|

Source: VietstockFinance

|

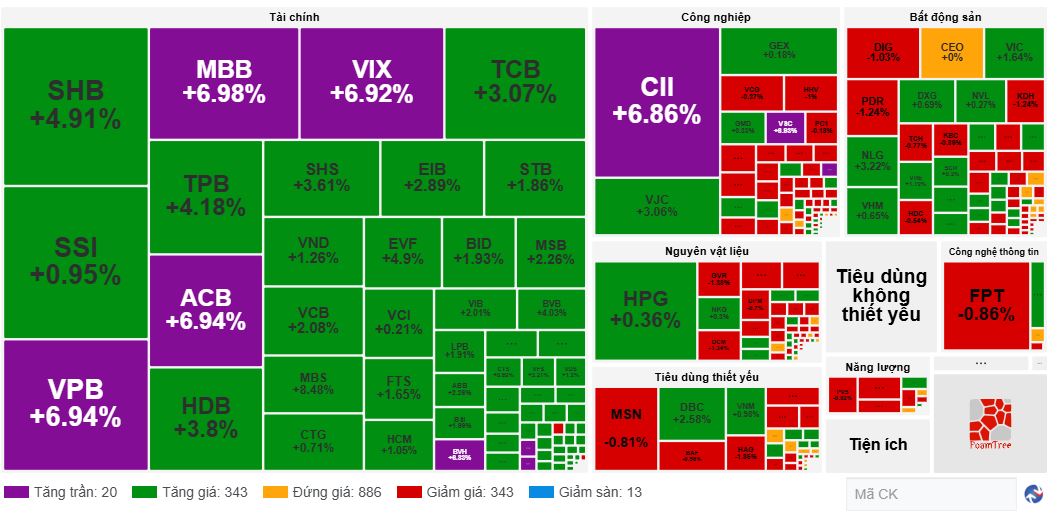

For most of today’s trading session, the financial and banking sector was the main driver of the market’s strong gains. VPB, HDB, ACB, and MBB hit their daily limit-up prices. Additionally, stocks such as SHB, VCB, MSB, STB, EVF, and TPB also witnessed significant upward momentum.

In the industrial sector, VSC and CII maintained their upward momentum from the start of the session, ending the day at their respective daily limit-up prices. VJC also witnessed a strong rally towards the end of the session, closing in the green.

The real estate sector showed signs of recovery compared to the morning session, with the number of gainers outpacing decliners. Notable performers in the sector included CEO, NVL, DIG, PDR, NVL, NLG, VHM, VIC, DXG, and VRE, among others. CEO stood out with a gain of over 6%.

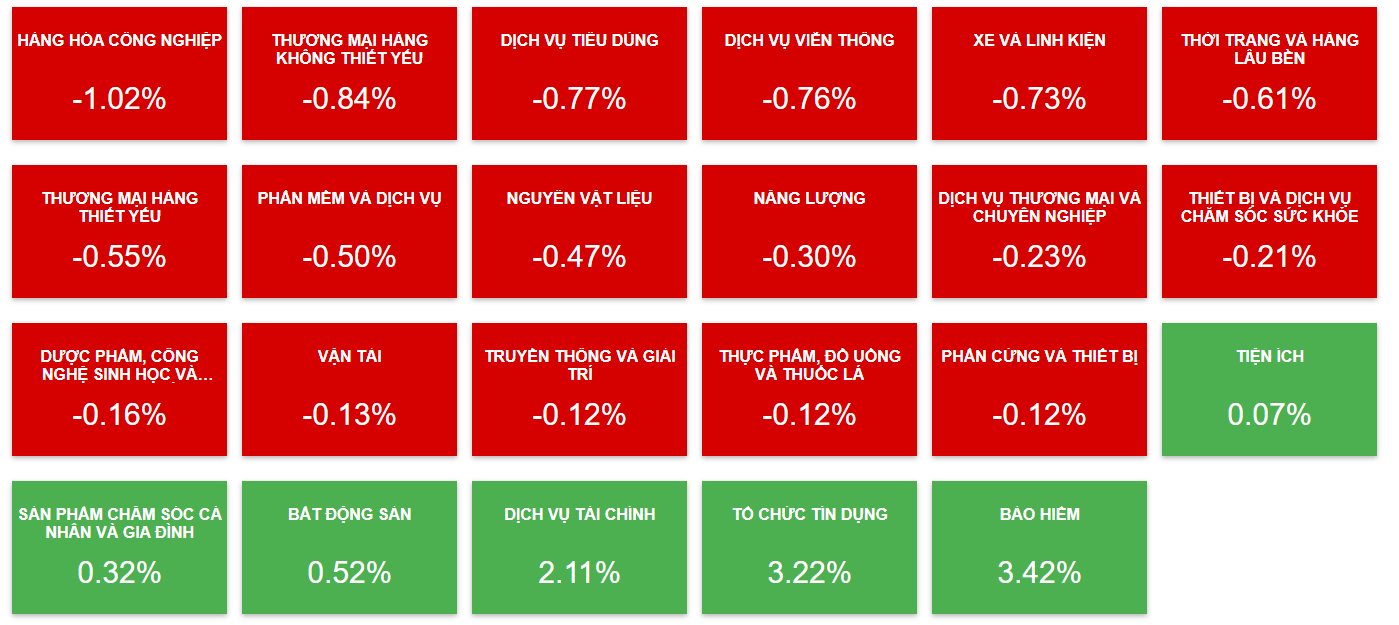

Compared to midday, the market witnessed a broader advance, with a more balanced performance across sectors. The insurance sector emerged as the top-performing sector for the day, followed by banking. However, due to their large market capitalization, banks contributed significantly to the market’s overall gains.

