The capital transfer deal at NBB Quang Ngai was approved by the NBB Board of Directors on April 11, 2024. Initially, the deadline for completing the transfer procedure was expected to be before June 30, 2024. However, after a delay, the NBB Board of Directors on July 28, 2025, announced that the final transfer date had been extended to before September 30, 2025.

NBB Quang Ngai was established in 2003 and is headquartered in Quang Ngai Province. The company’s main business is stone cutting, shaping, and finishing. According to NBB‘s 2024 annual report, this subsidiary owns two stone mines, Tho Bac and Nui Mang, in Quang Ngai Province. The chartered capital is currently at VND 45 billion, of which NBB owns 100%.

NBB Quang Ngai was acquired by NBB from CTCP Construction Infrastructure CII (CEE) following a resolution on June 28, 2023, by the NBB Board of Directors for VND 85 billion. The reason for the acquisition was to ensure a stable supply of construction materials for NBB‘s infrastructure projects in the central provinces of Vietnam.

Despite the upcoming transfer, on July 16, 2025, the NBB Board of Directors approved a capital support agreement for NBB Quang Ngai with a maximum debt limit of VND 50 billion.

Regarding the transferee, Dau Tu SDP was established in February 2024 and is headquartered in Thu Loi 4 Office Building, Nguyen Xi Street, Ho Chi Minh City. The company’s main business is real estate and land-use rights consulting and brokerage.

The chartered capital is currently VND 20 billion, including Director and legal representative Tran Duc Dung (40%), Luu Hai Duong (10%), and Nguyen Tan Thang (50%).

Following the news of the successful transfer of the subsidiary, NBB‘s stock price opened at VND 28,000/share on August 14, a more than 5% increase compared to the previous trading session’s close.

VND 48 billion profit from the transfer of project participation rights in Q2

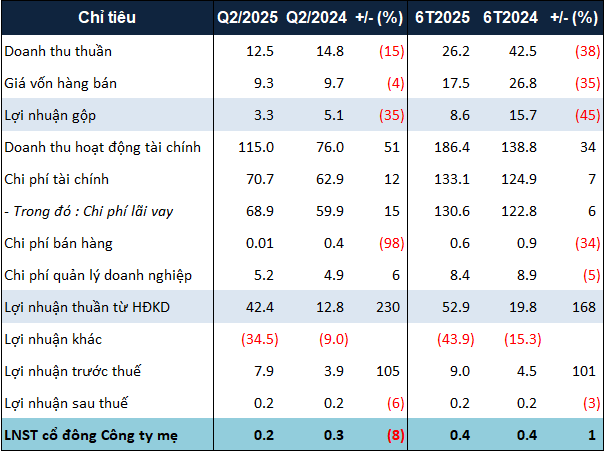

In terms of business results, according to the consolidated financial statements, NBB‘s revenue in Q2 2025 decreased by 15% over the same period to nearly VND 13 billion. This was mainly due to a 51% decrease in revenue from real estate business compared to Q2 2024.

However, NBB earned VND 48 billion from the transfer of project participation rights, thanks to which financial revenue increased by 51% to VND 115 billion. After deducting expenses, the company’s net profit was over VND 42 billion, triple that of the same period.

However, due to the impact of contract violation penalties and late payment of over VND 32 billion (compared to just over VND 1 billion in the same period), NBB‘s net profit decreased by 8% to VND 231 million.

Thanks to the results of Q1, NBB‘s net profit for the first half of the year remained unchanged compared to the same period. However, compared to the target profit after tax of VND 2 billion set for 2025, the profit for the first six months was only 11.3% of the plan.

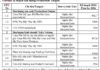

|

Business results for Q2 and the first half of 2025 of NBB. Unit: Billion VND

Source: VietstockFinance

|

On the balance sheet, NBB‘s total assets at the end of June 2025 were nearly VND 7,800 billion, unchanged from the beginning of the year. However, inventory increased by 5% to over VND 2,000 billion, of which the largest component was still investment and development costs for the Delagi project in Binh Thuan Province, with over VND 1,200 billion, up 6%.

Payables remained almost unchanged at nearly VND 6,000 billion. Borrowings fluctuated around VND 4,400 billion, including bank loans and borrowings from enterprises in the CII ecosystem.

– 13:31, August 14, 2025

TNG Issues Over 6 Million ESOP Shares at VND 10,000 Each, with the Chairman’s Family Planning to Purchase Nearly 40%

The Hanoi-based Investment and Trading Joint Stock Company TNG (HNX: TNG) plans to offer over six million shares to its employees and stakeholders at a discounted price of 10,000 VND per share, which is significantly lower than the current market price. This move will see the company’s Chairman, Nguyen Van Thoi, and his two sons being offered nearly 40% of this allocation.

“Record-breaking Revenue and Profits: Nafoods Commences Construction of NASOCO Phase 2”

Nafoods Group (HOSE: NAF) has reported record-breaking revenue and profits for the second quarter of 2025 and the first half of the year. Along with this impressive financial performance, the company is also embarking on an expansion journey with the second phase of the Nasoco project, positioning itself to capitalize on future growth opportunities.