points. The HNX-Index gained more than 2 points, trading around 287 points.

The market soon saw greens covering most sectors. In particular, banking and securities stocks continued to thrive. Specifically, MBB hit the ceiling price, VPB rose 3.41%, ACB climbed 3.82%, VCB added 1.99%, MBS gained 2.95%, SSI increased 0.54%, and VIX surged 6.16%… In contrast, only a few codes saw slight declines, such as STB dipping 0.36%, TPB falling 0.76%, and VCI losing 0.32%.

The industrial sector continued to attract investors’ attention, with most leading stocks in the sector surging from the opening. Notable gainers included VCG up 4.29%, VSC hitting the ceiling price, CII climbing 1.93%, and VJC rising 1.91%….

Meanwhile, the media sector continued to face selling pressure. The reds were concentrated in large-cap stocks such as VGI down 0.5%, FOX falling 0.83%, and YEG losing 0.96%…

– 12:00, August 15, 2025

Technical Analysis for August 14: Optimism Persists

The VN-Index and HNX-Index both climbed in the morning session, but the lack of significant improvement in liquidity revealed the prevailing cautious sentiment among investors.

“SCR Surges Past 10,000 VND per Share”

The trading session on August 14, 2025, witnessed a remarkable surge in the share price of SCR, breaching the 10,000 VND mark and culminating at 10,400 VND at the closing bell. This pinnacle represents a significant milestone, as it surpasses the highest level attained since September 2022, heralding a new era of potential growth and investor confidence.

The Sky’s the Limit: TAL Soars on HOSE Debut, Surpassing VND 10,000 Billion Market Cap

“Since its uplisting on August 1, Taseco Land’s stock, trading as TAL, has surged nearly 30% in just under 10 sessions on the Ho Chi Minh Stock Exchange (HOSE). This impressive performance witnessed an eightfold increase in trading volume compared to its yearly average, catapulting the company’s market capitalization to over VND 10,000 billion.”