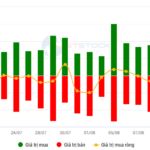

| Top 10 stocks with the most significant impact on the VN-Index on August 14, 2025 |

Market liquidity remained robust, with a total trading value of VND58.6 trillion. Foreign investors continued to be net sellers, offloading stocks worth VND2.3 trillion in the morning session.

Morning Session: Financial Stocks Dominate, Market Ends in the Green

The morning session concluded with impressive gains across the board. The VN-Index climbed over 20 points to close at 1,632.7, while the HNX-Index rose more than 2 points to 281.8.

The financial sector was a sea of green, serving as the primary catalyst for the market’s upward trajectory. The top 10 gainers contributed nearly 18.6 points to the index, with VPB, VCB, and MBB being the standout performers.

However, a closer look reveals a mixed bag across sectors. The industrial, consumer staples, consumer discretionary, materials, telecom, and automotive sectors all ended in negative territory.

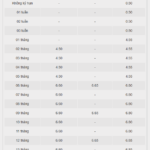

Sector Performance. Source: VietstockFinance

|

Foreign investors offloaded over VND1.1 trillion worth of stocks in the morning session, with HPG, SSI, FPT, and MSN bearing the brunt of the selling pressure.

| Top 10 stocks with the highest net foreign buying/selling in the morning session of August 14, 2025 |

10:40 AM: Financials Attract Strong Buying Interest

The financial sector continued to be the main driving force behind the market’s upward momentum, pushing the VN-Index above the 1,632.3-point threshold by 10:30 AM.

Of the top 10 stocks contributing the most to the index’s gains, eight were from the financial sector: MBB, VCB, VPB, ACB, TCB, BID, SHB, and HDB. The remaining two were VIC and VIX, with MBB, ACB, and VIX hitting their daily limit-up prices. Moreover, MBS, SHB, SHS, and BVB also witnessed strong buying interest.

Elsewhere, sector leaders such as HPG, DBC, CII, and VSC posted solid gains during the morning session.

Within the financial sector, insurance stocks stood out, with BVH, PVI, BIC, PTI, ABI, and MIG all recording strong gains. BVH and BIC hit their respective daily limit-up and limit-down prices.

Market liquidity remained robust, with a trading value of VND26.8 trillion in the first half of the morning session, indicating strong investor participation.

Market Heatmap as of 10:40 AM. Source: VietstockFinance

|

Market Open: Financials Lead the Charge, VN-Index Extends Gains

Vietnam’s stock market opened on a strong note, with the VN-Index surging over 20 points at the opening bell. However, profit-taking pressures later trimmed the gains, and the index stood at 1,620.0 points by 9:30 AM.

The market breadth was positive, with nearly 350 stocks advancing and 210 declining. Financial stocks took the lead, with a majority of them trading in the green. Notable performers in the sector included MBB, MBS, VIX, BVH, and VAB, with the first four stocks hitting their respective daily limit-up prices.

In the industrial sector, CII and VSC surged to their daily limit-up prices, while GEX and VJC also made strong gains, leading the sector in terms of liquidity.

The real estate sector witnessed mixed fortunes, with DIG, NLG, NVL, IDJ, TCH, DXG, and SCR advancing, while CEO, KDH, PDR, HDC, KBC, and VRE declined.

– 3:35 PM, August 14, 2025

Market Beat: Profit-Taking Pressure Mounts, VN-Index Retreats.

The selling pressure intensified, causing key indices to sink into the red by the end of the morning session. At the mid-session break, the VN-Index hovered near the reference level, settling at 1,639.45 points; while the HNX-Index stood at 282.49 points, a decline of 0.93%. The number of declining stocks is gradually gaining the upper hand, with 540 losers versus 207 gainers.

Technical Analysis for August 14: Optimism Persists

The VN-Index and HNX-Index both climbed in the morning session, but the lack of significant improvement in liquidity revealed the prevailing cautious sentiment among investors.

“SCR Surges Past 10,000 VND per Share”

The trading session on August 14, 2025, witnessed a remarkable surge in the share price of SCR, breaching the 10,000 VND mark and culminating at 10,400 VND at the closing bell. This pinnacle represents a significant milestone, as it surpasses the highest level attained since September 2022, heralding a new era of potential growth and investor confidence.

The Vietstock Daily: Scaling Greater Heights

The VN-Index surged and continued to reach new highs with its ninth consecutive gain. The upward trend of the index is supported by the MACD indicator, which continues to widen the gap with the signal line after a buy signal. However, the risk of intraday volatility cannot be overlooked as the Stochastic Oscillator ventures deep into overbought territory.

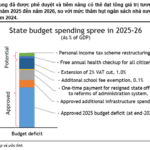

“Maybank Ups Year-End VN-Index Target to 1,800 Points”

As of the August 13 strategy report, Maybank Investment Bank maintains a positive outlook for the second half of 2025, raising its year-end VN-Index target by 20% to 1,800 points. This upgrade is underpinned by a target P/E of 14.5x, in line with the five-year average, and an expected earnings growth of 18.5% year-over-year for 2025.