NRC Pharma has registered up to 24 business sectors, primarily operating in the fields of cosmetics, pharmaceuticals, and wholesale drug trading. The company also deals in a range of other products, including stationery, personal care items, and home goods. NRC Pharma is the third subsidiary of NRC, with Mr. Trinh Van Bao, Vice President of NRC, appointed as its Chairman and legal representative.

|

The NRC Board of Directors approves the logo and seal design for NRC Pharma

|

This development comes just days after NRC changed its name from CTCP Tap doan Danh Khoi to CTCP Tap doan NRC, effective July 31st.

|

NRC unveils its new seal

Source: NRC

|

Notably, despite the lack of an official announcement regarding a logo change, NRC Pharma has started using a new image in its communications, as seen in Resolution No. 21/2025/NQ-HQT issued on August 11th. This new image is likely to become the company’s new logo, replacing the previous one.

|

NRC introduces a new image in its Resolution 21/2025/NQ-HDT issued on August 11th

|

NRC, established in 2006, has undergone several name changes over the years, reflecting its evolution and expansion into new industries. The latest change to Tap doan NRC marks a significant shift as the company ventures into the pharmaceutical industry, a departure from its traditional focus.

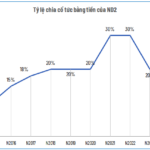

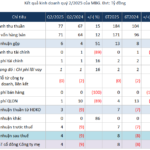

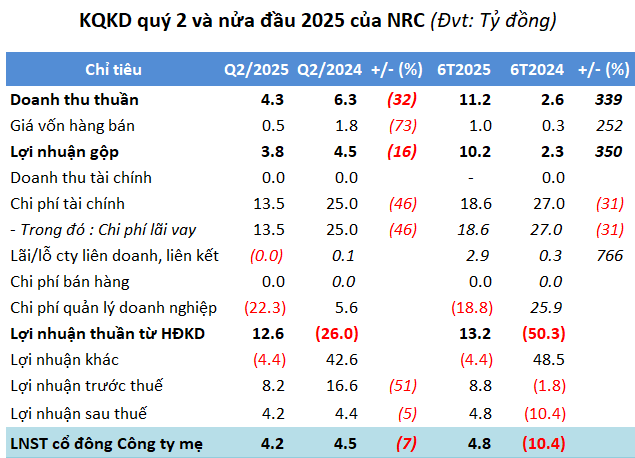

This strategic pivot comes at a time when their core business activities have been less than impressive. In Q2 of 2025, NRC recorded a 32% decrease in revenue compared to the previous year. While their gross profit remained relatively stable, there is a clear need for diversification and improvement.

| NRC‘s financial performance has been on a downward trend since Q3 of 2022 |

In Q2 of 2025, the company’s financial report showed a 46% decrease in interest expenses, and a net profit of over VND 4 billion, a 7% decrease compared to the previous year. For the first half of 2025, NRC reported a significant increase in revenue, primarily due to consulting and enterprise management services, with a net profit of nearly VND 5 billion, turning around from a loss of over VND 10 billion in the previous year.

Source: VietstockFinance

|

As of Q2 2025, NRC‘s total assets decreased by 2% compared to the beginning of the year, with short-term receivables accounting for 22% of capital sources. Inventories showed a slight increase, while financial liabilities decreased by 18%, accounting for 40% of total debt.

– 13:58 14/08/2025

The Million-Dollar Stock: Unveiling the High-Value Opportunity

The last time Vietnam’s stock market witnessed a share price surpassing the one-million-dong mark was in early 2023.

“IDP Appoints New CEO Amidst Record Losses and Plummeting Stock Prices”

In a bid to turn around its fortunes, International Dairy Products Joint-Stock Company (IDP) has appointed Doan Huu Nguyen as its new CEO and legal representative. This move comes after the company reported a net loss of over VND 36 billion in Q2 2025, marking the first time it has fallen into the red in its history. Nguyen replaces Bui Hoang Sang, who took on the role just over a year ago.