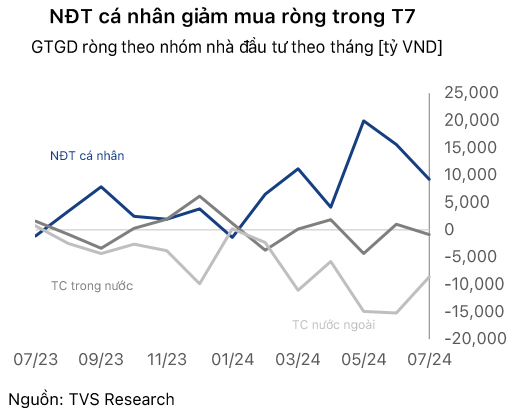

VN-Index surges 1.81% to 1,640.7 points, breaking through the psychological barrier and spreading green. The market’s liquidity reached 58.4 trillion VND, one of the highest levels in recent weeks, indicating optimism despite foreign investors’ net selling of over 2,400 billion VND. Finance and real estate sectors led the market in both the upward momentum and liquidity.

On August 14, shares of SCR, Saigon Thuong Tin Real Estate Joint Stock Company (TTC Land), rose 5.05% to 10,400 VND/share, up more than 76% in the last three months and hitting its highest level since September 2022. This is the first time SCR has reached a double-digit price after a long period of trading at low levels, even dipping below 5,000 VND/share at one point. This development occurs amid a buoyant broader market.

