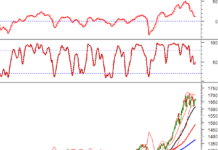

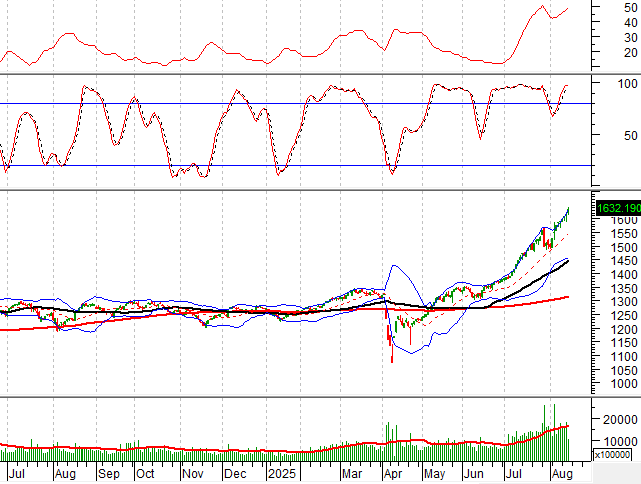

Technical Signals for the VN-Index

In the morning trading session of August 14, 2025, the VN-Index witnessed its ninth consecutive gain, forming a Spinning Top candlestick pattern. The session also saw lackluster trading volume, indicating a period of consolidation.

The index remains close to the upper band of the Bollinger Bands, while the ADX indicator continues to reside in the strong trend region (ADX>25), suggesting that the uptrend is still in play.

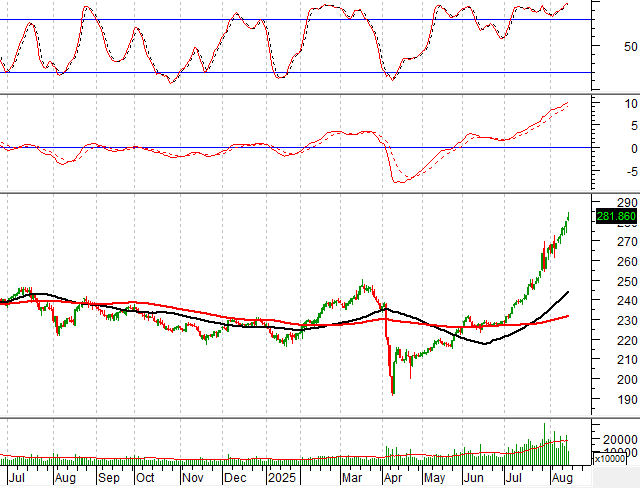

Technical Signals for the HNX-Index

During the morning session of August 14, 2025, the HNX-Index posted a modest gain, but trading volume remained subdued, reflecting investor indecision. Nonetheless, both the MACD and Stochastic Oscillator indicators are trending upward and have generated buy signals, indicating the persistence of the uptrend.

BVH – Bao Viet Holdings

On August 14, 2025, BVH’s share price opened with a significant surge, forming a Rising Window candlestick pattern, and witnessed robust trading volume, surpassing the 20-session average. This indicates active participation from traders.

Additionally, the price has broken above the long-term downward trend line, and the Stochastic Oscillator is heading higher after providing a buy signal, boding well for the stock’s outlook. Should this momentum be sustained, the potential target price could be the April 2022 high, which corresponds to the 61,500-63,000 region.

VPB – Vietnam Prosperity Joint Stock Commercial Bank

During the morning session of August 14, 2025, VPB’s share price surged, forming a Big White Candle, indicative of prevailing bullish sentiment. The stock has also reached a new 52-week high, suggesting that the optimistic outlook will likely persist in the near term.

Furthermore, the MACD line continues to ascend after providing a buy signal, and the ADX indicator remains in the strong trend region (ADX>25), reinforcing the ongoing uptrend.

(*) Note: The analysis in this article is based on real-time data up until the end of the morning session. Therefore, the signals and conclusions are preliminary and subject to change once the afternoon session concludes.

Vietstock Technical Analysis Team

– 12:09, August 14, 2025

“SCR Surges Past 10,000 VND per Share”

The trading session on August 14, 2025, witnessed a remarkable surge in the share price of SCR, breaching the 10,000 VND mark and culminating at 10,400 VND at the closing bell. This pinnacle represents a significant milestone, as it surpasses the highest level attained since September 2022, heralding a new era of potential growth and investor confidence.

The Vietstock Daily: Scaling Greater Heights

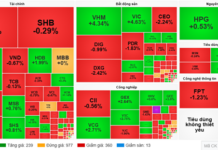

The VN-Index surged and continued to reach new highs with its ninth consecutive gain. The upward trend of the index is supported by the MACD indicator, which continues to widen the gap with the signal line after a buy signal. However, the risk of intraday volatility cannot be overlooked as the Stochastic Oscillator ventures deep into overbought territory.

The Vietnam Stock Market: Legally Prepared for Seamless Afternoon Trading, T+0

In the coming months, the Vietnamese stock market is set to introduce several notable products and initiatives. Among these are extended trading hours, potentially including a lunch break; the implementation of T+0 trading; and allowing the sale of securities “on the way home.” The legal framework and systems are in place, and the market eagerly anticipates the rollout of these initiatives by the relevant authorities.

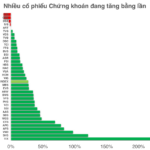

The Top Stocks to Watch at the Start of the 14th of August

The stock market is a dynamic and ever-changing landscape, and keeping up with the biggest gainers and losers is crucial for investors. Vietstock’s statistical insights offer a glimpse into the rising and falling stocks, providing valuable information for those seeking to make informed investment decisions.

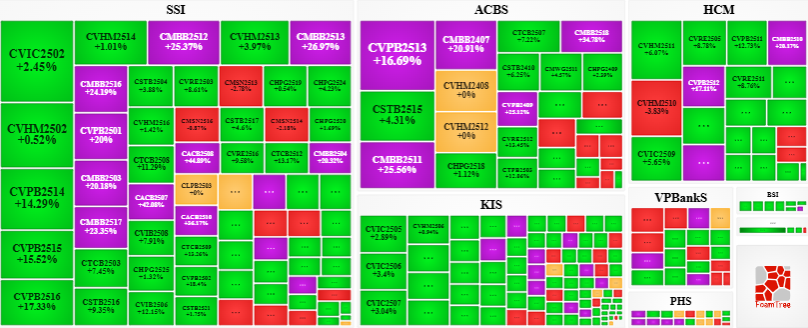

Valuing the Stock Market: Capital Increases Remain Vital Despite Premium Pricing

The stockbroking industry is riding a wave of success, with the Vietnamese stock market reaching unprecedented heights. While the valuation of stockbroking firms is no longer a bargain, capital increases remain pivotal for companies to compete and ride the wave of market upgrades and digital asset initiatives.