SH Water, a company specializing in water management, operations, and business, was established on August 21, 2020, in Hanoi, Vietnam, with an initial chartered capital of 10 billion VND. The company primarily focuses on water extraction, treatment, and supply.

Mr. Vu Ngoc Diep, the Director, initially served as the legal representative, followed by Mr. Dao Nam Phong, the Chairman, on May 19, 2021. The role was then transferred back to Mr. Diep on July 13, 2021. On January 16, 2023, Mr. Nguyen Dinh Quy, the current Vice President of SHI, took over as the legal representative.

SH Water, as introduced by SHI on their website. Screenshot taken on August 13, 2025

|

Despite SH Water’s long-standing establishment and frequent changes to its business registration content, the company is notably absent from SHI’s latest quarterly standalone financial statements for Q2 2025, which list investments in subsidiary companies.

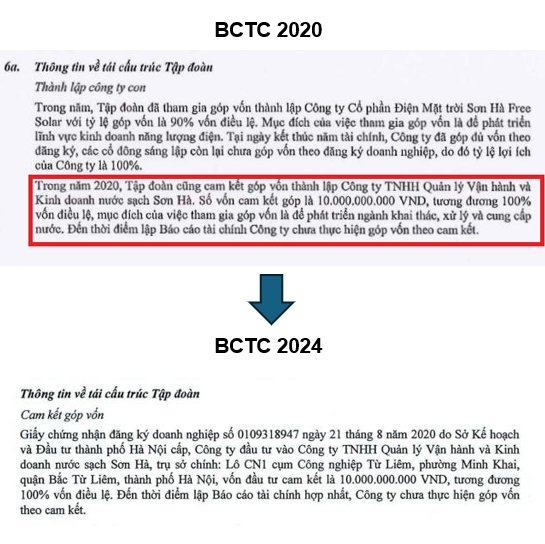

Looking back at SH Water’s early days, SHI’s 2020 audited consolidated financial statements revealed a commitment to contribute capital to this subsidiary in the amount of 10 billion VND, equivalent to 100% of its charter capital. The purpose of this investment was to develop the water extraction, treatment, and supply sector. However, as of the financial statement date, SHI had not yet contributed the capital as promised.

This pattern continued, as evidenced by SHI’s subsequent audited consolidated financial statements for the following fiscal years, up to and including 2024, where they consistently reported non-contribution of capital.

SHI’s non-contribution of capital to SH Water over the years. Source: Compiled by the author

|

Regarding SHI’s business performance, for the first six months of 2025, the company recorded a slight increase in net revenue, totaling 4,779 billion VND, compared to the same period last year. Their post-tax profit significantly doubled, reaching over 42 billion VND.

At the 2025 Annual General Meeting of Shareholders, SHI’s shareholders approved a revenue plan of 11,800 billion VND and a post-tax profit of 116 billion VND for the year. As of the end of the second quarter, the company has achieved 41% of its revenue target and 37% of its profit plan.

During the meeting, Vice President Nguyen Dinh Quy shared that the revenue structure for 2025 is expected to comprise 60-65% from the household goods sector and 30-35% from the industrial goods sector.

Vice President Pham The Hung also highlighted that they are gradually increasing the export ratio and consider it a critical growth driver for the company.

Huy Khai

– 16:13 13/08/2025

Yuanta Securities Adjusts 2025 Business Plan

On August 12, the Board of Directors of Yuanta Securities Vietnam JSC convened a meeting to discuss and approve significant matters, including the adoption of a new business plan for 2025. This revised strategy projects an average margin lending balance of VND 5.042 trillion and a total revenue of VND 793.6 billion, reflecting a 9% and 4% decrease, respectively, from the initial plan.

“Former Major Shareholder, Chairman Hoang Tuyen, Divests from Private Hospital TNH”

“Following the sale of 5 million TNH shares between July 18 and August 5, 2025, Chairman Hoang Tuyen’s ownership decreased to 3.2%, thus ceasing his status as a major shareholder at TNH Hospital.”

The Timber Industry’s Profit Divide: A Tale of Two Fortunes

The second quarter of 2025 wasn’t a bumper season for the timber industry, but it did provide a clear test of each enterprise’s intrinsic capabilities. Nearly 80% of the industry’s profits were concentrated among three major players, while the rest downsized, resorted to financial maneuvering, or cut costs to stay afloat.