| SCR’s market price (adjusted) is at its highest since September 2022 |

|

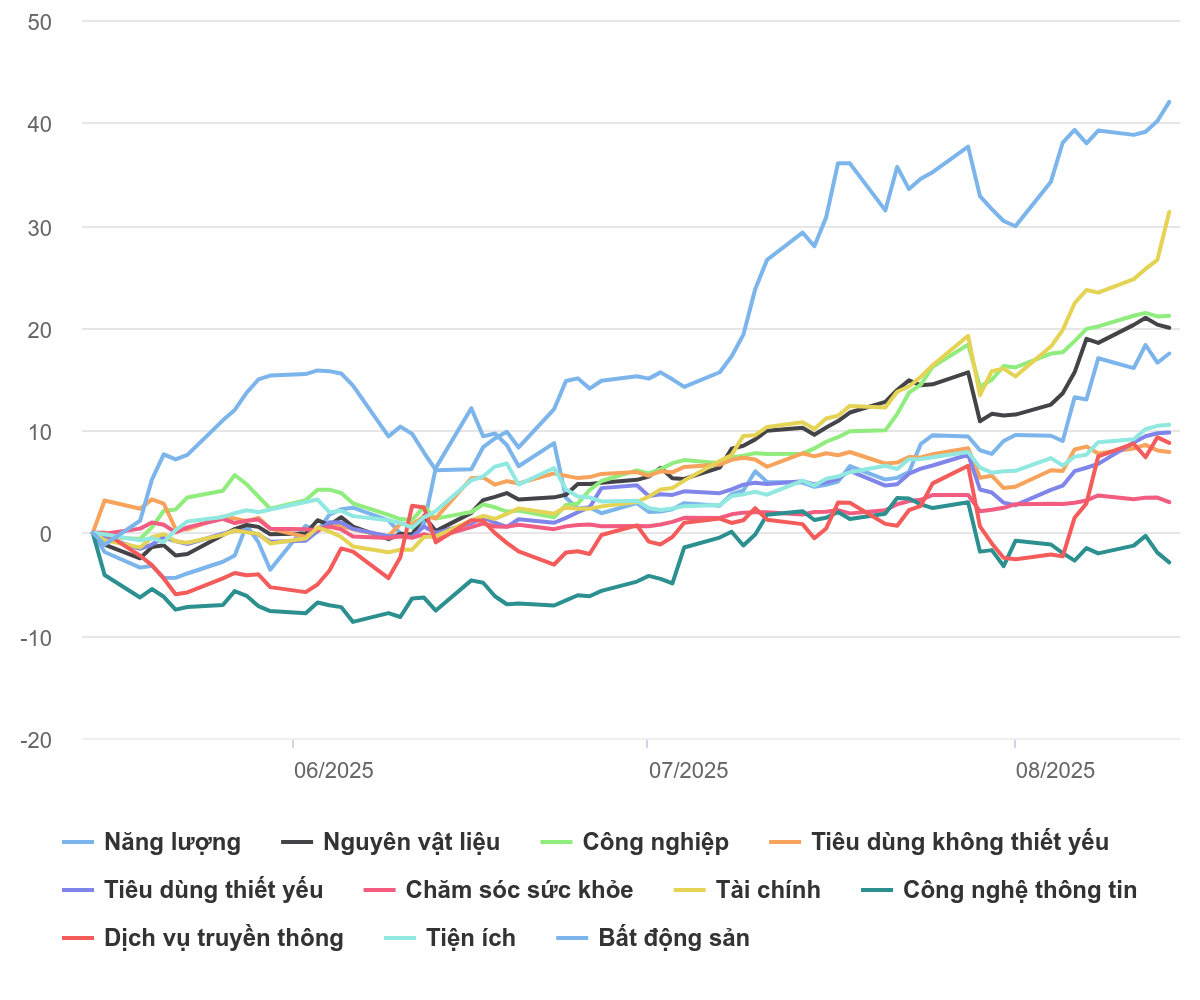

The real estate sector has been leading the market in the last three months

Source: VietstockFinance

|

A favorable macroeconomic environment plays a crucial role. Policy rates and deposit rates remain low, while credit has been unblocked for feasible projects, especially in real estate, reducing capital costs and encouraging a shift in funds from savings to securities. With its unique characteristics of financial leverage and strategic land banks, TTC Land benefits doubly from this trend while reinforcing investors’ expectations about improved profit margins in the coming quarters.

However, alongside market factors, SCR‘s growth in the first half of 2025 is underpinned by the company’s impressive financial results. TTC Land reported a net profit of 31 billion VND, nearly 26 times higher than the same period last year, surpassing the full-year profit target. TTC Land attributed this growth to its leasing and construction operations, as well as effective sales and project development strategies.

In May, the company topped out and handed over the commercial block of the TTC Plaza Da Nang project to AeonMall Vietnam and signed a management contract for the TUI SUNEO hotel within the project with the international tourism brand TUI Hotels & Resorts. Simultaneously, TTC Land introduced its “Dao Kim Quy” brand for a large-scale resort and entertainment island project.

According to several securities companies, SSI Research expects the VN-Index to target the 1,750 – 1,800 range in 2026. The primary driver is the robust recovery in profit growth, supported by four factors: the rebound in the real estate market and public investment; favorable interest rate environment; easing concerns over tariff risks; and, notably, the anticipated market upgrade in October.

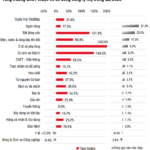

VPBankS experts noted that in the second quarter of 2025, the market’s profit increased by approximately 33% year-on-year, the fastest pace since the post-COVID-19 period. The leading sectors included real estate, electricity, retail, aviation, rubber, and fertilizers, which generally grew above the low base of the previous year.

SCR’s resurgence is an early indicator of investors’ optimism about the sector’s recovery. However, sustaining this growth will require TTC Land to continue managing financial risks, ensuring project progress and quality, and capitalizing on opportunities presented by the real estate sector’s recovery cycle.

– 09:07 15/08/2025

The Vietstock Daily: Scaling Greater Heights

The VN-Index surged and continued to reach new highs with its ninth consecutive gain. The upward trend of the index is supported by the MACD indicator, which continues to widen the gap with the signal line after a buy signal. However, the risk of intraday volatility cannot be overlooked as the Stochastic Oscillator ventures deep into overbought territory.

“Maybank Ups Year-End VN-Index Target to 1,800 Points”

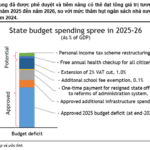

As of the August 13 strategy report, Maybank Investment Bank maintains a positive outlook for the second half of 2025, raising its year-end VN-Index target by 20% to 1,800 points. This upgrade is underpinned by a target P/E of 14.5x, in line with the five-year average, and an expected earnings growth of 18.5% year-over-year for 2025.

SSI Research: VN-Index Poised to Hit 1,800 Points, Short-Term Volatility Creates Opportunities

“SSI Research’s August strategy report presents a bullish long-term outlook, forecasting a sustainable upward trajectory for the VN-Index, targeting the 1,750-1,800 range by 2026. Short-term fluctuations caused by profit-taking provide opportune entry points for investors.”

The Sky’s the Limit: TAL Soars on HOSE Debut, Surpassing VND 10,000 Billion Market Cap

“Since its uplisting on August 1, Taseco Land’s stock, trading as TAL, has surged nearly 30% in just under 10 sessions on the Ho Chi Minh Stock Exchange (HOSE). This impressive performance witnessed an eightfold increase in trading volume compared to its yearly average, catapulting the company’s market capitalization to over VND 10,000 billion.”